Due Dates

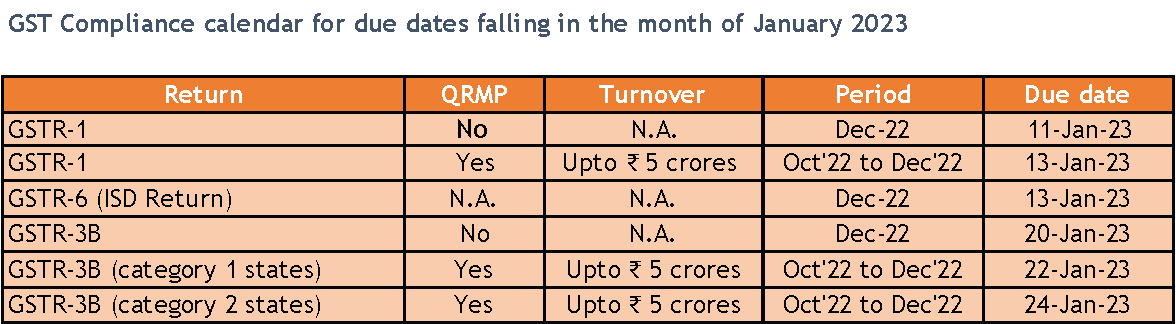

GST Due Dates

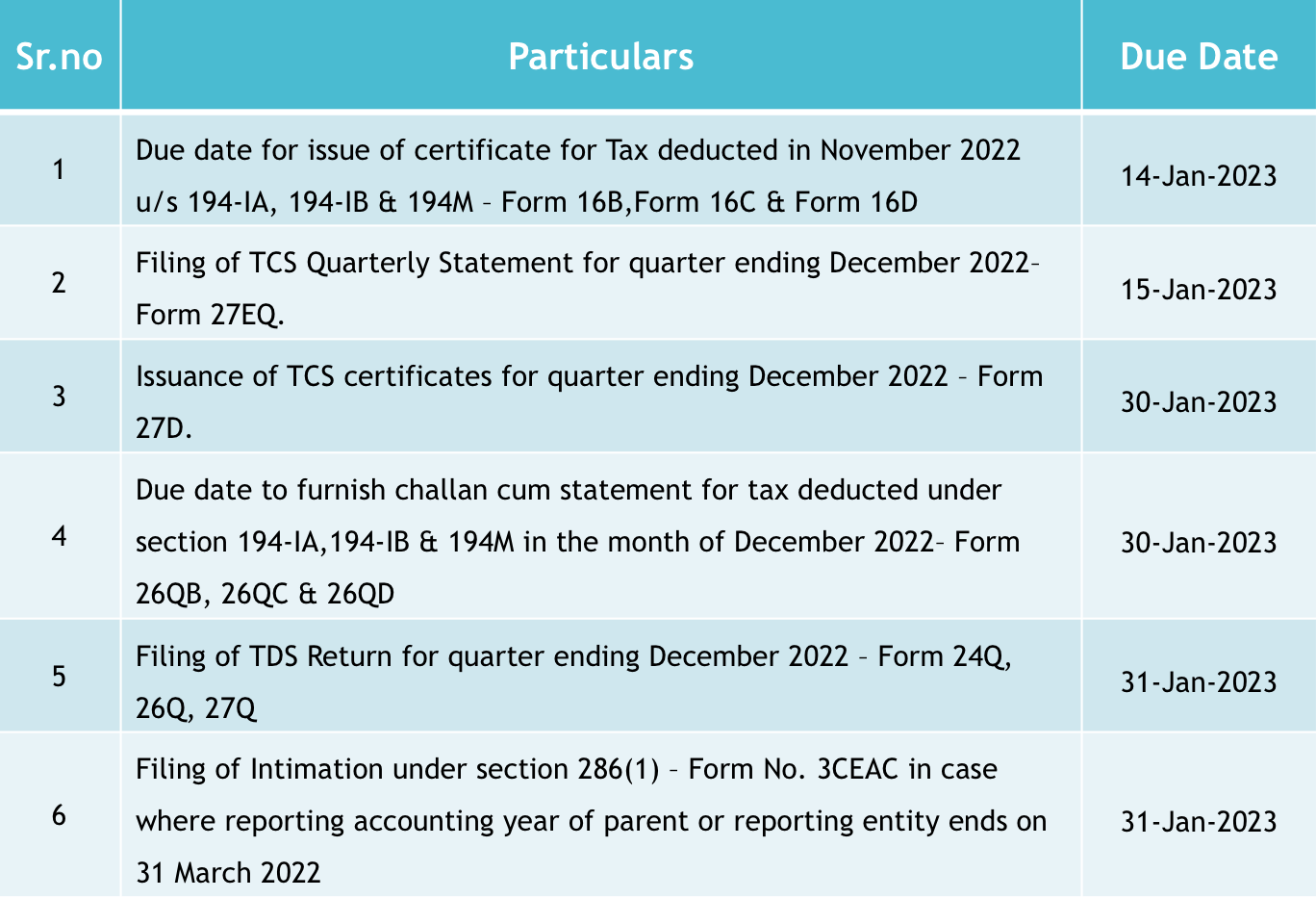

DIRECT TAX

Important Due Dates January 2023

Circulars/Notifications/Press Release

Circular on Employer obligation of TDS on salaries for Financial Year 2022-23

CBDT vide Circular No. 24/2022 explains in detail the employer’s obligation of deduction of tax at source from salaries under Section 192 of the Act. It broadly covers following aspects :

- Rates of taxes for the purpose of deduction of income tax

- Methodology of calculation of taxes

- Declaration and Forms to filed with the employer for claiming deductions and exemptions like Form 12BA, rental certificates etc.

- Consideration of other income in the total for the purpose of TDS deduction.

Exemption to Non-resident (not having PAN or not required to have PAN) from mandatory e-filing of Form 10F till 31-03-2023

- The competent authority vide Notification No. 3/2022 has decided that non-resident taxpayers who are not having PAN and not required to have PAN as per relevant provisions of the Income-tax Act,1961 read with Income-tax Rules, 1962, are exempted from mandatory electronic filing of Form 10F till 31st March 2023.

Such category of taxpayers may make statutory compliance of filing Form 10F till 31st March 2023 in manual form

Case Laws

Software development expenditure incurred on project which subsequently got discontinued is revenue in nature: Bombay High Court

- In the referred case, the assessee had incurred software development expenditure which were debited to capital work in progress. Subsequently the project was abandoned, and the expenditure was debited to profit and loss as exceptional item. Revenue treated the same as capital expenditure and disallowed the expenditure. CIT(A) & Tribunal allowed Assessee’s appeal.

- High Court dismissed revenue’s appeal by holding that if the expenditure incurred was in respect of the same business, which was already carried on by the assessee, even if it is for the expansion of business, such expense is to be treated as revenue expenditure.

Payment made by advertisement agency for online advertisements does not constitute royalty: Bangalore Tribunal

- Assessee made certain payments to its Irish group company (Google Ireland) towards purchase of online advertising space. Question was raised whether same was royalty or not as per Double Taxation Avoidance Agreement (‘DTAA’) or Income Tax Act.

- ITAT observes that Assessee acted as a distributor of online advertisement space to Indian Advertisers, for a specified margin over its cost from Google Ireland.

- ITAT also analyzed the distribution agreement between them and opines that none of the rights as per section 14(a)/(b) and section 30 of the Copyright Act, 1957 have been transferred by Google Ireland to the assessee Further, held that the assessee cannot be said to have gained the right to use any scientific equipment and any kind of technical knowhow.

- Considering the above, ITAT ruled in favour of assessee.

Salary reimbursement towards seconded employees by Indian Associated Enterprises is not Fee for Technical Services (FTS): Bangalore Tribunal

- Assessee, a foreign company entered into a secondment agreement with its Indian subsidiaries for providing admin services.

- Payments were made by assessee for social security of seconded employees in the nature of reimbursement was not accepted by Assessing Officer.

- Revenue held that the services provided by such seconded employees were managerial in nature and also in the nature of consultancy, thus covered within the definition of FTS both under Section 9(1)(vii) as well as Article 12 of India-Japan DTAA.

- Based on the above, the Assessing Officer made an upward adjustments as Fee for Technical Service under income tax act and Double Tax Avoidance Agreement (DTAA).

- Tribunal observed that TDS u/s 192 had duly been deducted with respect to the salary of the seconded employees. Further stated that the reimbursement made was on cost-to-cost basis which were in line to the Article 12 of Indo-Japan DTAA.

- Relying on the ruling of co-ordinate bench it was held that cost of seconded employees reimbursed by the Assessee to its Indian counterparts was not taxable as Fee for Technical Service under Indo-Japan DTAA and ruled in favor of the Assessee.

GST LITIGATION

Subsidized deduction from employees towards canteen facility is taxable - Karnataka AAR

The applicant M/s Federal Mogul Goetze India Ltd have about 3200 employees working on permanent as well as on contractual basis in its factory. The applicant entered a contract with a canteen service provider to operate and manage canteen within the factory premises. The applicant recovers a subsidized amount each month from its employees towards canteen services.

The applicant sought an advance ruling on (i) applicability of GST on subsidized deduction towards canteen facility and (ii) eligibility to ITC on GST charged by the canteen service provider.

The AAR in this case has held that the canteen services rendered by the applicant to its employees constitute ‘supply’ as per section 7 of the Central GST Act and the same merits classification under HSN code 996333 and GST at the rate of 5% without ITC facility is applicable in this case. The AAR in this case has also held that the CBIC Press Release dated July 10, 2017, which clarifies that GST is not leviable on services provided by employer to employee in terms of contractual agreement, is not applicable in this case because the clarification as per press release is applicable only in case of services provided free of cost to employees. Since in this case, a subsidized recovery is made towards canteen facility, the AAR held that the Press Release is not applicable.

Further, the AAR also held that the applicant is not entitled to ITC of GST charged by the canteen service provider because of the condition attached to payment of output GST at concessional rate of 5%.

High Court of Kerala allows refund of GST paid on notice pay recovery

The petitioner M/s Manappuram finance Ltd had filed a refund claim of GST paid on notice pay recovery which was rejected by the adjudicating authority. Two months after the rejection order, a favorable circular came to be issued by CBIC clarifying applicability of GST on notice pay recovery from employees. The petitioner filed a writ petition with High Court of Kerala against the refund rejection order by taking recourse to the favorable circular.

The Revenue in this case contended that the assessee has an effective alternate remedy of filing an appeal before the GST Appellate Tribunal and the petitioner can wait for constitution of Tribunal and thus the present writ petition is not maintainable.

The High court of Kerala considered the writ petition of the petitioner and held that the fact that the GST appellate tribunal is not yet constituted, cannot deprive the petitioner of justice. The HC further held that the circular issued is clarificatory in nature and thus it applies retrospectively. Considering this, the High court restored the application for refund before the adjudicating authority for fresh consideration.

THE RISK OF UNSECURED ADMIN ACCOUNTS IN ORGANIZATIONS

Full access rights to the organization’s systems are provided to system administrators with almost boundless opportunities.This potential can harm the organization when it goes into the wrong hands. There are various number of ways that malicious insider threats can harm an organization. They can:

- Manipulate files and confidential data

- Transfer confidential/sensitive information to third parties

- Create backdoor accounts with elevated rights

- Install malware

- Exploit vulnerabilities of the organization’s network

- Try to gain access to the accounts of other employees

- Modify the organization’s systems and networks.

The organization should mitigate this to significant extent by implementing some of the following safeguards and checks,

Use and Manage accounts, particularly ones with system administrator access wisely:

- The organization executive team should request the system administrators to publish a report of all accounts and their privileges, access rights and audit the need to have them.

- Further, creation of new accounts or elevated access levels to an account should have generated a notification to executive management and risk managers to be checked independently.

Restrict access to critical systems:

- This should be executed by following the Zero Trust model and principle of least privilege (POLP) for system administrator accounts.

- Access to these accounts can be restricted to specified end points and MFA (Multifactor Authentication) can be implemented to detect and block suspicious logging attempts.

- Separate accounts can be created for different admin duties.

- Each administrator’s access should therefore be limited to specific tasks to be performed by them on specified devices.

- No administrators should be given full access to all the systems and devices.

Monitor system administrator’s activity to track and detect any suspicious behavior:

- AI-based tools are needed to check access logs, browser logs, and emails to detect suspicious data exchange with external entities or devices.

Enhance password management and disable system administrator access from direct external logins:

- The organization should implement a Single-Sign-On model (SSO) with defined privileges based on roles, policy such that all access privileges to all systems are revoked when the employee id is disabled.

- System administrator access to all devices should be channelized through SSO, VPN (Virtual Private Network) model and this access should not be directly available through external browser logins.

SINGAPORE UPDATES

Latest Updates

Accounting and Corporate Regulatory Authority (ACRA)

1) Proposed Alternative Arrangements for Meetings Following the Cessation of the COVID-19 (Temporary Measures) Orders

On 15 December 2022, the Ministry of Law (“MinLaw”) announced that various COVID-19 (Temporary Measures) (Alternative Arrangements for Meetings) Orders which enable various entities to convene, hold or conduct meetings by way of electronic means will be revoked on 1 July 2023. These entities include issuers listed on the Singapore Exchange Securities Trading Limited (SGX-ST) (“listed issuers”) and non-listed entities, such as companies, variable capital companies (“VCCs”) and business trusts (“BTs”), among others.

In addition, the Accounting and Corporate Regulatory Authority (“ACRA”) and the Monetary Authority of Singapore (“MAS”) jointly announced that they are working on proposed legislative amendments to provide companies, VCCs and BTs with the option to conduct meetings by way of electronic means after the relevant Orders are revoked.

From 1 July 2023, SGX RegCo stated that listed issuers will have to conduct their general meetings in person. In the meantime, ACRA and MAS are working on proposed legislative amendments to the Companies Act 1967, the Variable Capital Companies Act 2018 and the Business Trusts Act 2004, to provide companies, VCCs and BTs with the option to conduct meetings through electronic means after the relevant Orders are revoked. Details of proposed legislative amendments are expected to be released in early 2023. SGX RegCo will work with MAS to provide guidance for listed issuers to have the option to conduct hybrid meetings.

2) Public Consultation for an Intangibles Disclosure Framework to Increase Transparency and Commercialisation of Intangibles

The Accounting and Corporate Regulatory Authority (ACRA) and the Intellectual Property Office of Singapore (IPOS) have launched a public consultation for an Intangibles Disclosure Framework (Framework) to help businesses disclose and communicate their intangibles. The public consultation exercise will run from 14 December 2022 to 28 February 2023.

A public-private initiative supported by the Ministry of Finance, the Framework was developed by the Intangibles Disclosure Industry Working Group which comprises representatives from the accounting, valuation, legal and finance sectors. The Framework seeks to improve market transparency by enabling businesses to identify and disclose their intangibles. Innovation has become a global engine of growth with the value of global intangibles reaching an all-time high of more than US$74 trillion in 2021. Intangibles are the non-physical assets of a company that include technologies, brand recognition, data, trade secrets, and intellectual property (IP) such as patents, copyrights and trade marks.

The Framework aims to provide stakeholders with standardised information about a company’s intangibles, so that more informed assessments of business and financial prospects can be made. The Framework will help businesses communicate the value of their intangibles and maximise their economic potential. This will enhance information transparency and facilitate the commercialisation of intangibles, such as increasing access to financing as businesses, investors and financial institutions gain clearer insights on a company’s intangibles.

The Framework consists of four pillars:

- Strategy:How a company’s use of intangibles contributes to the organisation’s overall corporate strategy.

- Identification:How intangibles are categorised based on their nature and characteristics. There are six recommended categories under this pillar, namely marketing, customer, artistic, contract, technology and human capital-related.

- Measurement:How a company measures its intangibles – the performance metrics and targets used.

- Management:How a company identifies, assesses, and manages intangibles-related risks and opportunities.

The Framework is a key initiative under the Singapore IP Strategy 2030, a 10-year blueprint to attract and grow innovative enterprises using IA, including IP. It aims to encourage growth for companies so as to move towards a vibrant and innovative Singapore economy driven by IA.

Inland Revenue Authority of Singapore

1) Preparing for GST Rate Change

As a general rule, purchases of goods and services from GST-registered businesses before 1 Jan 2023 will be subject to GST at 7%, and purchases on or after 1 Jan 2023 will be subject to GST at 8%.

To help Singaporeans cope with the impact of the GST increase, the Government rolled out a $6.6 billion Assurance Package earlier this year. In Nov 2022, it was announced that this package would be further enhanced to $8 billion. More details will be shared at Budget 2023.

Singaporean households will also continue to benefit from the permanent GST Voucher Scheme and the absorption of GST for publicly subsidised education and healthcare.

Ahead of the GST rate change, here are 3 things you need to know:

A. Price displays must show new GST rate

From 1 January 2023, the prices displayed by GST-registered businesses must be inclusive of GST at 8%. That is the final price you pay. Businesses that are unable to switch their price display overnight may display 2 prices:

- One applicable before 1 Jan 2023 showing prices inclusive of GST at 7%

- One applicable on/after 1 Jan 2023 showing prices inclusive of GST at 8%

An exemption is granted to hotels and F&B establishments that impose service charge on their goods and services. They are not required to display GST-inclusive prices due to an exemption to ease their operations. However, they must still display a prominent statement so that customers are aware that the prices are subject to GST and service charge.

a. Payment date matters

Generally, purchases of goods and services from GST-registered businesses before 1 Jan 2023 will be subject to GST at 7%, and purchases on/after 1 Jan 2023 will be subject to GST at 8%. As a consumer, you may order an item or sign up for services but only pay at a later date. WHEN you pay for the goods and services will determine which GST rate will be charged.

For transactions that span 1 Jan 2023, GST transitional rules may apply. A transaction spans the GST rate change where one or more of the following events takes place wholly or partially on/after 1 Jan 2023:

- The issuance of invoice

- The receipt of payment

The delivery of goods or performance of services

B. Unjustified price increases using GST as a cover is unethical

If a business raises its prices, it is not acceptable for the business to use the GST increase as the reason for raising prices before the GST rate change, nor is it acceptable for a business to raise prices by more than the GST increase after the GST rate change, citing the GST increase as the reason.

2) Revision in Annual Values in 2023

In a statement on Friday (2 December), the Ministry of Finance (MOF) and the Inland Revenue Authority of Singapore (IRAS) said that the Annual Values (AV) of most residential units, which include private properties and HDB flats, will be revised upwards from 1 January, reflecting the rise in market rents. The AV revision is part of IRAS annual review of properties.

The property tax payable is derived by multiplying the property tax rate with the AV of the property. As a concession, owner-occupiers enjoy lower property tax rates for their homes, while all non-owner-occupied residential properties – which include second homes and those held for renting out or investment – are taxed at higher residential tax rates.

One-off rebate

The government will provide a one-off 60 per cent property tax rebate for all owner-occupied properties, up to a maximum of S$60, they said. “All one- and two-room HDB owner-occupiers will continue to pay no property tax in 2023 as their AVs remain below $8,000. For the majority of owner-occupiers in other HDB flat types, they will pay between $30 and $70 more in property tax compared to 2022, after taking into account the rebate,” MOF and IRAS noted. The rebate will be automatically offset against any property tax payable in 2023.

Since the last revision of AVs on 1 January 2022, market rents of HDB flats and private residential properties have risen by more than 20 per cent.

https://www.iras.gov.sg/news-events/newsroom/revision-in-annual-values-in-2023

3) Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting

Singapore has signed Avoidance of Double Taxation Agreements (“DTAs”), limited DTAs and Exchange of Information Arrangements (“EOI Arrangements”) with around 100 jurisdictions.

Some of the DTAs have been amended by the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (“MLI”).

The MLI is an agreement negotiated under Action 15 of the OECD/G20 Base Erosion and Profit Shifting (BEPS) Project. It is intended to allow jurisdictions to swiftly amend their tax treaties to implement the tax treaty related BEPS recommendations. Singapore has worked with more than 100 jurisdictions around the world to develop the MLI and the negotiation of the MLI text was concluded on 24 November 2016 in Paris.

The MLI includes both mandatory provisions (i.e. the minimum standards under the BEPS Project) as well as non-mandatory provisions. Jurisdictions have the flexibility to determine how its DTA network would be amended by the MLI. More information on the MLI can be found on the OECD website.

Some of the DTAs provide for mandatory binding arbitration provisions or have been modified by Part VI (Arbitration) of the MLI to include mandatory binding arbitration provisions.

Others

1) SGX Group launches initiative to recognise Sustainable Fixed Income

Singapore Exchange (SGX Group) today launched the SGX Sustainable Fixed Income initiative. The new initiative identifies fixed income securities listed on Singapore Exchange Securities Trading Limited that meet recognised standards of green, social and sustainability fixed income securities.

The SGX Sustainable Fixed Income initiative allows investors to more easily identify investments that meet certain criteria at issuance. These criteria are:

- Alignment with recognised green, social or sustainability standards for fixed income securities.

- Confirmation by an external reviewer that the fixed income securities are aligned to the recognised standards. The reviewer must be a reputable firm with an established track record of providing similar reviews; and

- Publicly published reports setting out the fixed income securities’ alignment with the recognised standards.

Issuers may use an SGX Sustainable Fixed Income mark to identify the securities as having met these requirements.

To maintain recognition under the SGX Sustainable Fixed Income initiative, issuers must publish any post-issuance reports such as the annual report, as required under the applicable recognised standard, as well as information on any material developments which may affect alignment with the recognised standards. Such reports and information must be made publicly available.

Benefits

The list of fixed income securities recognised under the SGX Sustainable Fixed Income initiative is published on the SGX website and on Greennode, a GSS bond information hub operated by Marketnode. Marketnode, an SGX Group and Temasek joint venture, is a digital markets infrastructure provider. Issuers can use the recognition to demonstrate their commitment to the Recognised Standards, and to raise their visibility and profile with investors that are interested in sustainable fixed income. They can also upload sustainability-related reports and other documentation through SGXNet to inform investors of their sustainable finance strategy.

For investors, the recognition will enable them to easily identify sustainable fixed income securities and to access sustainability-related information. Moreover, the criteria that SGX imposes provide investors with assurance that the GSS fixed income securities recognised under the SGX Sustainable Fixed Income initiative have been independently verified for alignment with the Recognised Standards

IRAS- Due dates

Estimated Chargeable Income (ECI) (December year-end)- 31- March-2023

GST Return: October 2022 – December 2022- 31 January 2023

Form C-S/C -30-November-2023