Due Dates

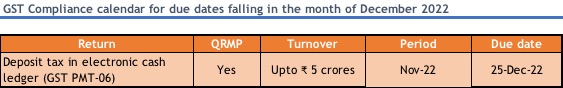

GST Due Dates

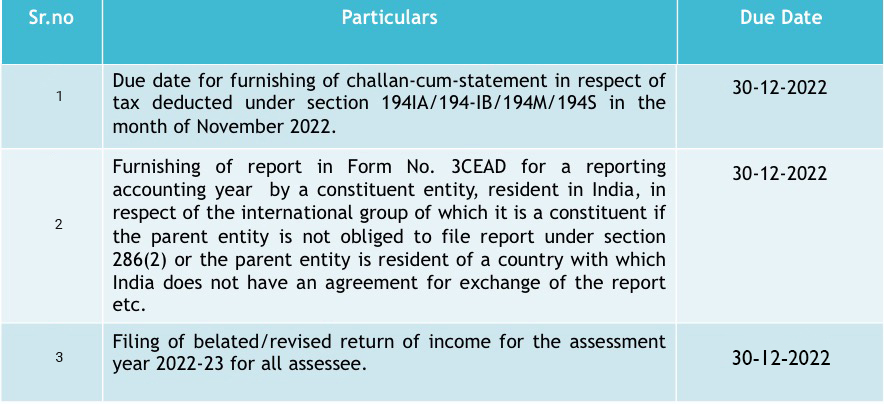

DIRECT TAX

Important Due Dates December 2022

Circulars/Notifications/Press Release/Gossips

Notification No. 125/2022

- The CentralBoardofDirectTaxes(CBDT) has issued a notification to include Public Investment Fund (PIF) within the ambit of a “sovereign wealth fund” as a specified person covered in the exemption under Section 10(23FE) of the Income-tax Act 1961.

Other Updates

- The co-browsing feature allows tax helpdesk agents to view and navigate a taxpayer’s browser in real-time, providing personalized support and guidance. In addition, the e-Pay Tax facility at the e-Filing portal has added four additional banks – Axis Bank, Central Bank of India, ICICI Bank, and Indian Bank – for the payment of taxes. These banks have been migrated from the OLTAS e-Payment of Taxes at Protean (previously NSDL) to the e-Pay Tax facility.

Case Laws

Luxora Infrastructure Private Limited Vs Deputy CIT

- In the referred case, Revenue passed an assessment order u/s 153A pursuant to search operation and added the entire receipts in to Assessee’s income u/s 68 and it was confirmed by CIT(A).

- ITAT observes that the issue is squarely covered by jurisdictional HC rulings in favor of the Assessee as per which in the absence of any incriminating material, no addition can be made in a post-search assessment.

- Accordingly, ITAT holds that the impugned additions must be deleted.

Umeshkumar Harilal Shah Vs Income Tax Officer (TDS)

- In the referred case, Revenue observed that assessee earned income from sale of scrap and no TCS was collected on such sale and determined tax liability u/s 206C(1) apart from interest u/s 206C(7).

- Assessee contented that TCS is not applicable as it is not generated through manufacturing activity whereas ITAT clarified that there is no requirement that the goods to be eligible for scrap should be produced/manufacture by the seller itself.

- ITAT thus dismisses Assesse’s appeal, upholds Revenue’s order against failure to collect tax at source on sale of scrap.

DSV Solutions Pvt Ltd Vs Deputy Commissioner of Income Tax

- In the referred case, order was sent to assessee at the old address available in PAN database whereas assessee had intimated new address and hence DRP dismissed appeal stating that objection filed were time barred.

- ITAT rejected revenue’s contention that address was taken as per PAN database and finds that notice u/s 142(1) was sent to new address and address on assessment order was not system generated and opines that the justification of using the old address is devoid of legally sustainable merits.

- ITAT thus holds that that there was no forwarding, not even an effort to forward, the draft assessment order to the correct address and holds impugned order as barred by limitation.

Deepak Kapoor Vs Principal Commissioner of Income-tax

- In the referred case, Assessee sold a property and reported capital gain, but the return was picked up for scrutiny and AO assessed the taxable income by making additions of Rs. 9.84 cr.

- Assessee appealed the order before CIT(A) and was partly allowed, but AO reopened the assessment contented that amount paid to sisters could not be claimed as expenses and also valued the property u/s 50C.

- Hon’ble Delhi HC allows assessee’s writ petition stating initiation of reassessment proceedings on mere change in AO’s opinion is impermissible in law.

Singapore Airlines Ltd. Vs Commissioner of Income Tax

- In the referred case, assessee had executed agreement with agent to pay standard commission on tickets sold by them. Along with this commission they charged additional amount above net fare.

- Assessee deducted tax on standard commission but did not make deduction on supplementary commission which is liable for TDS but included supplementary commission in income and paid taxes on the same.

- CIT held that assessee had a reasonable cause as specified u/s 273B for non-deduction of tax and thus quashes the penalty proceedings.

Triumph International Private Limited Vs Additional Commissioner of Income Tax

- In the referred case, assessee undertook international transaction of sale & purchase of RM and benchmarked them using TNMM with OP/TC as PLI.

- Assessee’s capacity utilization was less than the capacity utilization of comparable entities and hence excluded certain costs which in turn affects its own PLI.

- ITAT refuses the plea of grant of risk adjustment since it was characterized as normal risk bearing entrepreneu w.r.t to correct computation of the capacity utilization of comparable entities and also directs to consider the average of past three years data in case present years data is NA.

Rishikesh Buildcon Private Limited Vs Principal Commissioner of Income Tax

- In the referred case, Assessee filed returns showing loss which were selected for scrutiny by the AO and received notice for the same.

- Revenue appealed against the ITAT order stating that as per facts of the case, the penalty order(s) was passed within six months from the end of the month in which the penalty proceedings were initiated.

- ITAT contends that the order of the AO holding that the penalty order was passed after the expiry of the time limit laid down under Section 275(1)(c) of the Act and is time barred.

GST LITIGATION

Deposit cash in Electronic Cash Ledger does not amount to payment of GST liability- Jharkhand High court

Assessee in this case M/s RSB transmission India Ltd filed its GST return for the period July 2017 to December 2019 belatedly. Assessee had deposited part of cash liability in its electronic cash ledger before due date. However, GST authorities demanded interest from the assessee for the period from due date of filing of GST returns till date of actual filing of return and the interest was demanded on entire portion of GST liability which was paid from balance available in electronic cash ledger. Being aggrieved by this demand, assessee filed a writ petition before High Court of Jharkhand and contended that to the extent of amount deposited in electronic cash ledger before the due date, the assessee is not liable to pay interest.

The High Court a combined reading of section 39(7), 49(1) and 50 (1) of the Central GST Act read with the proviso to Rule 61(2) of the Central GST Rules held that that the registered person is required to discharge his tax liability by debiting the electronic cash and credit ledger and the same is done while filing GSTR-3B of the said period. Thus, depositing cash in electronic cash ledger does not amount to payment of GST Liability. Thus, the High Court upheld the entire interest demand and dismissed the writ petition filed by the assessee.

Rectification of GSTR-1 return not permissible beyond statutory deadline – Telangana High court.

Assessee in this case M/s Yokohama India Pvt Ltd inadvertently mentioned wrong GST number of one of its distributor in its GSTR-1 return due to which the distributor was unable to claim input tax credit. Since the statutory time period to rectify this error in GSTR-1 was already over, the assessee filed writ petition before Telangana High Court seeking to issue a direction to GST department to allow amendment in GSTR-1 and enable the assessee to rectify this error. The High Court held that the GST law provides for rectification of errors and omission in the specified manner. An assessee cannot be permitted to carry out the rectification beyond the statutorily prescribed period as it would inevitably affect obligations and liabilities of other stakeholders because of the cascading effect in the electronic records. Further, the High Court held that allowing the assessee to carry out rectification of errors and omissions beyond the statutorily prescribed period would lead to complete uncertainty and collapse of the tax administration. Thus, High Court rejected the request of the assessee to allow rectification of GSTR-1 return beyond the statutory time period.

However, it is pertinent to mention that, a contrary view has been taken by Jharkhand High court in case of M/s Mahalaxmi Infra Contract Ltd, where the HC allowed the rectification of GSTR-1 beyond the statutory time period and stated that the rectification in GSTR-1 does not generate any additional tax payment or loss of revenue to government; whereas, allowing the assessee to mention the correct GST number will enable the correct recipient to avail the input tax credit.

CYBER SECURITY THREATS ARISES IN WFH OR WFO?

Considering the relevance of work from home scenario, the concern of security has gone up significantly. It is extremely challenging to identify attacks on remote devices. Thus, some pointers for a safe remote working environment.

Pointers for EMPLOYERS:

- Are employees well-trained on how to prevent an organization from cyber-attacks?

- Did the organization provide official system device, VPN access for the employees?

- Is the organization monitoring and aiding the employees continuously, irrespective of wherever they are located?

- Is the organization ready to manage risks? Has the organization developed a risk management strategy to identify, detect and respond to the risks?

ROLES AND RESPONSIBILITIES TO BE FOLLOWED BY THE EMPLOYERS AND EMPLOYEES:

- It is important for every employee to get trained on different types of cyber-attacks by initiating an awareness program.

- Organizations can employ devices like YubiKeys or Multi-Factor Authentication apps to increase security to critical applications. Provide VPN access to remote workers so that they can have protected network connections to the office network.

- Ensure that systems are provided with end point security, hard drives of systems are encrypted using software like Bitlocker, and regular data backup to the cloud must be ensured.

- Proper Software management should be practices with priority to implementing security patches and rolling back or holding software updates with significant vulnerabilities.

- Risk Management strategy to be updated by the organization to include the current scenario of Work from Home.

- Incident Response (IR) team should be formed, trained, and prepped to be equipped to handle the situation. It is important to make sure that there isn’t a confused atmosphere at the time of breach. Procedures should be updated for Data Recovery and Business Continuity in case of an attack with Work from Home kept in mind.

- Fulfil security policies and guidelines pertaining to information security and data protection.

- Ergonomics might not be the first thing in mind when thinking about cyber security and remote work. But anything that might disturb your concentration can make you more vulnerable to scams and opening malicious content. For the same reason, remember to take breaks.

SINGAPORE UPDATES

Latest Updates

Accounting and Corporate Regulatory Authority (ACRA)

1) Financial Reporting Practice Guidance No. 1 of 2022 – Areas of Review Focus for FY2022 Financial Statements

On 4th November 2022, the Accounting and Corporate Regulatory Authority (ACRA) issued Financial Reporting Guidance No.1 of 2022 on Areas of Review Focus for FY 2022 Financial Statements highlighting financial reporting areas that may require closer attention by directors in the review of the FY2022 Financial Statements. To drive sustainable audit quality, ACRA has expanded the scope of the guidance to cover areas that audit committees should pro-actively engage their external auditors on to include the auditor’s assessment of risk, use of technology in audits, auditor independence, findings from ACRA’s audit inspections and audit quality indicators.

ACRA’s proposed areas of review focus for FY 2022 financial statements are

- Accounting impact from geopolitical uncertainties

- Accounting impact from macroeconomic uncertainties

- Accounting impact from climate change movements

- Risk assessment of companies, including fraud risk

- Multi- location audits of group companies

- Use of technology in audit

- Independence of an auditor

- Increasing transparency of audit inspection findings

Monetary Authority of Singapore

1) MOF and MAS Launch Process to Digitalise Banker’s Guarantees and Insurance Bonds

On 2nd November 2022 the Ministry of Finance (MOF) and the Monetary Authority of Singapore (MAS) has launched eGuarantee@Gov, a simple and secure digital process for businesses and individuals to provide a banker’s guarantee or insurance bond (collectively, “guarantee”) to government agencies within a day. It was jointly developed with the Association of Banks in Singapore (ABS) and in consultation with the General Insurance Association of Singapore (GIA).

With eGuarantee@Gov, businesses and individuals will no longer need to apply for a paper guarantee from a financial institution (FI), collect it when it is ready, and deliver the guarantee to the government agency, to discharge their contractual or licensing obligations. Businesses and individuals can instead apply for an eGuarantee from over 20 participating FIs through their websites or email for direct submission to 17 government agencies. More FIs and agencies are scheduled to come onboard eGuarantee@Gov by end 2023.

FIs and government agencies will also benefit from this more streamlined and simpler workflow. eGuarantee@Gov employs standardised texts which eliminate the need for each guarantee to undergo legal vetting. The eGuarantees are securely transmitted through the Singapore Customs’ Networked Trade Platform (NTP).

2) MAS Launches Expanded Initiative to Advance Cross-Border Connectivity in Wholesale CBDCs

On 3rd November 2022 the Monetary Authority of Singapore (MAS) launched Ubin+, an expanded collaboration with international partners on cross-border foreign exchange (FX) settlement using wholesale central bank digital currency (CBDC).

Ubin+ will focus on the following:

- Study business models and governance structures for cross-border foreign exchange (FX) settlement, where atomic settlement, based on digital currencies, can improve efficiencies and reduce settlement risks compared to existing payment and settlement rails.

- Develop technical standards and infrastructure to support cross-border connectivity, interoperability and atomic settlement of currency transactions across platforms using distributed ledger technology (DLT), and non-DLT based financial market infrastructures.

- Establish policy guidelines for the connectivity of digital currency infrastructure across borders, for better access and participation. This includes policy relating to governance, access and compliance issues for such linkages.

As part of Ubin+, the following projects will be undertaken with international partners:

- Foreign Exchange and Liquidity Management: Project Marianais a collaborative initiative that explores the exchange and settlement of Swiss franc, Euro and Singapore dollar wholesale CBDCs with an automated market maker [1] (AMM) arrangement. The project is a partnership involving MAS, Banque de France, Swiss National Bank, and the Bank for International Settlements Innovation Hub’s Eurosystem, Switzerland and Singapore Centres.

- Interoperability between DLT and non-DLT payment systems: MAS is participating in SWIFT’s CBDC Sandbox, together with more than 17 central banks and global commercial banks, to explore cross-border interoperability across digital currencies based on DLT and non-DLT payment systems.

- Connectivity across heterogenous digital currency networks: As wholesale digital currencies could potentially gain traction as a cross-border medium of exchange, MAS is studying possible mechanisms to maintain connectivity across CBDC and other heterogenous digital currency networks. MAS will also study the use of smart contracts to optimise efficiency and reduce counterparty risks in the settlement of cross-border transactions.

3) UK and Singapore deepen collaboration in FinTech and strengthen financial cooperation

On 25th November 2022 the United Kingdom (UK) and Singapore held the 7th UK-Singapore Financial Dialogue in Singapore. Both countries renewed their commitment to deepening the UK-Singapore Financial Partnership that was agreed in 2021, discussed mutual priorities such as sustainable finance, FinTech and innovation, and agreed on further cooperation in these areas.

At the Financial Dialogue, the UK and Singapore agreed on a Memorandum of Understanding on the UK-Singapore FinTech Bridge . The FinTech Bridge seeks to support continued growth, investment, and technological innovation in this sector, building on active interest of FinTech players in the areas of payments, RegTech and wealth management. Both countries strongly welcomed this deepened co-operation on FinTech and the opportunities the industry can deliver in relation to financial inclusion, enhanced innovation, and improved outcomes for consumers.

Inland Revenue Authority of Singapore

1) GST Rate Change for Consumers

As a general rule, purchases of goods and services from GST-registered businesses before 1 Jan 2023 will be subject to GST at 7%, and purchases on or after 1 Jan 2023 will be subject to GST at 8%.

To help Singaporeans cope with the impact of the GST increase, the Government rolled out a $6.6 billion Assurance Package earlier this year. In Nov 2022, it was announced that this package would be further enhanced to $8 billion. More details will be shared at Budget 2023.

Singaporean households will also continue to benefit from the permanent GST Voucher Scheme and the absorption of GST for publicly subsidised education and healthcare.

Ahead of the GST rate change, here are 3 things you need to know:

A. Price displays must show new GST rate

From 1 January 2023, the prices displayed by GST-registered businesses must be inclusive of GST at 8%. That is the final price you pay. Businesses that are unable to switch their price display overnight may display 2 prices:

- One applicable before 1 Jan 2023 showing prices inclusive of GST at 7%

- One applicable on/after 1 Jan 2023 showing prices inclusive of GST at 8%

An exemption is granted to hotels and F&B establishments that impose service charge on their goods and services. They are not required to display GST-inclusive prices due to an exemption to ease their operations. However, they must still display a prominent statement so that customers are aware that the prices are subject to GST and service charge.

B. Payment date matters

Generally, purchases of goods and services from GST-registered businesses before 1 Jan 2023 will be subject to GST at 7%, and purchases on/after 1 Jan 2023 will be subject to GST at 8%. As a consumer, you may order an item or sign up for services but only pay at a later date. WHEN you pay for the goods and services will determine which GST rate will be charged.

For transactions that span 1 Jan 2023, GST transitional rules may apply. A transaction spans the GST rate change where one or more of the following events takes place wholly or partially on/after 1 Jan 2023:

- The issuance of invoice

- The receipt of payment

- The delivery of goods or performance of services

C. Unjustified price increases using GST as a cover is unethical

If a business raises its prices, it is not acceptable for the business to use the GST increase as the reason for raising prices before the GST rate change, nor is it acceptable for a business to raise prices by more than the GST increase after the GST rate change, citing the GST increase as the reason.

2) 5 questions you may have when shopping online

To level the playing field for local businesses so that they can compete effectively with online/ overseas suppliers and ensure parity in GST treatment for goods and services consumed locally, consumers in Singapore will need to pay 8% Goods and Services Tax (GST) on the purchase of low-value goods (LVG) and non-digital services from 1 Jan 2023, as announced in Budget 2021.

3) Summary of Income Tax Advance Ruling

The Inland Revenue Authority of Singapore (IRAS) has published the summary of Income Tax Advance Ruling Issued on 1st December 2022. The summary includes the Income Tax advance ruling issued to Individual Income tax and other than Individual Income tax

The IRAS publishes summaries of advance rulings to enhance taxpayers’ understanding of the IRAS’ interpretation and application of the tax legislation in specific scenarios. The summaries are published in a redacted form that does not identify the applicant, the arrangement, any other parties to the arrangement, the date of the transaction, or the transaction values.

An advance ruling is a written interpretation of the Income Tax Act 1947 on how certain issues that arise from a proposed arrangement are to be treated for tax purposes. A ruling request has to be one where there are issues that require interpretation of the law, and not one seeking to know what the law clearly provides (e.g. what is the basis period for trade income).

IRAS has published the format of Application form for income tax advance ruling

The procedure to apply for Income tax advance ruling, application process, fee structure and the summary of Income Tax Advance Rulings issued is given in the link below.

Others

1) SGX RegCo proposes cap on Independent Directors tenure, disclosure of directors’ and CEOs’ exact remuneration

The Singapore Exchange Regulation (SGX RegCo) published a public consultation paper proposing to amend the Listing Rules to impose a hard nine-year limit on the tenure of independent directors, removing the current two-tier voting rule. The SGX RegCo is also proposing mandatory disclosures of the actual amounts of the remuneration of each listed company director and chief executive officer.

The proposal includes a one-year transitionary period for companies to find suitable independent directors.

Mandatory Nine-Year Tenure Limit on IDs

Currently, Listing Rule 210(5)(d)(iii) of the SGX-ST Mainboard Rules and Listing Rule 406(3)(d)(iii) of the SGX-ST Catalist Rules provide that a director of a listed issuer is not independent if he/she has been a director of a listed issuer for an aggregate period of more than nine years (whether before or after listing) unless his/her continued appointment as an ID has been approved in separate resolutions by:

(i) all shareholders of the issuer; and

(ii) shareholders of the issuer excluding its directors and CEO and associates of the directors and CEO (“Two-tier Vote”).

In line with CGAC’s recommendation, SGX RegCo proposes to amend the SGX-ST Mainboard Rules and SGX-ST Catalist Rules to:

- Provide that a director who has been a director of an issuer for an aggregate period of more than nine years (whether before or after listing) will not be considered independent. The nine-year tenure limit is aligned with the tenure limit imposed by MAS on IDs of Singapore-incorporated banks, insurers and managers of real estate investment trusts (“REIT Managers”); and

- Remove the Two-tier Vote mechanism for long-serving IDs.

Mandatory Disclosure of Remuneration Details of Directors and CEO

Currently, Principle 8 of the Code provides that a listed issuer must be transparent on its remuneration policies, level and mix of remuneration, the procedure for setting remuneration, and the relationships between remuneration, performance and value creation. Provision 8.1 of the Code recommends that a listed issuer should disclose in its annual report the policy and criteria for setting remuneration, as well as names, amounts and breakdown of remuneration of, among other things, each individual director and the CEO.

SGX RegCo is of the view that the remuneration details of directors and the CEOs should be transparent as they have a fiduciary duty and the question of competition is less of a concern. Therefore, it is proposed that the SGX-ST Mainboard Rules and SGX-ST Catalist Rules be amended to require:

- Companies listed on SGX-ST to disclose the exact amount and breakdown of remuneration of each director and the CEO in the annual report on a named basis.

- Real estate investment trusts (“REITs”) and business trusts (“BT”) listed on SGX-ST to disclose the exact amount and breakdown of remuneration of each director and the CEO of the REIT Managers and BT trustee-managers in the annual report on a named basis.

Singapore - Due dates

Estimated Chargeable Income (ECI) (September year-end)- 31- December-2022

GST Return: October 2022 – December 2022- 31 January 2023