Due Dates

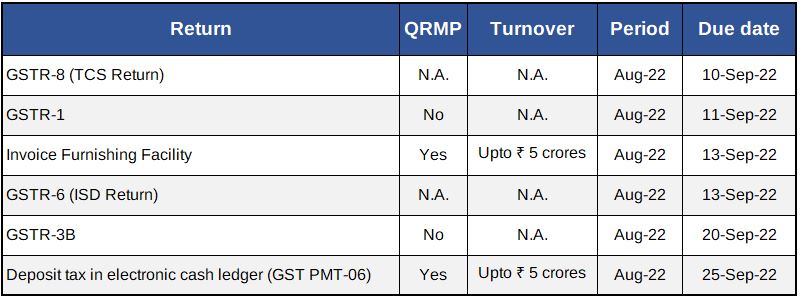

GST Due Dates

Corporate Laws Due Dates

ECB 2 return for the month of August 2022 to be submitted on or before 7 September 2022

DIR KYC filing to be completed on or before 30 September 2022. Any filing after this date will attract a filing fee of ₹ 5,000/-

In terms of Companies (Accounts) Fourth Amendment Rules, 2022, the books of accounts and other relevant books and papers maintained in electronic mode should remain accessible in India at all times. Further, the back-up of the books of account/other books and papers maintained in electronic mode, including at a place outside India, should be kept on a daily basis in servers physically located in India . Further in case the service provider is located outside India the company should intimate the name & address of person in control of the books of account in India to the Registrar on an annual basis.

In terms of Companies (Incorporation) Third Amendment Rules, 2022, a new rule 25B has been introduced. This gives power to Registrar of Companies to conduct a physical verification of the registered office of the Company and also prescribes the procedure to be followed for physical verification of the registered office of the company.

In terms of Companies (Acceptance of Deposits) Amendment Rules, 2022, Form DPT 3 now requires a declaration from Statutory Auditors about particulars of deposits and particulars of liquid assets. The amended provision also provides for a complete reconciliation of Loans / monies received but not considered as deposit as on 31 March every year in Form DPT-3 by providing details of opening balance, addition loan, repayment, adjustment, and closing balance as well as aging and it accordingly revised Form DPT-3 and Form DPT-4.

In terms of Foreign Exchange Management (Borrowing and Lending) (Third Amendment) Regulations, 2022, RBI has temporarily increased the individual borrowing limit of USD 750 million or equivalent per financial year to USD 1500 million or equivalent. It is further clarified that this dispensation will be available for ECBs raised till 31 December 2022.

In terms of Foreign Exchange Management (Overseas Investment) Directions, 2022, the existing framework for overseas investment by a person resident in India is simplified. Detailed note on the same will be circulated separately.

In terms of RBI Master Directions on Foreign Investment in India, RBI has provided that the valuation certificate issued by a Chartered Accountant or a SEBI registered Merchant Banker or a practicing Cost Accountant must not be more than ninety days old as on the date of the transfer of equity instruments.

DIRECT TAX

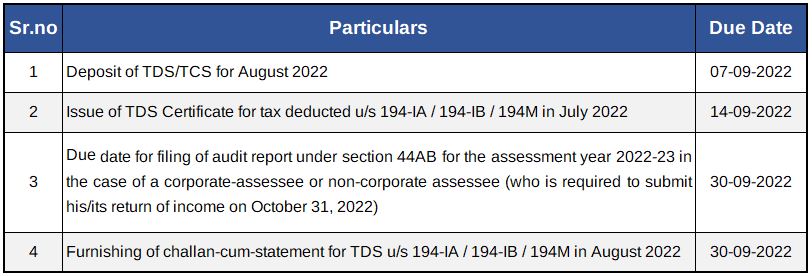

Important Due Dates September 2022

Circulars / Notifications / Press Release

Notification No. 05/2022

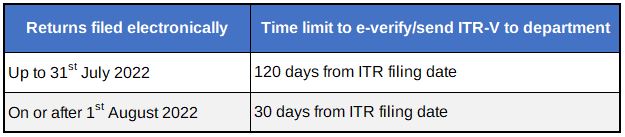

- Directorate of Systems has notified the time limit for ITR V Submission/E-verification as under:

- It has also clarified that:

i.where e-verification or lTR-V submission is done within 30 days of electronic transmission of ITR data, the date of transmitting the data shall be considered as the date of furnishing the return.

ii.where e-verification or lTR-V submission is done beyond 30 days of electronic transmission of ITR data, the date of e-verification or ITR-V submission shall be treated as the date of furnishing the return and all consequences of late filing of return under the Act shall follow.

Notification No. 91/2022

- Income tax act provides that any sum of money received by an individual, from any person, in respect of any expenditure actually incurred by him on his medical treatment or treatment of any member of his family in respect of any illness related to COVID-19, shall not be considered as income of such person.

- For claiming this benefit, the CBDT has notified Form No. 1 to be furnished by the assessee within nine months from end of Financial year or 31 December 2022 whichever is later.

Notification No. 89/2022

- In exercise of the powers contained in Section 47(viiab)(d), the Central Government has notified ‘Bullion Depository Receipt with underlying bullion’ for the purpose of exemption under Section 47(viiab) by amending earlier Notification No. 16/2022 dated 5 March 2022.

Notification No. 94/2022 dated 10 August 2022

- A new Rule (17AA) has been inserted to prescribe the books of accounts to be maintained by every fund, institution or trust or any university or other educational institution or any hospital or other medical institution which is required to keep and maintain books of account and other documents under section 10(23C)- clause “a” of the 10th Proviso or under section 12A(1)(b)(i) of the Act.

- The prescribed books shall be maintained for a period of 10 years from the end of the relevant assessment year.

Amendment to Notification No. 16/1/2015-PR

- From 1 October 2022, any citizen who is or has been an income-tax payer, will not be eligible to join the Atal Pension Yojana.

- The amendment also provides that in case a subscriber, who joins on or after 1 October 2022, is subsequently found to have been an income-tax payer on or before the date of application, the Atal Pension Yojana account shall be closed and the accumulated pension wealth till date would be given to the subscriber.

Notification No. 100/2022/F. No. 370142/35/2022-TPL

- With effect from 1 April 2022, the statement in Form 67 for claiming foreign tax credit shall be furnished on or before the end of the assessment year relevant to the previous year in which the income was offered to tax and prerequisite is return should be filed on or before the due date.

- In case of updated return, Form 67 is to be filed on or before the date of furnishing the return of income.

Notification No. 98/2022/F. No. 370142/33/2022-TPL

- By virtue of the recent insertion of section 239A, any tax-deductible u/s 195 on any income other than interest, where the taxes are borne by the person by whom the income is payable claims that no tax was required to be deducted on such income, he may file an application before the Assessing Officer for refund of such tax in form 29D. Time limit to file Form 29D is thirty days from the date of payment of such tax.

Case Laws

Commissioner of Income Tax vs Air India Ltd

- In the referred case, the Air India paid lease rental to a Non-resident Company (not having PAN in India) and deducted tax @10% as per the India-Netherland DTAA.

- Revenue argued that TDS rate applicable is 20.12% as per section 206AA since the assessee reported the transaction without PAN.

- Revenue approached ITAT, and ITAT dismissed revenue’s appeal by holding that TDS at beneficial DTAA rate prevails over income tax rate. Revenue then approached High court which also upheld ITAT’s decision.

S R Cold Storage Vs Union of India [Allahabad High Court- Writ Tax No - 723 of 2022]

- In the referred case, re-assessment proceedings were initiated on the assessee based on information in the Department’s Insight Portal regarding cash deposits without verifying the same. The Assessing Officer even passed the order without considering the response of the Assessee and did not pass a speaking order.

- On appeal, the court held that this was a violation of principles of Natural Justice.

- The Court imposed a penalty of ₹50 Lakhs on the respondents (Union of India and the tax department) and issued certain directions to ensure that all necessary steps be taken to avoid such situations.

GE Power Systems India Private Limited vs Assistant Commissioner of Income Tax

- In the referred case, the assessee had incurred CSR expenditure and had disallowed the same u/s 37 while computing its taxable income under the normal provisions of the Income Tax Act and the same was not added while computing the book profits under Minimum Alternate Tax (MAT) provision.

- The Assessing Officer made an addition of the same while computing book profits on the ground that Section 115JB provides for addition of any reserve. The Commissioner of Income Tax (Appeal) also confirmed this addition.

- Matter reached ITAT where it ruled that none of the clauses in 115JB (MAT provisions) provided that CSR expenses must be added to book profit.

Infineon Technologies AG vs DCIT

- In the referred case, the Assessing Officer issued a reassessment notice mentioning wrong assessment year.

- The Assessing Officer then issued a notice styled as a corrigendum to correct the Assessment Year which was time-barred.

- The Assessee challenged the reassessment in the court. It was held that the Notice / order passed is time barred and invalid in law.

Armine Hamied Khan vs Income Tax Officer

- In the referred case, the assessee while filing the return for the year claimed the capital gain exemption under section 54 instead of 54F.

- Revenue disallowed the claim of the assessee.

- Matter reache the ITAT which ruled that the claim of the assessee was a bonafide claim and the same cannot be dis-allowed just for claiming it under wrong section as all the conditions of section 54F were complied with. ITAT ruled the case in favour of assessee.

Infinity Infotech Parks Ltd

- In the referred case, the assessee who was engaged in leasing of IT parks received lump sum lease premium which was reduced from the block of fixed assets.

- During the year, the block ceased to exist and thus has resulted into a short-term capital gain as per deeming provision of Section 50. The assessee adjusted the brought forward business losses under head ‘profits and gains of business’ against this ‘short-term capital gain’ as such gain was in the character of business/profession.

- Revenue during revisionary proceedings ignored such set off and held it as irregular.

- Matter reached ITAT, where it was held that that the activity of leasing constructed spaces was undeniably the assesse’s core business activity. As long as profit or gain bears the character of income derived from a business/trading asset, then irrespective of the fact that it was being taxed under a different head of income, the brought forward business loss was liable to be set-off against such profit or gain.

Goods and Service Tax

GST transitional credit - Supreme Court extends the time for opening GSTN portal by 4 weeks

Last month, in our newsletter, we updated that the Supreme Court of India in the case of M/s Filco Trade Centre Private Limited, provided one more opportunity to all the registered taxpayers to claim transitional credits. The Court had directed Goods and Services Tax Network (GSTN) to open the GSTN portal for filling transitional credit forms for two months from 1September 2022. Recently, based on the petition filed by the Government, Supreme Court has extended the time for opening the GSTN Portal by 4 weeks.

GST input tax credit balance cannot be used for making pre-deposit under old central excise regime – CESTAT Allahabad

The appeal filed by the assessee in this case M/s Johnson Matthey Chemical India Pvt Ltd was rejected by the Commissioner (Appeals) on the ground that mandatory pre-deposit requirement as per Section 35F of the Central Excise Act, 1944 is not complied with as the assessee had deposited 7.5% of the disputed amount by reversal of CGST credit balance. Aggrieved by this order, assessee filed an appeal before the Tribunal and contended based on various Tribunal rulings that it is now settled position that the pre-deposit for filing an appeal can be made through reversal of CENVAT credit balance. In their case, since the old CENVAT credit lying in balance has been transitioned to GST regime, the assessee pleaded before the Tribunal that the pre-deposit made by them by reversal of CGST credit balance be allowed and treated as compliance with the requirement of Section 35F. The Tribunal in this case held that GST credit balance lying in electronic credit ledger can be utilized only for payment of self-assessed output tax and output tax cannot be equated with pre-deposit for filing an appeal. Thus, relying on the decision of Orrisa High Court in the case of M/s Jyoti Construction on identical issue, the Tribunal held that mandatory pre-deposit for filing an appeal under old central excise regime cannot be made through CGST credit balance.

Service tax on liquidated damages – matter remanded back to adjudicating authority in the light of recent GST Circular number 178 – CESTAT Ahmedabad

The assessee in this case M/s Gujarat State Petronet Limited challenged the service tax demand on liquidated damages recovered by them for delays in supply contracts or service contracts as per various agreements entered into between them and their vendors. The Tribunal referred to recent GST Circular number 178/10/2022-GST dated 3 August 2022 on the issue of taxability of liquidated damages under the GST law and noted that the said Circular covers the assessee’s case as well. The Tribunal further noted that the circular was not available to the adjudicating authority when the matter was decided and hence the authority could not examine the issue in the light of the aforesaid circular. Consequently, the Tribunal set aside the demand order and remanded back the matter to original adjudicating authority to decide the issue in the light of the aforementioned GST circular.

Right to Appeal is not lost on voluntary payment of tax for release of goods/conveyance detained in transit – Kerala High Court

In this case, the goods/conveyance of the petitioner viz. M/s Hindustan Steel and Cement were the subject matter of detention/seizure under Section 129 of the Central GST Act and the petitioner opted to pay tax and penalty under Section 129(1)(a) of the Central GST Act. Subsequently, the goods and the conveyance of the petitioner were released by issuing Form MOV-05; however, a summary of order/demand in Form DRC-07 was not issued which incapacitated the petitioner from appeal an appeal disputing the tax already paid. The Department contended before the High Court that once the petitioner decided to pay tax and penalty for release of the goods and conveyance, then by virtue of Section 129(5) the proceedings come to end and such payments cannot be the subject matter of any refund or adjudication at a later point of time. The High Court on perusal of the relevant legal provisions and circular issued by the Government, held that the provisions of Section 129(5) as referred by the department only contemplate that the procedure for detention/seizure would come to an end on payment of amounts by the assessee and it is always open to assessee who has suffered the proceedings under Section 129 to challenge the proceedings if he feels that the demand has been illegally raised on him. The High Court also held that the inability of the Portal to generate the demand or the fact that the Portal does not contemplate filing of an appeal in such case does not mean that the intention of the legislature was different. Thus, the High Court allowed the writ petition of the petitioner in this case to allow him to file an appeal.

Cybersecurity / IS AUDIT

Yesterday, Today, and Tomorrow

On the 75th anniversary of our independence, our Prime Minister put up a road map for India’s future. The pointers included an aspiration for India to become a developed country, conversations on our technological prowess, gender equality and so forth.

As the discussion on technological innovation carries on, one cannot help but look back into the Y2K bug problem that put India as an IT hub on the global map. The problem-solving skills shown by our engineers to solve the Y2K bug has always pointed out as accomplishment of our engineers and the time when the world saw a competitive pool of engineers here in the subcontinent. We are again at a crossroads now. The world is changing faster than ever, and the resilience of the country would depend on the foundation it lays for the digital revolution ahead.

Now our ecosystem is not just of service providers but also of entrepreneurs who are ushering in great changes with the rise of start-up unicorns and the enterprises bringing in technological opportunities across the nation. Many elements have come together in the past decades for the present state of our nation has and to drive the future, our nation aspires for. From the creation of strong educational institutions, engineers who migrated back from abroad with required skills, capital investments, policies and of course all the passionate techies who worked together. The overnight success the world sees today was decades in making.

As a global player with an ever-increasing number of internet users, it is time that India should broaden its role from solutions and products-based hub to a security-oriented environment. We should be changemakers of the world and lead the world to a safe, secure, and inclusive digital future about to be built. To do that, it’s imperative that we have a strong foundation in cybersecurity.

For a globally competitive products and services, cybersecurity should be above standard. This should be seen as an overhaul exercise where the stakeholders should go back to the drawing board and prepare a comprehensive cybersecurity strategy at the central level. It has already been proven through the creation of the UPI system by NPCL that we have what it takes to develop a fully secure payment system that can be scaled, and third parties can plug in to the system.

Such level of planning should be done to draw out a secure cybersecurity infrastructure for the nation that works as cyber shield for the entire nation. The security of infrastructure should be built not to protect the information today but to accommodate what comes tomorrow.

As said, the success we see in our IT sector was decades in making. As our service sector grows, not just IT services but all the industries in the service sector take off, the infrastructure built for its cybersecurity matters. The service sector, unlike the agricultural and manufacturing sector, grows exponentially. For a continuous growth of this sector without impediments, a secure infrastructure is as significant as skilled labour force, technological know-how, capital, and innovation. For the growth of tomorrow, the steps taken today are as crucial as the steps taken yesterday. If we aspire to build a digital future and fails to secure it, the growth we envision in them may not become a reality. If we have everything else but lacks proper cybersecurity, it won’t be surprising if investment and clients don’t reach us.

A digitally inclusive society is a transformative society. We can see the changes brought in by putting power in the hands of people through the internet. The benefits it brings, convenience that changes the lives of people, opportunities it presents, entrepreneur culture it cultivates and the innovation that accompanies; The digital future looks bright from here and we should be fully ready when it arrives because it is too valuable a moment to pass up.

SINGAPORE UPDATES

Monetary Authority of Singapore and Other Updates

1) MAS issues circular on disclosure and reporting guidelines for retail ESG funds effective from 2023

The Monetary Authority of Singapore (MAS) has published a circular (the “Circular”) on new disclosure and reporting guidelines for retail ESG funds in Singapore. The Circular was published alongside a Sustainability Report 2021/2022 issued by MAS and coincides with the issuance of Singapore’s first green bond. Pursuant to the Circular, retail ESG funds are required to provide details on their investment strategies, criteria and metrics used to select investments, and risks and limitations associated with the funds’ strategies. The Circular will take effect on January 1, 2023.

The Circular is published in the midst of a growing investor interest in ESG-related investment products in Singapore. The Circular intends to mitigate the risk of greenwashing, where investments are falsely or misleadingly claimed as environmentally sound, and to help investors make more informed investment decisions. According to Ravi Menon, the managing director of MAS, the new disclosures will need to be made on an ongoing basis, and the relevant ESG funds are required to publish annual reports detailing how their ESG focus in investments or strategy has been achieved.

The Circular applies to a collective investment scheme that:

(a) is authorised or recognised by MAS under the Securities and Futures Act 2001 for offers to retail investors in Singapore;

(b) uses or includes ESG factors as its key investment focus and strategy (i.e., ESG factors significantly influence the scheme’s selection of investment assets); and

(c) represents itself as an ESG-focused fund.

2) MAS Imposes Composition Penalty of $375,000 on UOB Kay Hian Private Limited for business conduct and AML/CFT failures

The Monetary Authority of Singapore (MAS) has imposed a composition penalty of $375,000 on UOB Kay Hian Private Limited (UOBKH) for its failures to comply with business conduct requirements under the Securities and Futures (Licensing and Conduct of Business) Regulations (SFR) and anti-money laundering and countering the financing of terrorism (AML/CFT) requirements under MAS Notice SFA04-N02. These failures were identified during an inspection by MAS. UOBKH has paid the penalty in full.

3) MAS Renews its Statement of Commitment to the FX Global Code

The Monetary Authority of Singapore (MAS) has renewed its Statement of Commitment to the updated Foreign Exchange (FX) Global Code (Code). MAS reaffirms its adherence to the principles of the Code as a market participant, and the alignment of its internal practices and processes with these principles.

The Code sets out principles that promote a robust, fair, liquid, open, and appropriately transparent FX market, underpinned by high ethical standards. The Code was first published in May 2017 and updated in July 2021 for alignment with the ongoing evolution of the FX market. The Code is promoted, maintained, and updated on a regular basis by the Global Foreign Exchange Committee.

MAS strongly encourages all wholesale FX market participants in Singapore as well as all its counterparties to adhere to the latest version of the Code, in order to promote the integrity and effective functioning of the global FX market.

4) Strengthening Singapore's Position as a Global Hub for Talent

The Ministry of Manpower, the Ministry of Trade and Industry and the Ministry of communication and information has announced four enhancements to Singapore’s work pass framework to better attract top talent and experienced tech professionals in areas of skills shortages and to strengthen Singapore’s position as a global hub foe talent in light of intensifying competition for talent.

These four enhancements are:

- Introduce new Overseas Networks & Expertise Pass – MOM will introduce a new Overseas Networks & Expertise Pass, named to reflect the qualities the pass holders will bring to Singapore. It is meant for top talent across all sectors. There will be a few routes to apply for the pass, and the pass will be open for applications from January 2023.

- Introduce new public benchmark pegged to top 10% of EP holders- This group of EP applicants will continue to be exempted from the Fair Consideration Framework (FCF) job advertising requirement and COMPASS, as well as be eligible for the Personalised Employment Pass (PEP).

- Enable companies to be more responsive to business needs- a. Restore the FCF job advertising duration from 28 days to 14 days b. Improve processing time for all EP applications – EP applications will be processed, or an update will be given to employers within 10 business days.

Introduce 5-year EP option for candidates that meet the following criteria:- MOM will offer the option of a five year EP to experienced professionals filling specific tech occupations on the COMPASS Shortage Occupation List. The first shortage occupation list will be announced in March 2023. Compared to the typical pass duration of two to three years. MOM states that a longer pass duration will give greater certainty to experienced tech professionals as well as businesses in their workforce planning and allow Singapore to anchor tech capabilities while developing the local pipeline.

IRAS- Due Dates

- Estimated Chargeable Income (ECI) (June year-end) 30 September 2022

- GST Return: July 2022 – September 2022 : 31 October 2022

- Form C-S/C : 30 November-2022