June 2023 Newsletter

DUE DATES

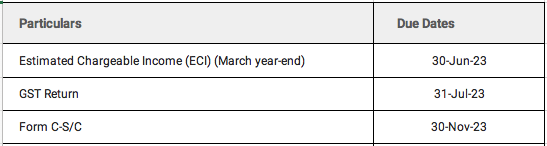

Compliance calendar for due dates falling in June 2023

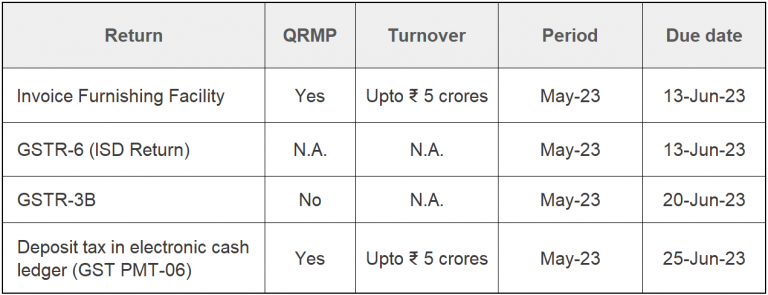

GST

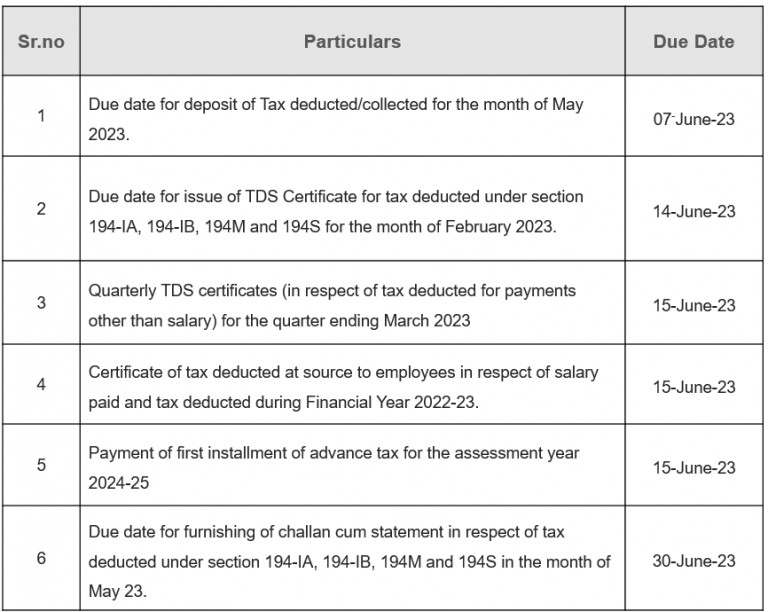

DIRECT TAX

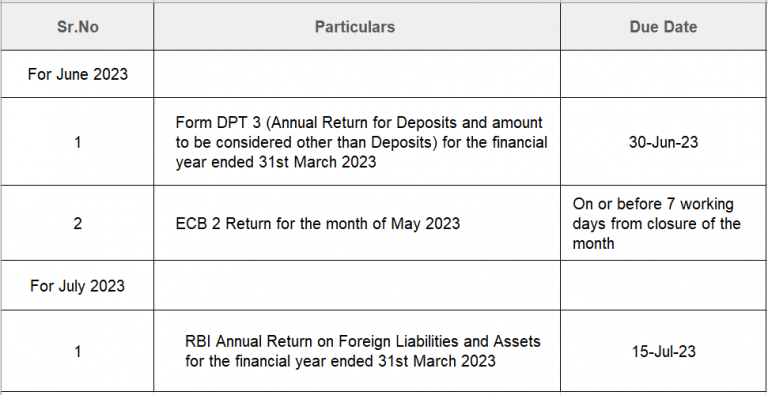

CORPORATE LAWS

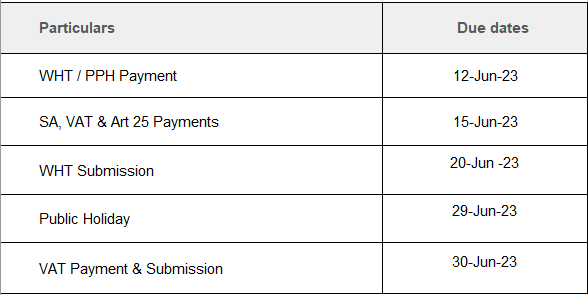

INDONESIA COMPLIANCE

SINGAPORE COMPLIANCE

Circulars/Notifications/Press Release

CBDT clarifies the applicability of TDS on interest on the Mahila Samman Savings Certificate

- The Central Board of Direct Taxes (CBDT) has issued a notification clarifying that withholding tax under section 194A will apply to the interest earned on the Mahila Samman Savings Scheme 2023 if such interest earned in a financial year exceeds INR 40,000.

CBDT proposes changes with respect to the Fair Market Value of shares under section 56(2)(viib)

- CBDT proposes to include five more (earlier there were 2 methods – Discounted Cash Flow & Net Asset Value) valuation methods for the issue of equity shares to non-resident investors.

- CBDT has also proposed that when any consideration is received by a company for the issue of shares, from any Non-Resident entity, the price of the equity shares corresponding to such consideration may be taken as the Fair Market Value of the equity shares.

- It also proposes to introduce a safe harbour limit of 10% for the valuation of Unquoted equity shares which can be availed by both resident and non-resident investors.

Increase in Exemption limit for Leave Encashment under section 10(10AA)

- CBDT notifies the increased limit of INR 25,00,000/- for tax exemption of leave encashment on retirement or otherwise. This limit is for employees other than Central and State government employees.

Clarification regarding registration/approval of charitable and religious trusts

- CBDT clarifies that the due date for re-registration/approval for charitable and religious trusts has been extended to September 30, 2023.

- The circular also clarifies that the due date for regular registration/approval for provisionally registered/approved trusts has been extended to September 30, 2023.

Clarification regarding the applicability of Tax Collection at Source (TCS) to small credit/debit transactions under Liberalised Remittance Scheme (LRS)

- Any payments by an individual using their international Debit or Credit cards upto INR 7 lakhs per financial year will be excluded from the Liberalised Remittance Scheme (LRS) limits and will not attract any TCS.

- This will be applicable from July 1 2023.

Case Laws

Expenditure of previous years can be taxed in the subsequent years, if there is evidence that expense is bogus: Delhi Tribunal

- Assessee was a trader in electricals and motor part items and the Assessing Officer(“AO”) had sought details regarding the outstanding balances of sundry creditors totalling INR 1.54 Crores out of which the Appellant was able to file confirmations of only INR 45.85 Lakhs which resulted in the addition of INR 1.08 Crores to the Assessee’s income.

- Assessee contended that the outstanding balances pertain to purchases made in the previous years and do not pertain to expenditure in the current year and was not unable to establish contact with any of the creditors.

- Assessee appealed before the Commissioner of Income Tax Appeals (“CIT(A)”) to disallow the additions.

- CIT(A) examined each creditor invoice and perused that bills of certain creditors were in nature of personal purchases and others were bogus and also held that the assessee never tried to contact the parties for their confirmation, nor there was any intent of the same by the Appellant, the same purchases were fictitious.

- Hence, there was a cessation of liability in the books of the Appellant and the same was deemed income under Section 41 of the Income Tax Act, 1961.

Receipt of Toll charges for construction of Project is Capital in nature: Delhi Tribunal

- Assessee is a company engaged in the business of construction, operation and maintenance of six-lane Kanpur Highway and filed its return of income declaring “NIL” income for AY 2015-16.

- They got a contract to convert the existing 4-lane roads to 6 lanes. As per the contract, the assessee will be entitled to collect toll charges from 4 lane road and used the proceeds for the construction of 6 lane road during the construction period.

- Assessing officer was of the view that the nature of toll receipts is revenue in nature whereas the assessee has reduced the toll receipts from the cost of construction (WIP).

- Cases reaches to ITAT wherein ITAT has given a finding that toll receipts received during the period of project construction were inextricably linked to the project because it was mandatorily required to be used for the construction of the project.

- The ITAT accordingly concluded the receipts to be capital receipts and held that the assessee had rightly reduced the same from the cost of the project.

GST LITIGATION UPDATE

Renting of immovable property services provided by NRI liable to GST under forward charge, GPA holder liable to take registration and pay GST – Karnataka AAR

The applicant in this case M/s. Nagabhushana Narayana, a non-resident Indian residing in California, USA owned a commercial property in Bengaluru, Karnataka that was being rented out. The applicant sought clarification on his liability to be registered under the GST law and whether he is required to pay GST on renting a commercial building. The applicant argued that as a non-resident without a fixed establishment in India, the renting service should be treated as an import of service, making the recipient-tenant responsible for tax payment under the reverse charge mechanism.

However, the Karnataka AAR ruled that the leasing of the property was carried out by the applicant’s mother as the General Power of Attorney holder. As a resident of Karnataka and the actual supplier of the taxable service, she is liable for GST registration and payment of GST on the rent received. The AAR also concluded that since both the place of supply and the location of the supplier are in Karnataka, the transaction qualifies as an intra-state supply under the IGST Act, 2017.

Market research services provided to foreign customers not ‘intermediary’ services – Delhi High Court

In this case, the key issue in question was whether the denial of the refund of integrated tax was justified based on the petitioner (M/s Ohmi Industries Asia Private Limited) being classified as an ‘intermediary’.

The Delhi High Court held that as per the plain language of Section 2(13) of the IGST Act, an intermediary is defined as someone who arranges or facilitates the supply of goods and services. In this case, there was no dispute that the petitioner had provided Market Research Services independently without arranging the supply from a third party. As the petitioner directly rendered the Market Research Services to M/s OHMI, Japan, they cannot be considered as an intermediary.

Consequently, the High Court allowed the petition, acknowledging that the petitioner is eligible for the refund of integrated tax paid on the invoices about Market Research Services.

Effective Threat Intelligence Implementation

Organizations around the world face a serious threats from cybersecurity risks. Although there are ways to reduce these risks, they can never be eliminated. Cybersecurity risks constantly change, making it hard to put a precise number on them. Some cybersecurity initiatives may not significantly reduce risk, but small initiatives over time can add up and help reduce the risk.

Risk Identification in Cybersecurity

No organization can eliminate risk, no matter how much they invest in cybersecurity or how talented their team is. It is important to understand the sources of the risk that exists for the organization and take steps to reduce it. Even with strong cybersecurity measures in place, an organization can still be vulnerable to attacks from determined threat actors. However, minor changes and improvements can make a significant difference in reducing cyber risk, so it is important to do everything possible to minimize risk.

Mitigating Risk through Effective Staffing Strategies

Having a strong cybersecurity defence requires multiple layers of protection, which may change over time. Some layers are easy to implement and do not require extra funding, while others may be costly and time-consuming. The biggest challenge for implementing these layers is often not having enough staff to work on them, especially for large projects that require a lot of time and resources. This can slow down progress and increase the risk of security breaches.

One solution that some cybersecurity professionals have found helpful is to bring in college interns to help with these projects. This benefits both the company and the interns, as the interns gain real-world experience, and the organization gets extra help without having to hire additional full-time staff.

The Dynamic Nature of Risk

It is important to understand that risk is always changing, and organizations should not treat it as a one-time, static evaluation. Some companies only review their risk once a year, usually in preparation for an audit, and then do not make any changes until the next audit cycle. However, in the rapidly evolving world of cybersecurity, this approach is not enough.

The threat landscape is constantly changing, and most risks faced by organizations are from groups seeking financial gain. This is true across different industries. For companies without valuable trade secrets, the main components of the threat landscape are:

- Loss of confidential data

- Loss of network or web services

- Inability to access digital resources.

- Reputational or legal issues due to compromised data.

To keep up with these changing risks, companies need to be more agile and adapt to new threats as they emerge.

Threat Intelligence is the Key

To understand and stay ahead of cyber risks and threats, it is important to consistently work on developing a cohesive threat intelligence strategy. This means gathering information on what threat groups are planning, how they are attacking, and what makes them successful or unsuccessful. By doing this, one can proactively defend against tactics being used by threat groups in real time.

For example, if a financial institution receives threat intelligence about a threat group deploying successful ransomware attacks against other financial institutions, they can use this information to perform countermeasures. This could include patching vulnerabilities, blocking certain information at the email gateway, sending end-users notifications, or providing additional training to staff and geo-blocking can also be used as a countermeasure against known or suspected threat groups operating in specific geographic regions.

Conclusion

To reduce cyberrisk in organizations, it is important to constantly update and improve defence against threats. Organizations should aim to make improvements more frequently than threat groups to stay ahead of them. Cybersecurity teams must have support from leadership to implement additional layers of defence and enhance their skills. By developing and maintaining a cohesive threat intelligence strategy and regularly reviewing and improving cybersecurity measures, organizations can better protect their digital assets and reduce the risk of cyber-attacks.

Singapore Updates

Latest Updates

Accounting Standards Committee issues Amendments to SFRS(I) 1-12 and Amendments to FRS 12 on International Tax Reform—Pillar Two Model Rules

The Accounting Standards Committee has issued amendments to SFRS (1) 1-12 and FRS 12 on international tax reforms- Pillar Two Model rules. The amendments give companies temporary relief from accounting for deferred taxes arising from the Organisation for Economic Co-operation and Development’s (OECD) international tax reform. The amendments will introduce:

- A temporary exception—to the accounting for deferred taxes arising from jurisdictions implementing the global tax rules. This will help to ensure consistency in the financial statements while easing into the implementation of the rules; and

- Targeted disclosure requirements—to help investors better understand a company’s exposure to income taxes arising from the reform, particularly before legislation implementing the rules are in effect.

https://www.acra.gov.sg/accountancy/accounting-standards/pronouncements/singapore-financial-reporting-standards-(international)/2023-volume https://www.acra.gov.sg/accountancy/accounting-standards/pronouncements/financial-reporting-standards/2023-volume

Monetary Authority of Singapore

1) Bill passed to establish a platform for financial institutions to share information on customers to combat money laundering and terrorism financing.

On May 9, 2023 the Financial Services and Markets (Amendment) Bill was passed in the parliament. The Bill provides a legal framework for financial institutions to share information on customers, through a secure digital platform called COSMIC “Collaborative Sharing of ML/TF Information & Cases”, to mitigating money laundering, terrorism financing and proliferation financing risks. The Bill sets out when and how such sharing of risk information relating to a customer may take place. It also sets out robust legal and operational safeguards to protect the confidentiality of the information being shared and the interest of legitimate customers.

Overview of COSMIC

COSMIC will initially focus on the following three risks 1) the misuse of legal persons, such as the abuse of shell companies 2) trade-based money laundering, and 3) proliferation financing and the evasion of international sanctions. MAS plans to introduce COSMIC in phases. MAS will prescribe the financial institutions that will participate in COSMIC. In the first phase, MAS will make COSMIC available to the six major Singapore banks which it is already co-developing the platform with. They are DBS, OCBC, UOB, SCB, Citibank, and HSBC. Sharing of information between MAS and these six banks will be voluntary in this first phase. This allows the COSMIC platform to achieve operational stability and enables MAS to closely engage participant financial institutions to calibrate COSMIC’s features and address operational concerns. Subsequently, MAS plans to expand COSMIC’s coverage to more focus areas and financial institutions and make sharing mandatory in higher-risk circumstances.

Modes of Information Sharing

There are three modes under the Bill in which information may be shared via COSMIC. They relate to one, a participanting financial institution requesting information from another participant; two, a participating financial institution proactively providing information to another; and three, a participant in a financial institution placing the customer on a watchlist to alert other participant financial institutions. An objective threshold needs to be crossed before information can be shared using any of the three modes. Which mode is to be used is largely guided by the extent of a customer’s “red flag” behaviours. The thresholds are progressively higher for Request, Provide and finally Alert.

Safeguards to Protect Legitimate Customers

As the owner of the COSMIC platform, MAS will ensure that COSMIC information is exchanged and stored securely. The platform will have robust controls, including cyber security measures which will be subject to periodic audits to ensure their efficacy.

When information is passed to participant financial institutions, participant financial institutions will not be allowed to disclose information obtained from COSMIC to a third party, except in tightly circumscribed and specific circumstances, such as for compliance with Court orders or requests from police to facilitate investigations. Additionally, the Bill will empower MAS to require participant financial institutions to maintain strong information cybersecurity measures for COSMIC data. This includes requirements to have systems and processes in place to prevent unauthorised use or disclosure of information obtained from COSMIC, and robust cybersecurity and encryption measures to safeguard information obtained from COSMIC. MAS will be able to inspect participants’ adherence to these measures, and will not hesitate to take firm action if they uncover any breach.

Apart from participant financial institutions, MAS will have access to all information shared on the platform. This is necessary for MAS to monitor if participant financial institutions are using COSMIC appropriately and will also support MAS’ broader supervisory and surveillance role to ensure that financial institutions have robust defences against financial crime. STRO, which analyses and disseminates financial intelligence to law enforcement and regulatory agencies, will also be able to view and use COSMIC information to support the prevention and detection of financial crime.

2) MAS Strengthens Collaboration Between Financial Institutions and Training Institutes to Enhance Artificial Intelligence and Data Analytics Skills

The Monetary Authority of Singapore (MAS) has launched the Financial Sector Artificial Intelligence and Data Analytics (AIDA) Talent Development Programme. The initiative, which is part of the National AI Programme in Finance, aims to increase the supply of AIDA talent to build deep AI capabilities in the financial sector. The launch event was officiated by Mr Tan Kiat How, Senior Minister of State, Ministry of Communications and Information. An AIDA Talent Consortium has been set up for key financial institutions (FIs) and training institutions to collaborate on the talent development programme.

Based on an informal survey conducted by MAS in 2022 on 131 local FIs, 44% of FIs indicated that the shortage of AIDA talent is the biggest challenge in the adoption of AIDA. The AIDA Talent Development Programme seeks to address this shortage through the following strategies:

- Aggregate: Through the Consortium, MAS will aggregate FIs’ talent demands across various AIDA roles, based on their stage of AIDA adoption. MAS will work with the Institute of Banking and Finance, Institutes of Higher Learnings (IHLs) and training providers to develop programmes to meet the needs of FIs.

- Collaborate: MAS will work with FIs, established training providers, and educational institutions to co-curate training programmes and modules which incorporate the latest developments and trends in AIDA, with strong financial sector application. This includes developing case studies to promote sharing of good use cases and industry-relevant data resources.

The AIDA Talent Consortium will comprise FIs, established training providers and IHLs. Through workgroups looking at the different stages of FIs’ AIDA adoption, the consortium will facilitate the matching of participating FIs to the relevant training institutions which are equipped to curate tailored programmes that meet industry’s needs. The consortium will also contribute their expertise in designing curriculums for AI-related modules.

In the second half of 2023, the consortium will publish a whitepaper detailing the current AIDA talent landscape in the financial sector, as well as an AIDA skills progression pathway and financial sector case studies.

The skills progression pathway will serve as a roadmap for financial sector AIDA roles and detail both financial sector-specific domain skills and technical AIDA skills required.

The case studies will cover key applications of AIDA in the financial sector, such as compliance, fraud monitoring, business intelligence, investment decisions, customer relations and KYC.

3) MAS consults on amendments to regulations and notices to operationalize payment services (Amendment) Act, 2021

The Monetary Authority of Singapore has on May 8, 2023 published a consultation paper proposing amendments to the Payment Services Regulations 2019 and Notices relating to payment services to extend business conduct requirements to payment services which will be newly regulated once the Payment Services (Amendment) Act 2021 comes into force.

Additionally, the MAS has proposed to provide a transitional exemption period for newly regulated payment service providers or existing PSPs which have to vary their licence as a result of the newly scoped-in payment services.

List of affected legal instruments

Once the PS(A) comes into force, the following legal instruments will be amended to apply to the newly scoped-in payment services:

- The PSR

- MAS Notice PSN01 on Prevention of Money Laundering and Countering the Financing of Terrorism –Specified Payment Services

- MAS Notice PSN02 on Prevention of Money Laundering and Countering the Financing of Terrorism –DPT Service

- MAS Notice PSN04 on Submission of Regulatory Returns

- MAS Notice PSN07 on Conduct

- MAS Notice PSN08 on Disclosure and Communications.

MAS is also proposing to update some existing business conduct requirements as part of this present round of consultation. This will have an impact on both PSPs already governed by the existing PSA regime and new PSPs that will come under the PSA by the new scoped-in payment services.

Inland Revenue Authority of Singapore

1) 2024 GST Rate Change: A Guide for GST-registered Businesses

On May 19, 2023, the Inland Revenue Authority of Singapore (IRAS) published the first edition of the e-tax guide (the “Guide”) on 2024 GST Rate Change: A Guide for GST-registered Businesses.

As per the Budget 2022, announced by the Minister for Finance, the GST rate will be increased in 2 steps:

- from 7% to 8% with effect from Jan 1 2023 (first rate change); and

- from 8% to 9% with effect from Jan 1 2024 (second rate change).

This guide explains the general transitional rules applicable to transactions spanning the second-rate change to prepare GST-registered businesses for the second rate change when the GST rate is increased from 8% to 9% with effect from Jan 1,2024. It covers the time of supply rules, the GST rates chargeable and provides information on the issuing of invoices, credit notes and other requirements.

LEGAL UPDATES

1. Amendments to the Prevention of Money-Laundering Act, 2002

a) The Ministry of Finance, Department of Revenue, has issued two notifications amending the Prevention of Money-laundering Act, 2002, (“Act”), the first, on May 3, 2023 (“First Notification”) and, the second, on May 9, 2023 (“Second Notification”).

b) First Notification: Through the enabling provision under Section 2(1)(sa)(vi) of the Act, which defines ‘persons carrying on designated business or profession’, the Ministry of Finance issued a notification stating that the ‘relevant person’ shall include:

i) an individual who obtained a certificate of practice under section 6 of the Chartered Accountants Act, 1949 and practising individually or through a firm

ii) an individual who obtained a certificate of practice under section 6 of the Company Secretaries Act, 1980 and practising individually or through a firm

iii) an individual who has obtained a certificate of practice under section 6 of the Cost and Works Accountants Act, 1959 and practising individually or through a firm

Further, the First Notification also states that the following financial transactions or activities carried out by a relevant person on behalf of his or her client, in his or her professional capacity, will be considered as an activity under the Act:

i) buying and selling of any immovable property

ii) managing client money, securities or other assets

iii) management of bank, savings or securities accounts

iv) organisation of contributions for the creation, operation or management of companies

v) creation, operation or management of companies, limited liability partnerships or trusts, and buying and selling of business entities

c) Second Notification:

The Ministry of Finance has notified that the following activities, when carried out in the course of business on behalf of or for another person, as the case may be, will be considered as an ‘activity’ under the Act:

i) acting as a formation agent of companies and limited liability partnerships

ii) acting as (or arranging for another person to act as) a director or secretary of a company, a partner of a firm or a similar position in relation to other companies and limited liability partnerships

iii) providing a registered office, business address or accommodation, correspondence or administrative address for a company or a limited liability partnership or a trust;

iv) acting as (or arranging for another person to act as) a trustee of an express trust or performing the equivalent function for another type of trust, and acting as (or arranging for another person to act as) a nominee shareholder for another person

However, as per the Second Notification, activities: (i) carried out as part of any agreement of lease, sub-lease, tenancy or any other agreement or arrangement for the use of land or building or any space and the consideration being subjected to income tax deductions; (ii) carried out by an employee on behalf of the employer; (iii) carried out by an advocate, a chartered accountant, cost accountant or company secretary in practice, engaged in the company formation and to the extent of filing a declaration under Section 7(1)(b)[1] of the Companies Act, 2013; (iv) of a person which falls within the meaning of an intermediary as set out under Section 2(1)(n)[2] of this Act, will not fall under the purview of the definition of ‘activity’.

2. Amendments to the Employees’ Pension Scheme, 1995 under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 (now subsumed under the Code of Social Security, 2020)

The Supreme Court of India, in the judgement Employees’ Provident Fund Organisation and Others v. Sunil Kumar B. and Others[1] has held that, the requirement of members to contribute 1.16% of their salary, to the extent that such salary exceeds INR 15,000/- per month, as an additional contribution, is ultra vires the provisions of the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 (“PF Act”).

Accordingly, the Ministry of Labour and Employment, vide notification dated May 3, 2023, has notified that the employer’s contribution of members who have contributed jointly in accordance with the provisions of Paragraph 11 of the Employees’ Pension Scheme, 1995 and are found eligible, shall stand revised to 9.49% of the basic wages, dearness allowance and retaining allowance of each member, thereby stipulating an increase of 1.16% from the erstwhile contribution of 8.33%. This amendment is retrospective in nature and shall come into effect on September 14, 2014.

https://www.epfindia.gov.in/site_docs/PDFs/Circulars/Y2023-2024/Circular_Pension_2061.pdf

3. Notification in relation to the Scheme for Faster Adoption and Manufacturing of Electric Vehicles in India - Phase II (“FAME Phase II”)

The Ministry of Heavy Industries and Public Enterprises vide notification dated May 19, 2023 has partially modified certain regulations of the Scheme for FAME Phase II. This notification has been notified in pursuance of the erstwhile notification dated June 11, 2021. It will come into effect on June 1, 2023 and would be applicable to all electric two wheelers registered on or after June 1, 2023.

In the notification dated May 19, 2023, the thresholds provided under the notification dated June 11, 2021 stand revised as follows:

a. the demand incentive for electric two-wheelers has been revised from INR 15,000/- to INR 10,000/- kWh;

b. the cap on incentives for electric two-wheelers will be revised from 40% of the cost of vehicles to 15% of the ex-factory price of vehicles.