F.No.375/02/2023-IT-Budget: –Remission of Certain Outstanding Direct Tax Demands

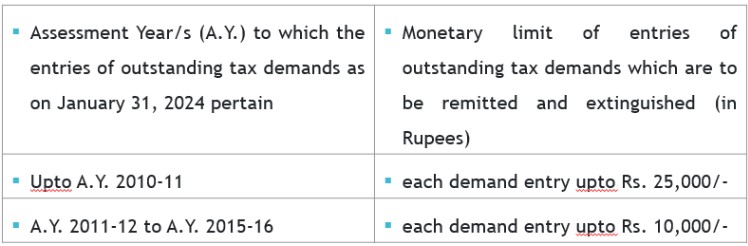

The remission of the above outstanding tax demand shall be subject to the maximum ceiling of Rs. 1,00,000/-(excluding calculation of interest on account of delay in payment of demand under the act) for demand entries such as Principal component of tax demand Interest, penalty, fee, cess or surcharge under various provisions of the Act.

Remission and extinguishment of entries of outstanding direct tax demands shall not be applicable on the demands raised against the tax deductors or tax collectors under TDS or TCS provisions of the Income-tax Act. 1961.

Approval of Punjab University for Scientific research under Income-tax Act, 1961, Notification No. 23/2024

The Central Government has approved Punjab University Chandigarh, having PAN AAAJP0325R, for scientific research purposes of 35(1)(ii) of the Income-tax Act, 1961. This approval is effective from the publication date in the Official Gazette (i.e., from the Previous Year 2023-24) and applies for Assessment Years 2024-2025 to 2028-2029.

Assessee prime facie found to be a willful defaulter vide 276CC

Vinayagam Sabarisanthanakrishnan vs. ACIT

Assessee individual failed to file ROI within the due date for AY 2014-15. 147 proceedings initiated and SCN for prosecution u/s 276CC was issued. Assessee’s argument that the mere delay in filing ROI due to ill health was not a willful failure was rejected. Further 147 order was appealed before the ITAT.

The appeal before HC held that pendency of appellant proceedings is not a relevant reason for not commencing prosecution u/s 276CC of the Act since if that had been the intention of the legislature then the same would have been provided in the section itself.

Further held that existence of culpable mind is presumed vide 278E and any argument against it can only be done at the stage of trial.

Improper issue of notice vide 144B is not a remediable defect

(GRS Hotels Pvt Ltd vs. UoI)

148A proceedings initiated in case of Assessee and notices as well as order served on an old e-mail ID. Subsequent notice u/s 142(1) read with 147 issued to new email ID.

Assessee appealed before Allahabad HC agitating failure of issue of notice u/s 148A. The department argued that the issue of notice to old email ID was valid vide 144B(t)(vi).

HC held that despite the provisions of 144B(t), (vi) has to be considered residual and can only be accessed when clause (i) to (v) fails. Further held that 148A is not merely a procedural requirement and is crucial for the functioning of the re-assessment function.

Quashed the 148A order as well as subsequent notices and instructed the department to allow Assessee to file a response to 148A within the next 4 weeks.

Validity of reopening of assessment u/s 147/148A

(Sumathi Janardhana Kurup vs. Income Tax Officer)

Assessee – senior citizen aged 75 years, AY – 2015-16.

The Assessee has not filed the ITR as there was no taxable income. Assessee made a payment of Rs. 10 lakhs M/s. Lucina Land Development Limited (“Lucina”) against allotment of a flat, Rose in the joint name of Assessee and her granddaughter.

A notice was issued, alleging a search and seizure action in 2016 for unaccounted income. The notice found material including cash receipts from M/s. Lucina Land Development Limited admitted receiving cash from customers, including the Assessee.

The Assessee claims that the amounts paid to Lucina came out of redemption of Fixed Deposits, Loans from the daughter and son-in-law etc.

The Assessee also claimed that the case does not qualify under Section 149 of the Act, as there is no income chargeable to tax represented in the form of an ‘asset’ that has escaped assessment of Rs. 50,00,000/- or more.

Validity of reopening of assessment u/s 147/148A

(Sumathi Janardhana Kurup vs. Income Tax Officer)

Assessee has denied having paid any cash to Lucina.

In the order u/s 148A(d), it is stated that the income of the source for the purchase of immovable property remained unexplained and therefore, it would fall within the meaning of “assets” as per Explanation-1 of Section 149 of the Act.

It was held that the onus is on the Revenue to show evidence that the Assessee has paid cash and purchased immovable property. Simply relying on a letter allegedly from Lucina is not enough.

The impugned order passed under Section 148A (d) of the Act has to be quashed and set aside Consequently, the notice issued under Section 148 of the Act and the assessment order also are quashed and set aside.

GST is exempt on solar energy sold to institutional customers – Kerala AAR

The Applicant M/s YIS Power Solutions Private Ltd in this case sought an advance ruling on the GST applicability for the electricity produced from solar power panels and sold to institutional customers.

The AAR has held that ‘Electricity’ and ‘electrical energy’ are synonymous terms. ‘Electrical energy’ falls under Heading 2716 00 00 of the Customs Tariff Act, categorizing it as a ‘good’ rather than a ‘service’. Consequently, the supply of electricity generated from solar panels is considered a supply of goods and is exempt from GST under entry 104 of Notification No. 02/2017 Central Tax (Rate) dated 28th June 2017.

Input tax credit cannot be denied solely on the ground that it is not claimed in GSTR-3B return – Madras High Court

In this case, M/s Sri Shanmuga Hardwares Electricals, the petitioner, failed to claim input tax credits (ITC) in their GSTR-3B returns despite the ITC being reflected in the GSTR-2A report. However, the petitioner claimed the ITC in their annual return, GSTR-9. The GST authorities rejected the petitioner’s ITC claim solely because it was not claimed in the GSTR-3B returns.

The High Court has held that when a registered person asserts eligibility for ITC based on the GSTR-2A report and GSTR-9 return, the assessing officer needs to thoroughly examine the validity of the ITC claim by reviewing all relevant documents. This includes requesting additional documents from the registered person if necessary. The assessing officer cannot reject an ITC claim solely on the grounds of its non-reflection in the GSTR-3B returns.

The High Court quashed the impugned order that rejected the petitioner’s ITC claim and has remanded the matter for reconsideration.

Input tax credit not allowed on differential IGST paid on import of goods pursuant to onsite audit – Tamil Nadu AAR

M/s Mitsubishi Electric India Private Limited, the Appellant in this case, paid differential customs duty and IGST, along with interest and penalty, following an on-site audit by Customs authorities, but before the issuance of any show cause notice. The issue revolved around the misclassification of imported goods. The appellant sought an advance ruling on whether they were eligible to claim input tax credit (ITC) for the differential IGST paid after the on-site audit.

The AAR noted that Section 74 of the Central GST Act, 2017, mandates the payment of tax, along with interest and a penalty of fifteen per cent of such tax, for avoiding a show cause notice. While penalties of fifteen per cent are specified in Section 74(5) for certain cases, they are not found elsewhere in the GST law except for under that provision. The AAR determined that the payment of a penalty at fifteen per cent on the tax amount determined by audit officers indicates that the differential tax was assessed under the provisions of Section 74(5), which involves willful misstatement or suppression of facts to evade tax. Section 17(5) of the Central GST Act, 2017, restricts the availment of ITC for

any tax paid per the provisions of Section 74. Therefore, as per Section 17(5) of the Central GST Act, 2017, the Appellant cannot claim ITC for the differential IGST paid consequent to the onsite audit.

Climate reporting to help companies ride the green transition.

On 28 th February 2024 the Accounting and Corporate Regulatory Authority (ACRA) and Singapore Exchange Regulation (SGX RegCo) have provided details of mandatory climate reporting for listed issuers and large non-listed companies.

As announced by Second Minister for Finance, Mr Chee Hong Tat at the Ministry of Finance Committee of Supply, Singapore will introduce mandatory climate-related disclosures (CRD) in a phased approach, in line with the recommendations from the Sustainability Reporting Advisory Committee (SRAC). This is part of the Government’s efforts to help companies strengthen capabilities in sustainability, and to ride the green transition. As the green momentum intensifies, companies who are able to provide CRD could benefit from access to new markets, customers, and financing.

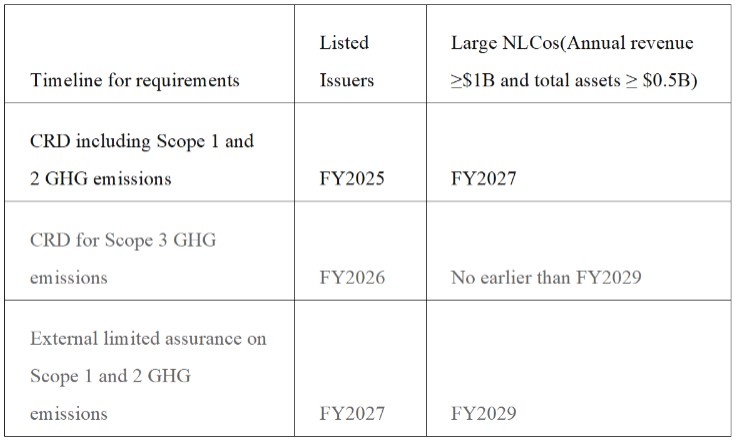

From FY2025, all listed issuers will be required to report and file annual CRD, using requirements aligned with the International Sustainability Standards Board (ISSB) standards.

From FY2027, large NLCos (defined as those with annual revenue of at least $1 billion and total assets of at least $500 million) will be required to do the same. ACRA will review the experience of listed issuers and large NLCos before introducing reporting requirements for other companies.

The timeline for the implementation of mandatory CRD is summarised in the table below, with an accompanying infographic in the Annex. More time will be given for companies to report CRD on Scope 3 greenhouse gas (GHG) emissions and conduct external limited assurance on Scope 1 and 2 GHG emissions.

Some companies have provided feedback that they are already reporting using other international standards and frameworks, to meet mandatory requirements of the

jurisdictions that they operate in and/or to cater to their investors’ information needs. To address this, ACRA will exempt large NLCos with parent companies that are reporting CRD, under the following circumstances:

a) A large NLCo whose parent company reports CRD using ISSB-aligned local reporting standards or equivalent standards (g. European Sustainability Reporting Standards) will be exempted from reporting and filing CRD with ACRA, subject to certain conditions; and

b) A large NLCo whose parent company reports CRD using other international standards and frameworks (g. Global Reporting Initiative Standards, Task Force on Climate-related Financial Disclosures Recommendations), will be exempted from reporting and filing CRD with ACRA2 for a transitional period of 3 years, from FY2027 to FY2029. ACRA will review whether to extend the transitional period, depending on global developments relating to the adoption and recognition of other standards and frameworks.

Incorporation of Companies by Medical Professionals and Relevant Tax Implications

On 1 st March 2024, the Inland Revenue Authority of Singapore (IRAS) updated a circular on tax implications for the incorporation of companies by medical professionals.

Topics covered include:

1) the increase in the highest marginal personal income tax rate to 24 percent, from 22 percent;

2) the 17 percent corporate income tax rate.

3) guidance on corporate tax exemptions and rebates.

4) start-up tax and partial tax exemption regimes.

5) tax avoidance and its legal consequences; and

6) common arrangements in tax avoidance, including shifting of income, artificial splitting of income, artificial re-incorporation, and attribution of income.

Notification relating to the Competition (Amendment) Act, 2023:

The Ministry of Corporate Affairs has issued a notification under the Competition (Amendment) Act, 2023, on 19 th February 2024 (hereinafter referred to as “Notification”). This Notification states that the provisions of Section 33 of the Competition (Amendment) Act, 2023 (“Amendment Act”), shall come into force from 20 February 2024.

The Amendment Act substituted erstwhile Section 46 [Power to impose lesser penalty] of the Competition Act, 2002 (“Principal Act”).

Section 46 of the Principal Act empowers the Central Government to impose lesser penalties if it is satisfied based on the full and true disclosure made by any producer, seller, distributor, trader or service provider included in any cartel, that has allegedly caused an appreciable adverse effect on competition within India.

Notifications relating to criminal laws:

On 25 th December 2023, the Ministry of Law and Justice published the Bharatiya Nyaya Sanhita, 2023, the Bharatiya Nagarik Suraksha Sanhita, 2023, and the Bharatiya Sakshya Adhiniyam 2023, which intend to replace the Indian Penal Code 1860, the Code of Criminal Procedure, 1973 and the Indian Evidence Act, 1872 respectively. It was stated in the respective notifications that, the provisions of the abovesaid laws will come into force as and when the Central Government notifies in the Official Gazette. The Ministry of Home Affairs, on 23 rd February 2024, has issued three notifications relating to the aforesaid laws.

As per the notifications S.O 848(E) and S.O 850(E), each dated 23 rd February 2024, the Central Government has notified the date 01 July 2024, as the date on which the Bharatiya Nagarik Suraksha Sanhita, 2023 and the Bharatiya Nyaya Sanhita, 2023, will come into force respectively, except for the provisions relating to Section 106(2) of the Bharatiya Nyaya Sanhita, 2023, i.e. penalty and fine in case of the offence of causing death by rash and negligent driving of vehicle and escaping.

As per the notification S.O 849(E), dated 23 rd February 2024, the Central Government has notified the date 01 July 2024, as the date on which the Bharatiya Sakshya Adhiniyam 2023, will come into force.

The Information Technology (Procedure and Safeguards for Interception, Monitoring and Decryption of Information) Amendment Rules, 2024:

Section 69 of the Information Technology Act, 2000, gives powers to the Central Government to conduct surveillance and investigate by way of monitoring, decryption or interception of any information, stored in any computer resource, in case of commission or prevention of any cognizable offence and frame rules thereunder. The Central Government published Information.

Technology (Procedure and Safeguards for Interception, Monitoring and Decryption of Information) Rules, 2009 (“Principal Rules”) on 27 October 2009.

Subsequently, the Ministry of Electronics and Information Technology, on 26 th February 2024, brought into force the Information Technology (Procedure and Safeguards for Interception, Monitoring and Decryption of Information) Amendment Rules, 2024 (“Amendment Rules”). The Amendment Rules have substituted sub-rule (1) of Rule 23 [Destruction of the records of interception or monitoring or decryption of information] of the Principal Rules.

Rule 23(1) of the Principal Rules stipulates a time limit of six months for the destruction of records/ electronic records of interception, monitoring or decryption, by security agency. The Amendment Rules have substituted the words ‘security agency’ with the words ‘competent authority and the security agency’.

A Competent Authority as per Rule 2(d) of the Principal Rules means: (i) the Secretary in the Ministry of Home Affairs, in case of Central Government; or (ii) the Secretary in charge of the Home Department, in case of a State Government or Union Government

Amendment Rules – Information Security Decryption Rules, 2024

S.O.850_Bharatiya Nyaya Sanhita 2024

S.O.848_Bharatiya Nagarik Suraksha Sanhita 2024

S.O.849_Bharatiya Sakshya Adhiniyam 2024

Competition Amendment Act 2024