July 2023 Newsletter

DUE DATES

Compliance calendar for due dates falling in July 2023

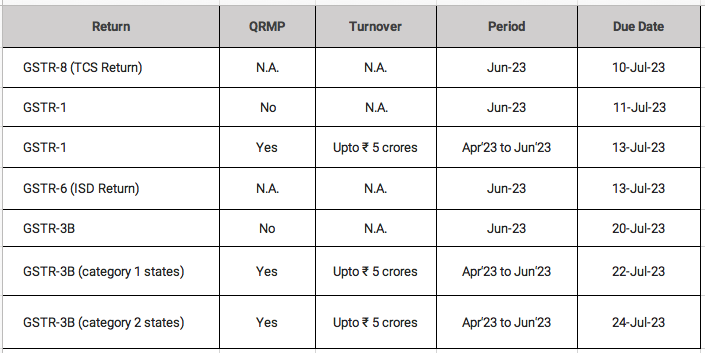

GST

DIRECT TAX

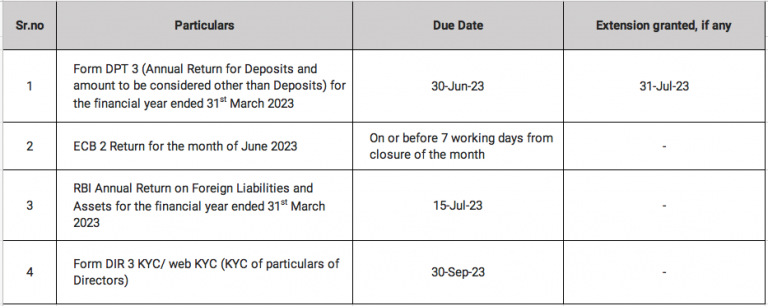

CORPORATE ADVISORY SERVICES

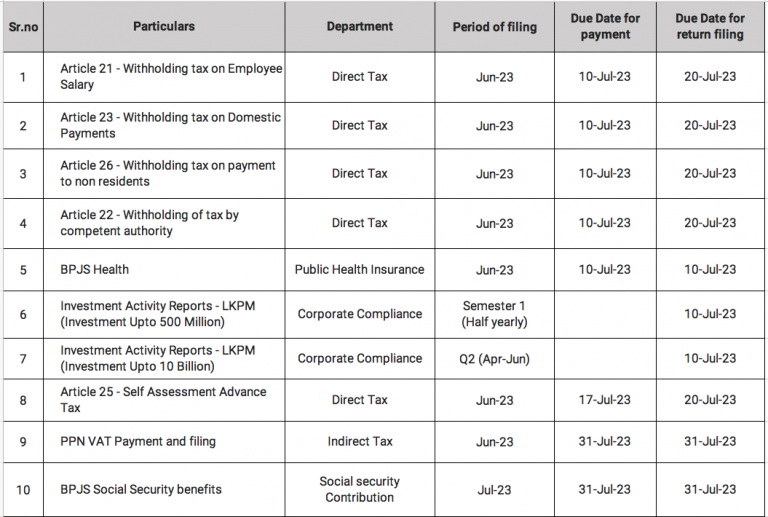

INDONESIA COMPLIANCE

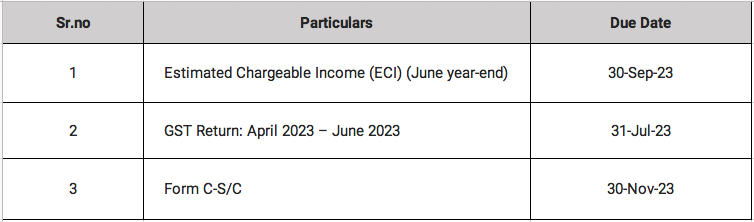

SINGAPORE COMPLIANCE

Circulars/Notifications/Press Release

Central Government issues notification concerning determination of arm's length price u/s 92C

- Central Government, vide Notification No. 46/2023 dt. Jun 26, 2023, has notified the tolerance range of 3% (1% for wholesale trading) for determining the arm’s length price under transfer pricing regulations for AY 2023-24.

Clarification regarding Tax collected at Source (TCS) to small Debit/Credit Transactions

- It has been decided that any payments by an individual using their international Debit or Credit cards upto Rs 7 lakh per financial year will be excluded from the Liberalised Remittance Scheme (LRS) limits and hence, will not attract any TCS.

Extension of time limit for submission of certain TDS/TCS Statements

- Form 26Q and Form 27Q for the first quarter, FY 2023-24 which were required to be furnished on or before 31st July 2023 shall now be furnished before 30th September 2023

- Form 27EQ for first quarter, FY 2023-24 which was required to be furnished on or before 15th July 2023 may be now furnished on or before 30th September 2023

Case Laws

Reimbursement of Salary Costs - Whether Fees for Technical Services (FTS) or Salary under Income Tax : Bangalore ITAT

- Assessee is a private limited company engaged in the business of providing software development and support services to its holding company. Assessee made payments to seconded employees and deducted TDS under section 192. However, department argued that it is FTS payment and TDS to be deducted under section 195 and disallowed the expenditure for non-deduction of TDS.

- The matter reaches to ITAT. ITAT directed the Assessing Officer (AO) to examine whether the assessee has deducted tax at source under section 192. If assessee is able to prove that it had deducted tax at source with regard to the salary payment of the seconded employees in its entirety, the AO shall not make any disallowance under section 40(a)(i) of the Act for non-deduction of tax under Section 195 of the Act

High Court quashes order passed by Assessing Officer without considering Assessee's request seeking time to furnish required details

- Assessee received a show cause notice wherein assessee was directed to submit details and produce certain documents for which a time period of 2 weeks were sought to furnish the same since the documents were voluminous in nature.

- The Income Tax Department had passed the assessment order without considering the petitioner’s objection due to time limitations.

- The high court held that the assessment order was passed without giving a reason as to why department had not granted specific time.

- Court considered that the principles of natural justice has been violated by the respondent and therefore, the assessment order was quashed.

ITAT (“Income Tax APPELLATE TRIBUNAL”) justified additions towards short collection of tax as a declaration in Form 27BA collected after lapse of 7 years: ITAT

- The Assessing Officer (“AO”) noticed that the assessee neither collected TCS nor obtained Form no. 27C under section 206C(1A) and computed short collection of TCS and relevant interest under section 206C(7).

- However, the assessee has filed Form no. 27C after assessment proceedings and filed an appeal.

- AO observed that Form no. 27C filed after date of assessment could not be considered and Form 27C shall deliver or cause to be delivered to the concerned authorities on or before the seventh day of the next month in which the declaration is furnished to him.

- Assessee has taken an alternate plea and is able to collect declaration in Form no. 27BA where the Accountant has certified that the purchasers have filed the return of income.

- Tribunal held that if the buyer has furnished his return of income, has paid the tax on the income declared by him and furnishes 27BA then the assessee shall not be treated as an assessee in default in respect of such tax.

GST litigation Update

Indirect Litigation update

Service Tax

Provision of service by commission agent to foreign principals is export of services – CESTAT Mumbai Larger Bench

In a recent ruling, the Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) Mumbai addressed the question of whether services provided by a sub-agent to its main agent, located in a foreign country, would qualify as an export of services. The case specifically examined the provision of services by Arcelor India, acting as a commission agent, to its main agent, Arcelor France, for the products supplied by foreign steel mills to customers in India.

CESTAT concluded that taxable services are only those that are provided or are to be provided within India. It further emphasized that there is no provision under the service tax law deeming extra-territorial transactions as taking place in India for the purposes of taxation. Therefore, the commission received by Arcelor India in foreign exchange from Arcelor France would be considered an export of services. This classification was based on the fulfilment of all the conditions required for a transaction to be treated as an export.

Payments received in INR from a foreign bank account is deemed as payment received in convertible foreign exchange –CESTAT Chennai

In a recent case, the CESTAT Chennai addressed the issue of whether payments received in Indian Rupees (INR) from a foreign bank account to an Indian bank account can be treated as convertible foreign exchange. The Department had denied the appellant’s contention that the services provided were exported on the grounds that the consideration was not received in convertible foreign exchange.

The appellant in this case contended that when a person receives payment in INR from an account of a bank situated in a country outside India, maintained with an authorized dealer, it is deemed that the person has repatriated the realized foreign exchange to India. The appellant provided Foreign Inward Remittance Certificate (FIRC) documents as evidence to support their claim.

CESTAT Chennai referred to a previous decision in the case of Mitsubishi Heavy Industries India Pvt. Ltd., where it was established that when a service is provided to a person located abroad and the condition is payment of consideration in convertible foreign exchange, this condition is satisfied if the recipient of the service transfers the money from their account in convertible foreign currency and remits it to the Indian service provider. The credit to the Indian recipient’s account at an Indian bank will be in INR, as no foreign exchange amount can be credited to a bank located in India.

Considering the proposition laid out in previous decisions, CESTAT Chennai concluded that the department’s view that the appellant had not received consideration in convertible foreign exchange lacked factual and legal basis and thus, set aside the service tax demand.

Duty Free Shops at International Airports Exempt from Indirect Tax Burden - Supreme Court

In a significant ruling, the Supreme Court addressed the issue of whether Duty Free Shops (DFS) at international airports in India are eligible for a refund of service tax paid on rent. The case involved M/s Flemingo Travel Retail Limited, which operates DFS at Mumbai and Delhi International Airports. The key question was whether the assessee could claim a refund of the service tax paid on the rent of the DFS.

After considering previous judgments of High Courts and a revision order of the Central Government in the context of levy of customs duty, the Supreme Court held that DFS, whether located in arrival or departure terminals, are situated outside the customs frontiers of India. Therefore, imposing any form of indirect tax burden on DFS would be unconstitutional. Any tax levied in such cases cannot be retained, and DFS operators are entitled to a refund without any technical objections, including those related to limitations.

VAT

Sales tax leviable on credit note for replacement of defective parts under warranty – Supreme Court in case of M/s Tata Motors Ltd.

The key issue of this case was that whether a credit note issued by the manufacturer to a dealer for replacement of the defective part in the automobile according to a warranty agreement chargeable to Sales tax.

SC held that when a dealer replaces a defective part of the automobile by a spare part from his stock or by purchasing it from open market, the credit note issued by the manufacturer to the dealer is a valuable consideration for transferring the property in spare part made by dealer to the customer and hence a ‘sale’ within the meaning of sales tax legislations. Therefore, sales tax is applicable on the same.

GST

Sale/right to use car parking is not naturally bundled with construction services, hence liable to GST at 18% - West Bengal AAAR

In a recent ruling, the Appellate Authority for Advance Ruling, West Bengal addressed the issue of whether the amount charged for the right to use a parking space, along with the sale of apartments, should be considered a composite supply or a separate supply.

The authority determined that as per the provisions of the RERA, an open parking space is categorized as a “common area”. Since the provision of a parking facility was optional, as indicated by the appellant to the authority, it cannot be considered a naturally bundled service. Therefore, the amount charged by the appellant for the right to use the parking facility, although not permissible under RERA, is deemed a separate supply. Consequently, GST is applicable at a rate of 18%.

Cyber Security

The rise of Artificial Intelligence (AI) has been a game-changer for industries across the board. From healthcare to finance, businesses are using AI tools to automate processes, improve decision-making and gain a competitive advantage. AI’s impact on the IT industry, especially in governance, risk, compliance (GRC), and security operations, is revolutionary. AI tools offer automation, improved decision-making, and a competitive edge. In the realm of cyber security, AI presents unparalleled benefits for organizations seeking robust protection against evolving threats.

AI-powered tools empower GRC and security teams to swiftly identify and respond to risks and issues. Machine learning algorithms detect patterns and anomalies in data, while natural language processing analyses unstructured sources like emails and social media, enhancing risk management and compliance, and strengthening overall security posture.

The automation capabilities of AI provide a significant advantage in GRC, streamlining compliance tasks, such as policy creation, updates, and monitoring. By leveraging AI, businesses ensure continuous adherence to regulations, minimizing risks through proactive data analysis to identify compliance issues.

In the realm of security operations, AI transforms cyber defence strategies. AI automates critical security tasks, including threat detection, incident response, and risk assessment, enabling organizations to respond swiftly and effectively to vulnerabilities.

Despite challenges like specialized expertise and data requirements, the increasing prevalence of AI tools highlights their importance for competitive businesses.

Automated threat detection and incident response fortify cyber defences, pre-empting attacks and minimizing damages. Investing in AI demonstrates a commitment to safeguarding critical assets and staying ahead of adversaries in the increasingly treacherous cyber landscape.

In conclusion, AI is reshaping the IT industry, empowering businesses with automation, improved decision-making, and competitive advantage. AI tools are indispensable for robust protection and maintaining a strong security posture in today’s digital age.

Singapore Updates

Latest Updates

Accounting and Corporate Regulatory Authority (ACRA)

1) Companies, Business Trusts and Other Bodies (Miscellaneous Amendments) Act 2023 to come into effect on 1st July 2023

The following key amendments in the Companies, Business Trusts and other bodies (Miscellaneous Amendments) Act 2023 will take effect on 1st July 2023:

1) Changes to the computation of the threshold for compulsory acquisition of shares under section 215 of the Companies Act1 967

2) Amendments to provisions relating to the disqualification of persons as directors under section 155A of the Companies Act

3) Updates to the penalties imposed on directors of the companies for failing to prepare and table financial statements in compliance with the prescribed accounting standards in Singapore.

The Amendment Act also contains provisions which permanently provide Companies, business trusts and variable capital companies with the option to conduct fully virtual or hybrid meetings and board meetings held virtually are no longer prohibited. Companies are also now required to accept proxy instructions given electronically rather than leaving this to be stipulated in the company’s constitution.

The bill also amends the multiple-proxy regime, which has been introduced to replace the former ‘one proxy’ rule in the case of schemes of arrangement. By doing so, beneficial shareholders whose shares are held by relevant intermediaries will have the right to attend the Scheme of Arrangement (SOA) meeting, ensuring that representation at the SOA meeting and all other corporate meetings is handled consistently where the intermediary is allowed to appoint multiple representatives.

2) Commencement of Requirements under the Accountants (Amendment) Act from 1st July 2023

With effect from 1st July 2023, ACRA will be implementing the requirements under the Accountants (Amendments) Act which was passed by Parliament in October last year.

These amendments seek to enhance ACRA’s audit regulatory regime and ensure that high audit quality standards are upheld by public accounting entities (PAEs) and public accountants (PAs).

The requirements or changes under the Act are as follows:

1.Quality Control Inspections on PAEs:

The amendment allows ACRA to conduct statutory QC inspections on PAEs to ensure compliance with professional standards and legal and regulatory requirements. Furthermore, it will help mandate the remediation of lapses and impose sanctions on PAEs for non-compliance discovered during inspections.

2. AML/CFT Inspections on PAEs and PAs:

The amendment gives ACRA powers to conduct Anti-Money Laundering/ Countering the Financing of Terrorism (AML/CFT) inspections to impose sanctions on PAEs and PAs if they fail to comply with the requirements.

3. Introduction of a tiered assessment framework:

It includes a tiered assessment framework (satisfactory, satisfactory but with findings, partially satisfactory, and not satisfactory) for the Practice Monitoring Programme and QC inspections. This helps improve PAEs’ and PAs’ compliance with professional standards.

4. Disclosure of audit inspection findings:

The Accountants (Amendment) Act allows ACRA to compel a PA who received a “Not satisfactory” inspection to disclose their audit inspection findings to the audited entity. This offers greater transparency of the PA’s inspection findings and improves the audit committee’s ability to evaluate the effectiveness of their auditor.

https://www.acra.gov.sg/news-events/news-details/id/725

https://www.acra.gov.sg/legislation/legislative-reform/accountants-(amendment)-act-2022

Monetary Authority Of Singapore

1) MAS Proposes Standards for Digital Money

The Monetary Authority of Singapore (MAS) published a whitepaper proposing a common protocol to specify conditions for the use of digital money such as central bank digital currencies (CBDCs), tokenised bank deposits, and stablecoins on a distributed ledger.

The whitepaper was supported by the release of software prototypes that demonstrate the concept of Purpose Bound Money (PBM), which enables senders to specify conditions, such as validity period and types of shops when making transfers in digital money across different systems. The whitepaper, which was developed in collaboration with the International Monetary Fund, Banca d’Italia, Bank of Korea, financial institutions and fintech firms, covers the following:

- Technical specifications that outline the PBM lifecycle from issuance to redemption, and the protocol to interface with digital currencies backing it;

- Business and operating models for how arrangements could be programmed such that money is transferred only upon fulfilment of service obligations or terms of use. The PBM protocol is designed to work with different ledger technologies and forms of money. It enables users to access digital money using the wallet provider of their choice. With a common protocol, the same infrastructure can be used across multiple use cases. Stakeholders using different wallet providers can transfer digital assets to one another without the need for customization.

Financial institutions and fintech firms are launching trials to test the usage of PBM under different scenarios:

• Online commerce: Amazon, FAZZ and Grab are collaborating on a pilot use case involving escrow arrangements for online retail payments. This allows payment to be released to the merchant only when the customer receives the items purchased, thus providing greater assurance to both parties.

• Programmable rewards: DBS, Grab, FAZZ, NETS and UOB, will trial the use of PBM-based cashback and other incentives to improve consumer experiences while reducing frictions faced by merchants, such as manual reconciliation of sales proceeds and time needed to onboard new sales campaigns.

The PBM whitepaper builds on MAS’ Project Orchid, and aims to encourage greater research among central banks, FIs, and fintech’s, to understand the design considerations in the use of digital money. To support ongoing development and learning, PBM source codes and software prototypes developed under Project Orchid were released today for public access. The open-source codes and prototypes demonstrate how PBM can be used to embed digital money in escrow arrangements. This serves as a reference model to foster interoperability across different platforms. Policy makers, businesses and FIs can tap into the open source codes and prototypes to facilitate their experiments and research.

Sopnendu Mohanty, chief fintech officer, of MAS, said: “This collaboration among industry players and policymakers has helped achieve important advances in settlement efficiency, merchant acquisition, and user experience with the use of digital money. More importantly, it has enhanced the prospects for digital money becoming a key component of the future financial and payments landscape.”

https://www.mas.gov.sg/news/media-releases/2023/mas-proposes-standards-for-digital-money

2) MAS Proposes Framework for Digital Asset Networks

The Monetary Authority of Singapore in collaboration with the Bank for International Settlements’ Committee on Payments and Market Infrastructure, has released a comprehensive report outlining a framework for the design of open and interoperable networks for digital assets. The report, titled “Enabling Open & Interoperable Networks,” aims to establish international standards that promote secure and efficient financial market infrastructure.

As part of its efforts to ensure the sound development of emerging digital asset networks, the Monetary Authority of Singapore (MAS) has expanded its Project Guardian initiative. This collaborative project with the financial industry focuses on testing the feasibility of asset tokenization and decentralized finance applications. The report also explores how the principles for financial market infrastructures set by the CPMI-IOSCO can be applied to evolving models of digital asset networks.

MAS has formed the Project Guardian Industry Group, comprising 11 prominent financial institutions, to lead industry pilots across various financial asset classes. These pilots will explore the potential of asset tokenization and its benefits in areas such as asset and wealth management, fixed income, and foreign exchange.

In the field of asset and wealth management, HSBC, Marketnode, and UOB successfully concluded a technical pilot on the issuance and distribution of digitally native structured products. The pilot demonstrated the potential for lower costs, reduced settlement times, customization, and broader distribution within the structured product chain. Other pilots in this domain include UBS Asset Management’s exploration of native issuance for Variable Capital Company (VCC) funds and Schroders’ partnership with Calastone to develop a tokenized investment vehicle.

Within fixed income and foreign exchange, Standard Chartered collaborated with Linklogis to develop a platform for the issuance of asset-backed security tokens. DBS Bank, SBI Digital Asset Holdings, and UBS AG are conducting a pilot on repurchasing agreements with digitally issued bonds. Additionally, Citi is testing the pricing and execution of digital asset trades on a distributed ledger to improve post-trade reporting and analytics.

MAS has also welcomed the Japan Financial Services Agency (JFSA) as the first overseas financial regulator to join Project Guardian, marking a significant milestone in international collaboration.

This partnership between MAS and JFSA aims to enhance knowledge in the areas of digital asset innovation and best practices for asset tokenization while safeguarding financial stability and integrity.

Leong Sing Chiong, Deputy Managing Director (Markets and Development) at MAS, emphasized the authority’s commitment to fostering a responsible and innovative digital asset ecosystem. While discouraging speculation in cryptocurrencies, MAS recognizes the potential value creation and efficiency gains in the digital asset space. The organization looks forward to collaborating with policymakers and industry practitioners to develop effective frameworks that guide the future development of financial networks.

With the publication of the framework and the expansion of Project Guardian, Singapore’s Monetary Authority is taking significant steps to ensure the safe and efficient development of open and interoperable digital asset networks. By collaborating with industry experts and international regulators, MAS aims to promote responsible innovation in the rapidly evolving landscape of digital assets.

https://mas.gov.sg/news/media-releases/2023/mas-proposes-framework-for-digital-asset-networks

3) MAS Publishes Investor Protection Measures for Digital Payment Token Services

The Monetary Authority of Singapore (MAS) has announced new requirements for Digital Payment Token (DPT) service providers to safekeep customer assets under a statutory trust before the end of the year. This will mitigate the risk of loss or misuse of customers’ assets and facilitate the recovery of customers’ assets in the event of a DPT service provider’s insolvency. MAS will also restrict DPT service providers from facilitating lending and staking of DPT tokens by their retail customers.

These measures are introduced following an October 2022 public consultation on regulatory measures to enhance investor protection and market integrity in DPT services. The consultation received significant interest from a wide range of respondents, with broad support for DPT service providers to:

- segregate customers’ assets from its assets and held in trust;

- safeguard customers’ money;

- conduct daily reconciliation of customers’ assets and keep proper books and records;

- maintain access and operational controls to customers’ DPTs in Singapore;

- ensure that the custody function is operationally independent from other business units; and

provide clear disclosures to customers on the risks involved in having their assets held by the DPT service provider.

MAS will proceed with the proposal to restrict DPT service providers from facilitating lending or staking of their retail customers’ DPTs, as these activities are generally not suitable for retail public. DPT service providers may continue to facilitate such activities for their institutional and accredited investors. There were diverse views received on this proposal. Some respondents suggested to allow DPT service providers to offer these activities with the retail customer’s consent and risk disclosures, while others advocated a ban on these high risk and speculative activities. MAS will monitor market developments and consumer risk awareness as these evolve, and will take steps to ensure that our measures remain balanced and appropriate.

MAS had also consulted on the broad regulatory approach on market integrity in the October 2022 public consultation. Most respondents agreed with MAS’ observations on good industry practices to address market integrity risks, and some respondents suggested that MAS should impose further measures to prevent market abuse and unfair trading practices. To follow up more specifically, MAS is issuing today a separate consultation paper proposing requirements for DPT service providers to address unfair trading practices. It will also set out legislative provisions and the types of wrongful conduct that constitute offences.

Inland Revenue Authority of Singapore

1) IRAS e-Tax guide on Enterprise Innovation Scheme

On 30th June 2023, the Inland Revenue Authority of Singapore (IRAS) published the e-tax guide (the “Guide”) on Enterprise Innovation Scheme.

This e-Tax Guide explains the Enterprise Innovation Scheme (“EIS”) and is relevant to businesses that wish to claim EIS benefits.

The EIS was introduced in Budget 2023 to encourage businesses to engage in R&D, innovation and capability development activities.

Under the EIS, existing tax measures are enhanced and a new tax measure is introduced. In addition, eligible businesses may opt to convert up to $100,000 of the total qualifying expenditure incurred across all the qualifying activities for each YA into cash at a conversion rate of 20%, insted of tax deductions/ allowances.

Legal Updates

1. Amendment to Foreign Exchange Management (Current Account Transactions) Rules, 2000

The Ministry of Finance on 30th June 2023 notified the Foreign Exchange Management (Current Account Transactions) (Amendment) Rules, 2023 (“Amendment Rules”).

Vide the amendment, Rule 7 concerning usage of international credit card outside India has been inserted in the Foreign Exchange Management (Current Account Transactions) Rule, 2000, with retrospective effect from 16th May 2023.

Rule 7 of the Amendment Rules states that no prior approval of the Reserve Bank of India (as contemplated under Rule 5) is required for making payment towards meeting expenses while a person is on a visit outside India.

2. Amendment to Legal Metrology (Packaged Commodities) Rules, 2011

The Ministry Of Consumer Affairs, Food And Public Distribution on 23rd June 2023 has notified the Legal Metrology (Packaged Commodities) (Amendment) Rules, 2023, to amend the Legal Metrology (Packaged Commodities) Rules, 2011, in pursuance of the Legal Metrology Act, 2009. The following amendments have been inserted by way of proviso to Rule 6 in relation to declarations to be made on every package:

a) The package of an electronic product shall declare the name of the manufacturer or packer or importer, as the case may be, on the package itself, and such declaration shall also inform the consumers to scan the QR code for the telephone number, email address, address and other related information if such information is declared through the QR Code and not declared on the package itself.

b) In the case of an electronic product, the package of such product shall inform the consumers to scan the QR code for the common or generic name of the commodity and where such package contains more than one product, then for the name and number or quantity of each product, including size and dimension of the commodity, if such information is declared through the QR Code and not declared on the package itself.

3. Amendment to Consumer Protection (Direct Selling) Rules, 2021

The Ministry Of Consumer Affairs, Food And Public Distribution on 21st June 2023 notified the Consumer Protection (Direct Selling) (Amendment) Rules, 2023 to amend the Consumer Protection (Direct Selling) Rules, 2021 introducing the concept of “network of sellers”.

Vide amendment, Rule 3(1)(ga) has been inserted to incorporate the definition of network of sellers. As per the said definition, the “network of sellers” shall mean a network of direct sellers formed by a direct selling entity to sell goods or services for the purpose of receiving consideration solely from such sale.

As per Rule 3(1)(d), “direct selling entity” shall mean the principal entity which sells or offers to sell goods or services through direct sellers, but does not include an entity which is engaged in a Pyramid Scheme or money circulation scheme.

A corresponding change is introduced in the definition of “direct selling entity” under Rule 3(1)(d), wherein the words “through direct sellers” are substituted by “directly through a network of sellers”.