To remove the practical difficulty in claiming TDS where taxes are withheld in one year, but corresponding income is reported in another year, CBDT has introduced Form 71 which is to be filed electronically. This is introduced to rectify the TDS credit difference.

Section 47(viiab) of the Income-tax Act provides that any transfer of capital assets by a non-resident on a recognized stock exchange located in any International Financial Service Centre (IFSC) shall be exempt from Capital gain tax provided the consideration is paid or payable in foreign currency.

The Central Board of Direct Taxes (CBDT) has further added the following securities for the purpose of section 47(viiab) exemption:

-Unit of investment trust

-Unit of a scheme

-Unit of Exchange Traded Fund launched under International Financial Services Centers Authority (Fund Management) Regulations, 2022.

In the present case, the applicant sought an advance ruling on two questions:

The applicant contended that the construction of apartments constitutes provision of a service and once the transaction is subject to taxation in the hands of the developer, it should not be taxed again when the applicant enters into an agreement to sell the flats to buyers before the issuance of the Completion Certificate.

The Karnataka AAR has ruled that the applicant’s perspective is not correct. This is because two distinct supplies are involved: one between the applicant and the developer, and the other between the applicant and the buyer. In this scenario, the applicant is providing works contract services to the buyers, and there is no direct supply of construction services between the developer and the buyer. As a result, the applicant is liable to pay GST. In terms of eligibility to avail ITC, the Authority ruled that the applicant is eligible to claim ITC of GST charged by the developer, however, they cannot claim ITC on other expenses.

In this case, the applicant purchased raw materials for manufacturing steel nails and availed of an input tax credit (ITC). The finished steel nails were destroyed in the fire. The applicant sought clarification on whether ITC on the raw materials should be reversed. They argued that Section 17(5) requires ITC reversal “in respect of” the destroyed goods, suggesting it applies solely to the finished products.

The Telangana Authority for Advance Ruling (AAR) has determined that the interpretation of Section 17(5) needs to be considered within the framework of other statutory provisions, specifically Section 17(2) and Section 18(4). These provisions explicitly state that ITC is available only when it can be attributed to taxable outward supplies. If, for any reason, the outward supply is not taxable, then ITC must be reversed on the inputs held in stock, as well as inputs integrated into semi-finished or finished goods and capital goods. Consequently, the AAR has ruled that ITC should be reversed on the raw materials.

Accordingly, CBIC previously granted an exemption from the Electronic Cash Ledger provisions for certain goods, which was effective until September 30, 2023. This exemption has now been extended to November 30, 2023. The exemption applies to the following categories of goods:

-Goods imported or exported in customs stations where a customs automated system is not in place.

-Goods imported or exported in an International Courier Terminal.

-Accompanied baggage.

Deposits other than those used for:

-Payments related to customs duty,

-Integrated tax,

-GST Compensation Cess,

-Interest penalty fees, or any other amount payable under the Customs Act or the Customs Tariff Act, 1975.

On 19 September 19, 2023, the Monetary Authority of Singapore (MAS) issued its 4th Enforcement Report detailing robust enforcement actions taken against financial institutions (FIs) and individuals for market abuse, financial services misconduct and money laundering (ML) related offences.

The Report covers enforcement actions taken during the period January 2022 to June 2023 for breaches of MAS’ regulatory requirements. These include:

-High-profile actions against four financial institutions in relation to their dealings with Wire card-linked persons, as well as against Noble Group Limited and individuals relating to Three Arrows Capital.

-$7.10 million in composition penalties for anti-ML related breaches and $12.96 million in civil penalties for market abuse cases.

-18 prohibition orders issued against unfit representatives.

-39 criminal convictions of individuals involved in market misconduct and related offences: a result of joint investigations with the Singapore Police Force’s Commercial Affairs Department (CAD).

The Report includes new features to provide more granular disclosure of MAS’ enforcement activities and more comprehensive coverage of the combined investigation efforts of MAS and the CAD in tackling offences under the Securities and Futures Act and the Financial Advisers Act:

-Statistics on cases opened for review and investigation during the reporting period, broken down by offence types.

-More details on enforcement outcomes in terms of offence types.

MAS enforcement priorities for 2023 and 2024 include:

-Enhancing capabilities to tackle misconduct in the digital asset ecosystem, including by working with foreign regulators and law enforcement agencies to obtain and share information on errant entities and individuals.

-Continued focus on asset and wealth managers’ compliance with the applicable laws and regulations, particularly business conduct and anti-ML and countering the financing of terrorism requirements and holding senior management accountable for their FI’s lapses where appropriate.

The Monetary Authority of Singapore (MAS) and McKinsey & Company today jointly published a working paper setting out how high-integrity carbon credits can be utilized as a complementary financing instrument to accelerate and scale the early retirement of coal-fired power plants (CFPPs). The paper explores the conditions for generating such carbon credits and identifies what is needed to develop a high-quality market for such credits.

To address this, the paper explores the use of high-integrity carbon credits to reduce the economic gap for early retirement of CFPPs. It considers the possible generation of “transition credits”, arising from the emissions reduced through retiring a CFPP early and replacing with cleaner energy sources. The key elements of this approach are:

MAS and McKinsey have also proposed a template that provides detailed steps and sample tools for market participants to assess and execute such transactions. This includes a cashflow model to compute the economic gap that could potentially be covered by transition credits, and a list of standardized documents required to execute such a transaction.

As next steps, MAS invites interested parties to join a coalition of partners to further validate this transaction approach and identify suitable CFPPs to pilot integrating transition credits into the early retirement of CFPPs. This builds on the extensive engagements that were carried out to-date with industry practitioners across the carbon credit, energy financing, and project development space.

On September 26, 2023, the Inland Revenue Authority of Singapore (IRAS) published the e-tax guide (the “Guide”) on Income Tax Treatment of Foreign Exchange Gains or Losses for Businesses (Fifth Edition).

This e-tax Guide provides details on the tax treatment of foreign exchange gains or losses for businesses (banks and businesses other than banks). This e-tax Guide consolidates the two e-tax guides issued previously on the income tax treatment of foreign exchange gains or losses.

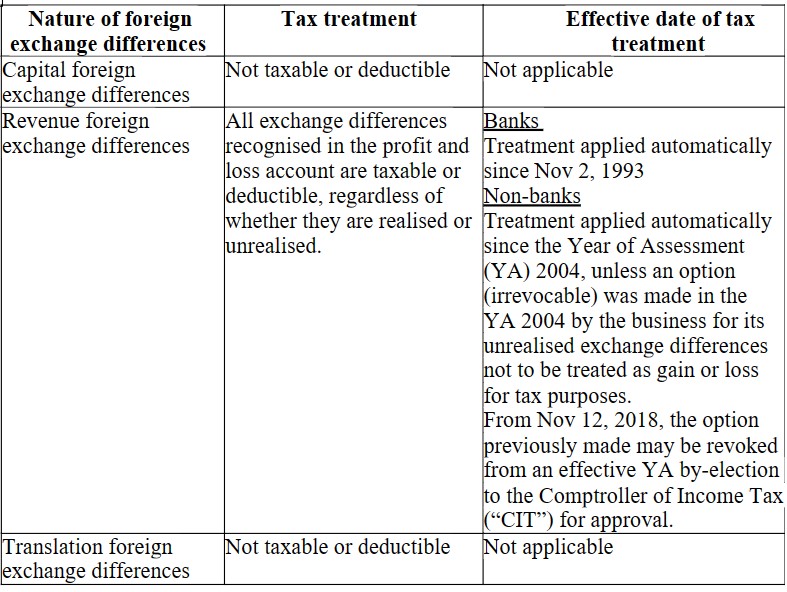

The tax treatment of foreign exchange differences is summarized in the table as follows:

The Ministry of Finance, Department of Revenue has, on September 4, 2023 notified the Prevention of Money-laundering (Maintenance of Records) Second Amendment Rules, 2023 (“PML Second Amendment Rules, 2023”), to amend the Prevention of Money-laundering (Maintenance of Records) Rules, 2005.

The following amendments have been made:

-Rule 2(f) sets out the definition of ‘Principal Officer’, who is an officer designated by a reporting entity. A provision has been inserted under Rule 2(f), which states that the Principal Officer will be an officer at the management level.

-Rule 9 mandates client due diligence procedures to be undertaken by every reporting entity. Rule 9(3) defines a beneficial owner who is a natural person having controlling ownership interest (entitlement to more than 25% of shares or capital or profits of the company) or who exercises control through other means in case of companies, partnership firms, unincorporated associations etc. An amendment to clause (b) of Rule 9(3) has been made, where the threshold for ownership of entitlement, in a partnership firm, is revised to 10% from 15%.

-Under Rule 9(3)(b), a person who does not have any ownership or entitlement of capital or profits of the partnership, but ‘exercises control through other means’ will also be treated as a beneficial owner. Further, an explanation is inserted under Rule 9(3)(b), to clarify that “Control”, in instances of partnership, will mean and include the right to control the management or policy decision.

-Rule 9(10) stipulates client due diligence procedures in the instances of juridical persons. A proviso to this sub-rule has been inserted, which states that in case of a trust, the reporting entity will ensure that trustees disclose their status at the time of commencement of an account-based relationship or when carrying out transactions as specified in Rule 9(1)(b).

-Rule 10 stipulates the obligations of reporting entities regarding the maintenance of records. In the Explanation set out to this Rule, the expression ‘records of identity of clients’ is set out to mean updated records of identification data, account files and business correspondence. This Explanation has been amended to include any analysis undertaken under Rule 3 and Rule 9 (Client Due Diligence).

The Mediation Bill, 2023 received the assent of the Hon’ble President of India on September 14, 2023. While the Bill received Presidential assent on September 14, 2023, the provisions of the Mediation Act, 2023 (hereinafter referred to as “Act”) will come into force as and when the Central Government notifies in the Official Gazette. The key provisions of the Act are as follows:

Every mediation will be conducted within the territorial jurisdiction of the court /tribunal of competent jurisdiction to decide the subject matter of the dispute, or at any other place as may be mutually consented to by the parties, or in online mode.

The Ministry of Commerce and Industry, Department for Promotion of Industry and Internal Trade has issued a notification, dated September 19, 2023, to bring into effect the provisions relating to the Legal Metrology Act, 2009, set out under serial 40 of the Jan Vishwas (Amendment of Provisions) Act, 2023 and the same will be in effect from October 1, 2023.