Due Dates

Compliance calendar for due dates falling in the month of March 2023

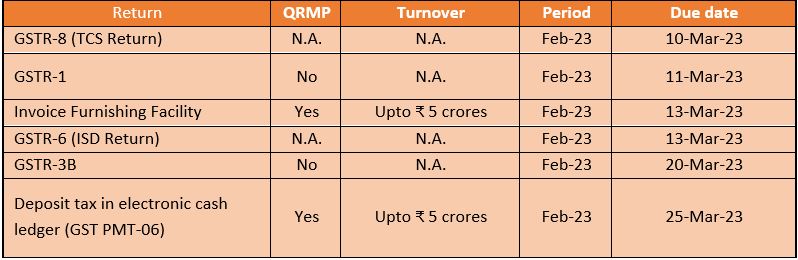

INDIA : GST Due Dates

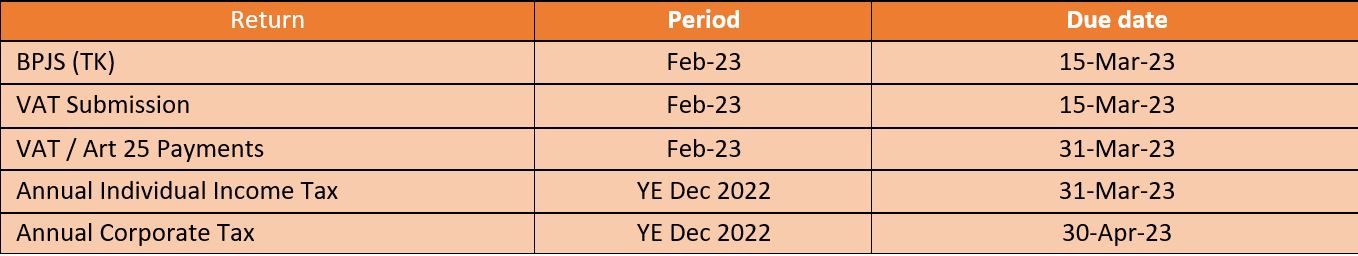

INDONESIA: Compliance Due Dates

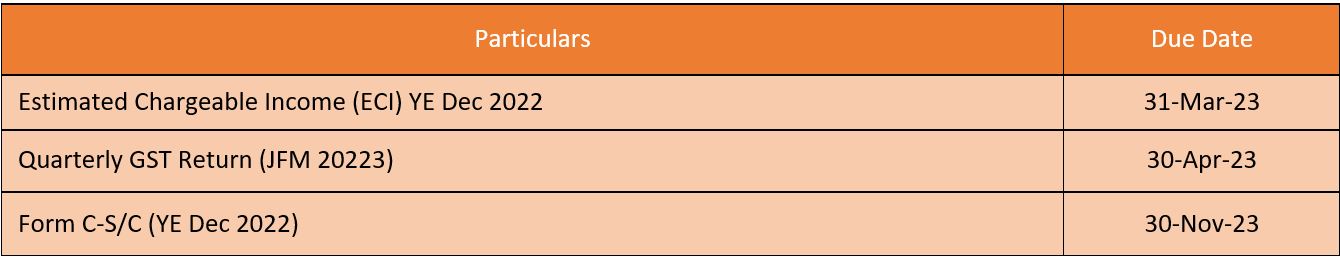

SINGAPORE: Compliance Due Dates

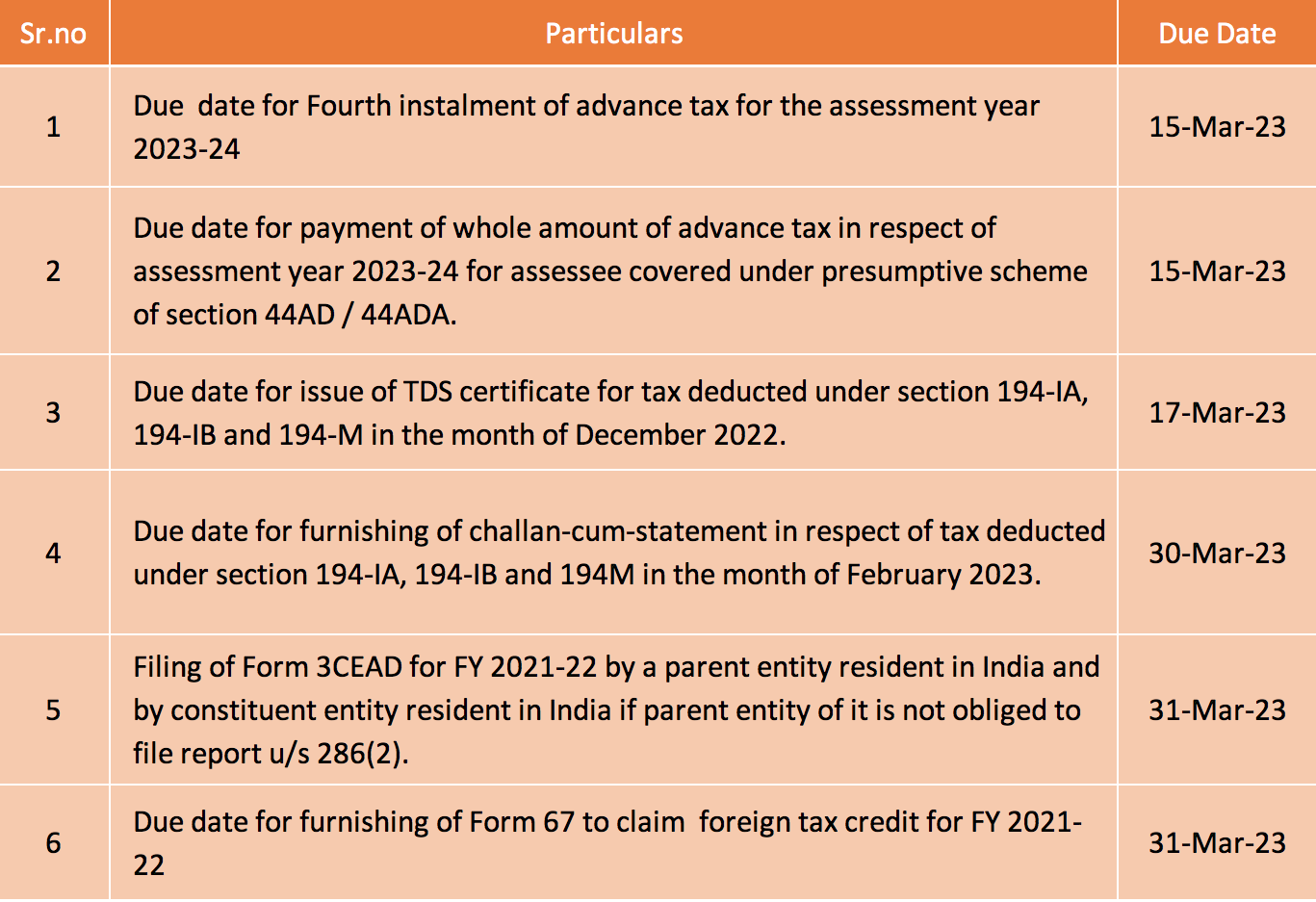

DIRECT TAX

INDIA: Direct Tax Due Dates

Circulars/Notifications/Press Release

CBDT abolishes limit of ₹5,000 for Submission of Statement of Financial Transaction in relation to Interest Income

- Previously, reporting of interest in the SFT-016 was required if interest exceeded ₹5000. But, CBDT has removed this limits vide notification no. 01/2023 and now with the exception of “Jan Dhan Account” holders, the information in SFT must now even include information about account holders earning interest income up to ₹5000.

CBDT notifies Centralised Processing of Equalisation Levy Statement Scheme 2023

- CBDT vide Notification no. 03/2023 has notified “the Centralized Processing of Equalisation Levy Scheme, 2023 with respect to processing of Equalisation Levy Statement filed by E-Commerce Operators.

Case Laws

Assessment cannot be Re-opened after period of four years: Pune ITAT.

- Assessee filed return for AY 2010-11 and the case was selected for scrutiny and assessment was completed on 26th February 2013

- Thereafter, income tax department issued notice under section 148 on 29th March 2017 on the ground that assessee has wrongly claimed deduction of ₹11.30 lakh which were required to be disallowed.

- Aggrieved by this, assessee preferred an appeal that the notice under section 148 was issued after a period of 4 years from the end of relevant AY 2010-11.

- However, department contended that since it a failure on part of assessee to disclose fully and truly all material facts and hence he can open reassessment beyond period of four years.

- Income Tax Appellate Tribunal after hearing both the parties held that assessee had disclosed the deductions in profit and loss which was allowed by Assessing Officer in assessment and hence does not fall within the meaning of failure on part of assessee to disclose all facts necessary for reassessment.

- Therefore, ruling was passed in favour of assessee.

Expat Salary reimbursement by Google India to Google US not taxable as Fee for Technical Service or Fee for included service: Bangalore ITAT

- Google US, a US based company, received payments for seconding its employees to its Indian associated enterprise.

- Tax officer opines no employee-employer relationship existed between seconded employees and the Indian entity and holds it as services provided as technical, managerial and consultancy services and payments received by assessee were in nature of ‘fee for technical service’ taxable under both income-tax and Double Tax Avoidance Agreement (DTAA).

- Assessee evidences that employees were solely working for Indian entity during secondment period and tax was with held against salary by the Indian entity.

- Bangalore Income Tax Appellate Tribunal relies on coordinate bench’s ruling along with references to various other supporting rulings to hold that the amounts paid to seconded employees does not come within fees for technical service or fee for included service whether under the Act or DTAA.

GST LITIGATION UPDATE

Pre-paid instruments (PPIs) neither ‘goods’ nor ‘services’, not liable to GST – Karnataka High Court

The assessee, Premier Sales Promotion Pvt Ltd procures and supplies Prepaid Payment Instruments (PPIs) of Gift Vouchers, Cash Back Vouchers and E-Vouchers to clients for a face value. Clients issue the vouchers to their employees as incentives or promotional schemes. The assessee filed a writ petition before High Court to quash an order by the Karnataka Appellate Authority for Advance Ruling that deemed the supply of vouchers as taxable ‘goods’ under the GST Act, with a determined time of supply and GST rate.

- The High Court noted that the vouchers in question are semi-closed PPIs and their issuance require prior approval from RBI. These are distributed to employees or customers for redemption and cannot be withdrawn as cash. They are akin to printed currency and can only be transacted upon redemption. The issuance of vouchers is more like a pre-deposit than a supply of goods or services. Therefore, the High Court held that, vouchers are neither goods nor services and thus, cannot be taxed.

SEZ unit is eligible to claim refund of unutilized input tax credit – Gujarat High Court

- The petitioner M/s SE Forge Ltd., a SEZ unit, filed a refund application for unutilized input tax credit on supplies received from DTA suppliers. The refund was sought under the category of ‘Export of Goods/Services without payment of tax.’ The refund application was rejected on the ground that supply to SEZ unit is zero-rated supply and only a DTA supplier can file the refund application. The petitioner challenged the rejection before the High Court. The High Court noted that the petitioner had given a specific undertaking that any eventuality of the supplier having been given the refund, the petitioner is taking responsibility to make good the amount which may have been given. The High Court thus held that the issue is already covered by a previous decision and allowed the petition, stating that the petitioner is entitled to seek a refund of the ITC in connection with the goods or services supplied to the SEZ unit.

Customs litigation update:

Re-assessment of imported goods after their clearance for home consumption not permissible – Delhi Tribunal

- The assessee M/s Holy Land Marketing Pvt Ltd made a request for re-assessment of imported goods under a different Customs Tariff Heading (CTH) after the goods had already been cleared for home consumption and duties had been paid. The Customs Electronic Data Interchange System (EDI) had already cleared the Bill of Entry without any re-assessment or examination by an officer. After more than 8 months, the Deputy Commissioner accepted the assessee’s request and re-assessed the goods under the new classification.

- The Delhi Tribunal held that this re-assessment was done without any authority, as once an order permitting clearance of goods for home consumption is given, the goods cease to be “imported goods” and “dutiable goods” under Sections 2(25) and 2(14) of the Customs Act, respectively. Therefore, the Deputy Commissioner had no authority to issue the assessment order under Section 17(5) of the Customs Act after the goods had already been cleared for home consumption. The Tribunal further held that the correct course of action for the appellant would have been to file an appeal before the Commissioner (Appeals) if they had noticed any errors in the initial assessment, including self-assessment.

CORPORATE TAX UPDATE

Due Dates under the legislation

CSR 2 for the financial year ended March 2022 to be filed with MCA on or before March 2023. ECB 2 Returns for the month of March 2023 should be filed with RBI on or before April 2023.

Notifications / Circulars / Amendment issued during Feb 2023

- MCA has issued General Circular No. 4/2023 dated 21 February 2023 and has given extension of time for filing of various e-forms without payment of additional fees. This extension of time was given due to V3 poratal of MCA is not completely operational and stakeholders are facing technical issues in filing of forms. Details of extended time and forms which may be filed under this extended time are given in the General Circular attached.

- MCA has issued General Circular No. 5/2023 for allowing filing of certain forms in Physical mode. Filing of physical forms is permitted from 22 Feb 2023 to 31 March 2023. Only forms as listed in this General Circular can be submitted in physical mode.

Cost Benefit Analysis ISO 27001

Potentially words like audits and certifications bring to our minds obstacles and stretching of resources. Another hurdle to be passed that brings in extra expense and brings in more resources to meet the standards. It is however time for the organizations to rethink about cyber security audits and standard certifications as positive force. Here we will help you understand the cost efficiency it brings to the table.

Pricing in Cyber Insurance Premiums

Along with factors such as number of assets, employees, cyber insurance premiums take in the security posture of the company while determining the premium for each organization. It can be considered the most important aspect. In this age, with world submerged in geopolitics, hybrid wars and with the looming danger of climate catastrophes, insurers are extremely vigilant about their own risks. Companies who cannot show ISO 27001 certification or equivalent certifications will have to pay a very high premium or they may not even able to take out a policy at all or may find it difficult to make their claims if things go south. Being ISO certified can come a long way while you get your cyber insurance, reduce the risks and increase the confidence the insurer which in turn would help you secure a lower premium as well.

Organized Effectiveness

Treating cybersecurity like a game of “whack-a-mole” is expensive and time consuming. Departmental knowledge would mostly act as a reactive force. On the contrary, it is essential to built cyber security where majority of departmental knowledge should be on pre-emptive cyber security. Knowledge is power and creating a posture of risk reduction through awareness means fewer surprises and less responding to blind emergencies which will stretch precious resources and incur unpredictable costs. A certification in ISO 27001 prepares you for all this and more.

Optimum Resource Allocation

Let’s be real, change comes slow to organizations. However, cybersecurity should be dynamic and needs to evolve and adapt. The concerning ubiquitous practice we see are that there is least to no changes in the set up in security made in organizations once it is established. Priority given to assets change according to time and the cyber security policy should align to accommodate those changes. For example, work from home trend has changed how systems should be protected from a cyber security perspective. It is essential to secure the network of the remote worker as you secure your office network. ISO conducts periodical review to make sure that things are upgraded to the current standards. Cyber security audits would provide you with a road map on the optimum usage of your resources in the best way possible. You might be still paying for tools that may be less useful at the current times and require change or resources may be still employed to protect less important assets. Thus, ISO 27001 helps you overcome that inertia with an external push.

Development of a Quality Brand

Another big advantage of ISO 27001 certification is the benefits it brings to your organizational reputation. The standard is internationally recognized, externally assured, and carefully developed conveying to the business world that your organization is credible and trustworthy. Your commitment to cybersecurity and compliance with legislation will be demonstrated to your clients. It would help in opening you up to new industries and contacts. So, make sure to remember, you are not just investing in your cybersecurity but also in the development of your organization brand. The competitive advantage it provides you when you are taking on new clients is tremendous as their security requirements would mostly match with your standards. Basically, showing your ISO 27001 certification would be adequate to satisfy their security requirements at most times.

Culture of Continuous Improvements

In the everchanging landscape of cyber security it is important to have a strong foundation for continuous development. Once you established a security culture in your organization where everyone is a stakeholder for the organization’s cybersecurity policy, where everyone has a role to play, not just tech savvy ones, then building up from there would be easy for you. There would be responsibilities in the local level, awareness among everyone which makes this model a success. Training your employees would be small cost to pay considering the breaches they avoid because of their awareness. So, once the foundation is laid strong, building it up requires less cost, less effort and less resources.

Alignment with Management System

The good news is that ISO 27001 aligns with any current ISO management system you may already have in place. Because this standard fits so easily and has many overlapping clauses with other ISOs, it eliminates the need for constant verification and auditing of all your management systems thus saving your cost and time.

Thus be assured, when you consider the cost benefit analysis for a properly implemented compliance and audited organization, the benefits for you will always outweigh the cost.

SINGAPORE UPDATES

Latest Updates

Accounting and Corporate Regulatory Authority (ACRA)

1) ACRA, MOF and MAS issue consultation paper on legislative amendments to enable conduct of general meetings electronically

The Accounting and Corporate Regulatory Authority (ACRA), the Ministry of Finance (MOF), and the Monetary Authority of Singapore (MAS) have proposed legislative amendments to the Companies Act 1967 (CA), Variable Capital Companies Act 2018 (VCC Act) and the Business Trusts Act 2004 (BTA), to enable the conduct of general meetings electronically.

Summary of the proposed amendments:

The CA is proposed to be amended to allow companies to have the option to conduct fully virtual or hybrid meetings. Business trusts combine elements of a company and a trust and the Business Trusts Act 2004 provisions are largely based on provisions under the Companies Act. VCCs are also subject to requirements, similar to companies under the CA, to hold meetings under the Variable Capital Companies Act 2018. As such, similar changes are proposed to be made to the BTA and the VCCA to enable BTs and VCCs to have the same option to conduct fully virtual or hybrid general meetings.

Monetary Authority of Singapore

1) MAS Imposes Due Diligence Requirements for Corporate Finance Advisers

On 23 February 2023, the Monetary Authority of Singapore (MAS) has issued a Notice imposing mandatory baseline standards of due diligence and conduct requirements for corporate finance (CF) advisers . These requirements raise the standards of conduct of CF advisers, improve the quality of disclosures and allow investors to make informed decisions.

CF advisers that assist entities in fund raising from the general public will henceforth be subject to mandatory minimum standards when conducting due diligence on CF transactions. These include conducting background checks and interviews with relevant stakeholders ; conducting site visits of prospective issuers’ key assets; assessing knowledge, skills and experience of third-party service providers; as well as ensuring that material issues are satisfactorily resolved or clearly disclosed. CF advisers will also have to comply with enhanced requirements to mitigate conflicts of interests, such as where the adviser’s related corporations or controlling shareholders also provide services to the same customer.

2) MAS extends variable capital companies grant scheme

Monetary Authority of Singapore (MAS) has extended the variable capital companies scheme for two years from 16 January 2023 to 15 January 2025(both dates inclusive).

Under the Extended VCCGS, the Financial Sector Development Fund (“FSDF”) will co-fund 30% of qualifying expenses paid to Singapore-based service providers for qualifying work performed in Singapore in relation to the incorporation or registration of a VCC, up to a maximum grant cap of S$30,000 per application.

Applicant Eligibility

First-time Qualifying Fund Managers that must not have previously incorporated a VCC or successfully re-domiciled a foreign corporate entity as a VCC and must not have previously applied for the VCCGS.

Project Eligibility

The Extended VCCGS is available only to First-time Qualifying Fund Managers that have incorporated a VCC or successfully re-domiciled a foreign corporate entity to Singapore as a VCC for the first time, and have obtained a Notice of Incorporation or Notice of Transfer of Registration from the Accounting and Corporate Regulatory Authority (“ACRA“) (as the case may be) which specifies a date between 16 January 2023 and 15 January 2025 (both dates inclusive).

The following conditions apply:

- The set-up of the VCC cannot be simultaneously funded by other government grants/incentives with respect to the same set of qualifying costs and commitments;

- Each applicant may only apply for the Extended VCCGS for qualifying work performed in relation to one VCC that has been incorporated or successfully re-domiciled;

- Qualifying expenses must be paid to Singapore-based service providers for work done in Singapore in relation to the incorporation and registration of the VCC and its sub-fund(s) (if any);

- A Qualifying Fund Manager may not claim co-funding under the grant scheme solely for registration of sub-fund(s) (without the accompanying incorporation or transfer of registration of a VCC). However, a Qualifying Fund Manager may claim qualifying set up costs incurred for the registration of sub-fund(s) as part of the set-up of an umbrella VCC; and

Applicants should formally submit their applications within three months from the date specified on the Notice of Incorporation issued by ACRA (for a newly incorporated VCC) or within three months from the date of ACRA’s approval of the VCC’s evidence of de-registration (for a foreign corporate entity re-domiciled to Singapore as a VCC).

Funding – 30% co-funding of qualifying expenses listed below, capped at S$30,000 per VCC.

- Legal services

- Tax services

- Administration or regulatory compliance services

Minimum Operational Period

A VCC which has been awarded a grant under the Extended VCCGS is required to remain operational for at least one year from the Registration Date. This means that the VCC cannot be wound up within the first year from the Registration Date. In the event that the VCC is wound up within the first year from the Registration Date, the Qualifying Fund Manager is to inform MAS promptly and by no later than one week from the date of the application for the winding up or passing of resolution for a voluntary winding up. MAS reserves the right to claw back the grant awarded if the VCC is wound up within the first year from the Registration Date and/or if the recipient fails to inform MAS of the winding up of the VCC within one week from the date of the winding up.

3) Launch of Real-time Payments between Singapore and India

On 21 February 2023, The Monetary Authority of Singapore (MAS) and the Reserve Bank of India (RBI) has launched the linkage between Singapore’s PayNow and India’s Unified Payments Interface (UPI). This will enable customers of participating financial institutions in Singapore and India to send and receive funds between bank accounts or e-wallets across the two countries in real-time. They can do this using just the mobile phone number, UPI identity, or Virtual Payment Address (VPA). The linkage provides customers with a safe, simple, and cost-effective way to make cross-border fund transfers.

The launch was officiated by Prime Minister of Singapore, Lee Hsien Loong, and Prime Minister of India, Narendra Modi. MAS Managing Director Ravi Menon and RBI Governor Shaktikanta Das executed live cross-border fund transfers to each other from their respective locations in Singapore and India.

The PayNow-UPI linkage is the world’s first real-time payment systems linkage to use a scalable cloud-based infrastructure which can accommodate future increases in the volume of remittance traffic. It is also the first linkage to feature a non-bank financial institution as a participant.

The service will be made available to Singapore customers of DBS Bank and Liquid Group under a phased approach, where these institutions will progressively increase the number of eligible user groups and transaction limits from today till end-March 2023. Indian customers of all participating Indian banks will be able to receive funds through the service from the onset. Sending of funds is limited to customers of four Indian banks at the time of launch , with this scope to be gradually expanded.

The PayNow-UPI linkage is the result of extensive collaboration between MAS, RBI, both countries’ payment system operators , payment scheme owners, and participating banks and non-bank financial institutions. It is a major milestone in enhancing the infrastructure for cross-border payments and supports India’s G20 Presidency priorities to improve the cost, speed, access and transparency of cross-border payments.

IRAS- Due dates

- Estimated Chargeable Income (ECI) (December year-end)- 31- March-2023

- GST Return: January 2023 – March 2023- 30 April 2023

- Form C-S/C -30-November-2023