DIRECT TAX

Circulars/Notifications/Press Release

India withdraws retrospective amendment to tax indirect transfers

The Indian Government vide Taxation Law Amendment Bill, 2021, has withdrawn retrospective application of tax on indirect transfers which were made before 28 May 2012. The Bill was introduced to prevent taxation of indirect transfers that took place prior to 28 May 2012, along with a provision to refundtax collected, but without interest. The provision to tax indirect transfers will henceforth apply prospectively.

Dedicated email-ids for Faceless Scheme

The Income Tax Department has provided specific email ids for registering grievances in respect of pending cases/issues under the Faceless Scheme-

- faceless assessments –samadhan.faceless.assessment@incometax.gov.in

- for faceless penalty- samadhan.faceless.penalty@incometax.gov.in

- for faceless appeals- samadhan.faceless.appeal@incometax.gov.in

CBDT notifies rule for computation of tax relief on Book Profits increased due to APA and Secondary Adjustments

The CBDT has notified a rule to recompute any adjustment on account of income of past years included in books of account of previous year due to an advance pricing agreement or a secondary adjustment.

CBDT notifies rules prescribing ‘any other person’ to verify ITR & appear before authorities for Co./LLP

The CBDT has inserted two new rules to prescribe ‘the other person’ who can verify a tax returns of Companies and LLPs or who can appear as their authorized representative before tax authorities. This rule provides that any other person shall be the person, appointed by the National Company Law Tribunal (NCLT) for discharging the duties and functions of an interim resolution professional, a resolution professional, or a liquidator under the Insolvency and Bankruptcy Code, 2016.

Case Laws

Kawasaki Microelectronics Inc

- In a recent judgement, Bangalore ITAT held that Section 40(a) provides for disallowance in respect of expenditure which is revenue in nature and depreciation is not an outgoing expenditure but an allowance and therefore, provisions of section 40(a) are not applicable.

- The Appellant in this case had purchased software from outside India which was capitalized, and depreciation @ 60% was claimed. The Assessing Officer disallowed the claim of depreciation on the ground that the Appellant had not deducted taxes while making the payment for the software. The ITAT placing reliance on Bangalore High Court ruling in Tally Solutions held in favour of the Appellant that Section 40(a) provides for disallowance in respect of expenditure which is revenue in nature. Depreciation is not an outgoing expenditure but an allowance and therefore, provisions of section 40(a) are not applicable.

Hitachi HI REL Power Electronics Pvt Ltd

- In this case, the Gujarat High Court held that in the absence of satisfaction that income or potential of an income arising/embedded in the loan and/or having bearing on determination of the arms length price, Assessing Officer had no jurisdiction to refer the matter to the Transfer Pricing Officer. Further, the High Court set aside the reference of the Assessing Officer to the Transfer Pricing Officer for not giving the Appellant an opportunity of being heard before reference to the Transfer Pricing Officer. Accordingly, the High Court also quashed the Transfer Pricing Officer’s notice.

Tushar Agro Chemicals

- In this case, the Gujarat High Court reiterated the view taken by the Supreme Court that the Vivad Se Vishwas Scheme was in substance a litigation settlement scheme and keeping in mind its object, High Court directed the Revenue to accept the Declaration under the said Act even though the original appeal was filed belatedly, and it was not condoned.

Promac Engineering Industries Ltd

- In this case, the Bangalore ITAT directed Revenue to grant foreign tax credit under Article 23 of India-Tanzania DTAA on taxes paid in Tanzania but limited it to the taxes payable in India on the doubly taxed income following coordinate bench ruling in Ittiam Systems.

- Facts of the case are that the Appellant had various transactions under a project from a Tanzanian company; the Tanzanian company deducted taxes showing only part of revenue and Appellant had included this revenue in the total turnover and claimed the entire tax deducted. The Assessing Officer allowed relief only on total income tax payable in India on such income attributable to Tanzania (considering the turnover appearing on withholding certificate only and not the project revenue).

- The ITAT took note of its coordinate bench’s ruling in Ittiam Systems where, in the context of India-Korea DTAA, it was held that, “in India foreign tax credit is available to the taxes paid in Korea and such credit shall not exceed the taxes payable in India on doubly taxed income. Thus, there is a difference in foreign tax credit available to assessee on taxes paid in USA, Japan and Germany vis-s-vis Korea.” Considering this, the ITAT held that Article 23 of India-Tanzania DTAA is pari materia with Article 23 of India-Korea DTAA and found the present case to be squarely covered by India-Korea DTAA. Thus, it directed the Assessing Officer to grant foreign tax credit “on the amount which is lower of the following i.e., Tax paid on income outside India; or payable in India on such doubly taxable income”.

Pramod Lele

- Facts of the case are the Appellant was an individual who had declared an income of Rs. 2.1cr for the AY 2015-16 which included Management consultancy fees of Rs. 61.4 lacs. The Assessing Officer was of the view that Management Consultancy was a professional service as it fell under the ambit of “Technical consultancy” and tax had been deducted u/s 194J. Therefore, the Appellant was liable for tax audit u/s 44AB as professional receipts.

- The ITAT held that the nature of income in the hands of Appellant cannot be decided by the rate at which tax is deducted and the nature of income (whether it is business or professional receipt) was not in doubt and it was just the Assessing Officer’s own interpretation, which might be subjective, which led to the dispute. Therefore, as the subject matter is debatable it is a reasonable cause u/s 271B for not imposing the penalty.

Goods and Services Tax

“Other Charges” collected by the Builder from customers taxable at 18% without any abatement: Maharashtra AAR

The Applicant in this case M/s Puranik Builders Pvt. Ltd., was engaged in the business of construction and sale of residential apartments. Apart from consideration for the main construction activity, the Applicant also collected various other charges such as electric meter installation, security deposit, water connection charges, advance maintenance, club house maintenance, development charges, infrastructure charges, legal fees etc. (“Other Charges”) from their customers. The Applicant contended that the Other Charges collected are naturally bundled with the main construction services and thus the same constituted a ‘composite supply’ in which the main supply would be construction services. The Applicant therefore claimed that the entire value of Other Charges would attract the effective rate of GST as applicable on the main construction services with 1/3rd deduction from the total value for computation of GST liability. However, the Maharashtra AAR rejected the claim of the Applicant and held that GST at 18% would be applicable on the Other Charges without any deduction. In arriving at its conclusion, the AAR noted that when it came to payment of stamp duty the value of Other Charges was not being considered as a part of supply of main construction services, thus for determining taxability under GST law also such Other Charges ought not to be considered as a part of main construction service.

Commitment charges to offtake minimum quantity an independent supply: Telangana AAR

The Applicant in this case was engaged in supply of LPG to industrial consumers for periods of 5 to 10 years. They setup a structure called manifold at the customer’s premises for supply of LPG. In the event of the purchaser not lifting the minimum quantity, he was liable to pay commitment charges as specified in the agreement. The Applicant claimed that the commitment charges were an integral part of supply of LPG and thus this constituted a composite supply where principal supply would be supply of LPG and consequently, GST rate as applicable to LPG would also apply to commitment charges collected. However, the AAR held that such commitment charges cannot form part of composite supply. According to AAR, ‘Take or Pay’ Charges are compensation for breach of contract. These charges come into existence only when there is no supply of LPG and this implies that the supply of LPG and ‘Take or Pay’ Charges are mutually exclusive and can never exist together.

Electricity is one of the inputs to carry out manufacturing activity, input tax credit on captive solar power plant eligible: Tamil Nadu AAR

The Tamil Nadu AAR in the case of M/s KLF Nirmal Industries Private Limited has held that input tax credit on works contract for design, engineering, and installation along with supply of solar power panel is not a blocked credit, and the solar power plant being plant and machinery to the Applicant, the input tax credit in respect of the same is eligible. The AAR noted that though electricity is exempt under GST, the same would be captively consumed by the Applicant for manufacture and supply of taxable goods. Thus, electricity would be an input for manufacture of goods by the Applicant.

Transfer of business without transfer of liabilities and employees is not a transfer of ‘going concern’: Andhra Pradesh AAR

The Andhra Pradesh AAR has held that in a case where business is transferred without transfer of liabilities and employees, it would not constitute of ‘transfer of a going concern’ and thus, GST exemption in this case would not be available to the Applicant. The contention of the Applicant that the purchaser would continue with the same business with the same end-customers and non-passing of liabilities would not disqualify this as ‘transfer of a going concern’, was rejected by the AAR.

Supply of electric vehicle without fitting of battery eligible for concessional GST rate of 5%: Odisha AAR

The Odisha AAR in the case of M/s Anjali Enterprises has held that fitting of battery in the electric vehicle before supply is not a precondition for the same to be classified as electrically operated vehicle. Electrically operated vehicles enjoy lower GST rate of 5%.

In this context, the Odisha AAR noted that the term ‘electrically operated vehicle’ means “vehicles which run solely on electrical energy derived from an external source or from one or more electrical batteries fitted in to such vehicles. Electrically operated vehicles are designed to run only on electrical energy. As such, they will run on battery as and when put to use. Thus, even if battery is not fitted in the electric vehicle at or before the time of supply, it would still be eligible for a concessional GST rate.

Additional discount reimbursed by a company to its distributor is a consideration in the hands of distributor: Kerala Appellate AAR

The Kerala Appellate AAR has held that additional discount reimbursed by the principal supplier viz. M/s Castrol in this case, is an additional consideration in the hands of the Appellant-distributor for the supply made by him to the customers/dealers and GST at applicable rate is liable to be paid. In arriving at its decision, the Appellate AAR noted that the bare word ‘discount’ mentioned in the agreement without there being any parameters or criteria mentioned with it would not fulfil the requirement of Section 15(3)(b)(i) of the Central GST Act. The word ‘discount’ if left open ended or without any qualifications or criteria attached can mean there can be any percentage of discount ranging from bare minimum to even 100% as per discretion of the supplier. According to AAR, such abnormal discounts without any criteria or basis can in no way be considered as fair and no taxation statute can be construed to be having open ended discount. Therefore, the amount reimbursed is not in the nature of reimbursement of discount but an additional consideration for the distributor liable to tax for the supply made by him. Further on the second question, the Appellate AAR has held that the distributor is not liable to reverse input tax credit on commercial credit notes issued by the supplier since the supplier cannot reduce his output tax liability.

Value of assets outside GST purview also to be considered for transfer of input tax credit to resulting company under de-merger scheme

In case of de-merger, GST law allows transfer of unutilized balance of input tax credit of the de-merged unit to a resulting company based on the ratio of the assets transferred under the scheme of demerger. ‘Value of assets’ has been defined under the GST law to mean the value of assets of the business, whether or not input tax credit has been availed thereon. In this context, the Karnataka AAR in the case of M/s IBM India Private Limited has held that even the value of assets such as trade receivables, cash/bank balances, security deposits etc. which are outside GST net and on which there is no question of availing credit, are required to be considered for the purpose of apportionment of input tax credit to the resulting company.

No input tax credit on air-conditioning and cooling system and ventilation system: Gujarat AAR

The Gujarat AAR in the case of M/s Wago Private Limited has held that input tax credit in respect of HVAC system is a blocked credit under Section 17(5)(c) of the Central GST Act. The AAR noted that the HVAC system as a whole cannot be shifted as such from one place to another and it satisfies the test of permanency so to be considered as immovable. Further, the same is also not ‘plant or machinery’ for the Applicant. Considering the supply, installation, erection and commissioning of HVAC system in the nature of works contract service, the AAR held that input tax credit on the same is not eligible.

Due Dates

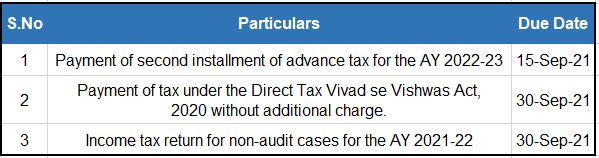

Important Due Dates September 2021

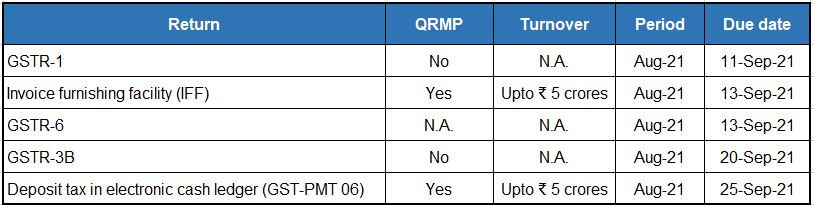

GST Compliance Calendar for September 2021

SINGAPORE UPDATES

Accounting and Corporate Regulatory Authority (ACRA)

1) Updated BizFinx Preparation Tool and Multi Upload Tool are now available

ACRA has released the latest versions (version 3.3) of the BizFinx preparation tool and multi upload tool. Companies are required to prepare, validate and upload their financial statements in XBRL format using the latest version from 1 October 2021.

The updated tool includes the following improvements:

- Software updates from Microsoft;

- New guidance notes for “Income Statement”, “Note – Property, Plant and Equipment” and “Note – Intangible Assets” to facilitate your completion;

- Re-categorisation of business rule – Misc_212 from genuine error to possible error, as some companies may have zero revenue.

All Excel / XBRL.zip files prepared using the older version can be opened and edited in the latest version, without any loss of data.

2) Cessation of Deposit Service Accounts service from 1 Oct 2021

The Deposit Service Accounts (DSA) service, which is one of the payment options available for customers transacting with BizFile+ and ACRA iShop, will be ceased from 1 Oct 2021.

BizFile+ users who have set up an account to use the DSA service are encouraged to use the available e-payment options and terminate their DSA before 1 Oct 2021, to minimize any inconvenience to their transactions with ACRA.

BizFile+ users can continue to use the wide range of payment options including credit and debit card, PayPal, Google Pay and Apple Pay for their transactions on BizFile+ and ACRA iShop.

DSA holders are required to submit a request in BizFile+ portal for ACRA to terminate their account, by logging to BizFile+ portal using their CorpPass ID and select eServices > Others > Deposit Service Account > Termination of Deposit Service Account. UEN or DSA number is required for the termination.

DSA holders who wished to retain records of their past DSA transactions have up to 31 Dec 2021 to download past statements of their DSA transactions for the period covering 1 Jan 2016 to 30 Sep 2021. The statements will no longer be available for download from 1 Jan 2022.

https://www.acra.gov.sg/about-bizfile/cessation-of-deposit-service-accounts-service-from-1-oct-2021

Monetary Authority of Singapore and Ministry of Manpower Updates

1) The United States Department of the Treasury and the Monetary Authority of Singapore Sign Cybersecurity MoU

Treasury and the Monetary Authority of Singapore (“MAS”) finalized a bilateral memorandum of understanding (“MoU”) on Cybersecurity Cooperation on 23 August 2021. The announcement was made during Vice President Kamala Harris’s visit to Singapore, during which both the U.S. and Singapore acknowledged that enhanced cooperation in “new domains” is important for addressing twenty-first century cybersecurity challenges.

The MoU formalizes and bolsters Treasury and MAS’s existing cybersecurity partnership by enhancing cooperation between the agencies with respect to:

- conducting activities, such as cross-border exercises, to develop cybersecurity proficiencies;

- staff education and “study visits” to advance cooperation in the area of cybersecurity; and

- the exchange of information relating to the financial sector, including information pertaining to regulations and regulatory guidance, incidents, and “threat intelligence” involving cybersecurity.

2) New measures to facilitate retention and hiring of work permit holders in the Construction, Marine Shipyard and Process sectors

On 13 August 2021, The Ministry of Manpower (MOM) announced that the Government is introducing new measures to help Companies in construction, marine shipyard and process sectors retain their existing work permit holders (WPHs) and facilitate the inflow of new WPHs.

The following measures were announced:

- WPHs whose work permits are expiring between July and December 2021 will be allowed to renew their permits for up to two years, even if they do not meet the renewal criteria. This includes WPHs who are reaching the maximum period of employment, or who are reaching the maximum employment age. Firms also do not need to maintain at least 10% of their WPHs as higher skilled workers.

- From July 2021, the validity of In-Principle Approvals (IPAs) of all work pass holders, including Employment Passes, S Passes and Work Permits, who are unable to enter Singapore due to border control measures, will be extended by up to one year.

- The Government will partner the Singapore Contractors Association Ltd (SCAL) to introduce a six-month retention scheme (1 September 2021 till 28 February 2022) for experienced construction WPHs whose previous employment has been terminated.

- There is a minimum Period of Employment (POE) requirement for WPHs to qualify for Man-Year Entitlement (MYE) waiver. From 1 October 2021 to 31 March 2022, this requirement will be removed for new and renewal WPH from non-traditional sources (NTS) and the People’s Republic of China (PRC) for firms in the Construction and Process Sectors.

IRAS- Due dates

Form C-S/C for the FY 2020 -30-November-2021

Estimated Chargeable Income (ECI) (June year-end)- 30-Sep-2021

GST Return: July 2021 – September 2021- 31 October 2021