Due Dates

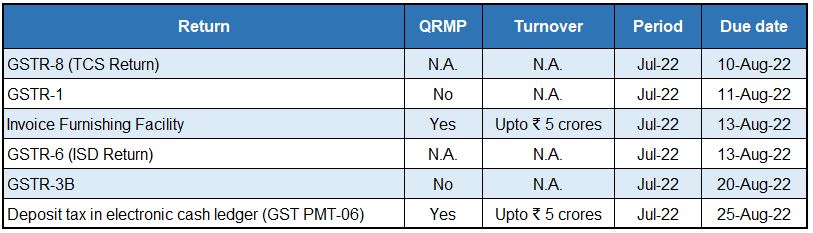

GST Due Dates

Corporate Laws Due Dates

ECB 2 returns for the month of July 2022 needs to be submitted on or before 7 August 2022.

DIR 3 KYC needs to be submitted on or before 30 September 2022.

MCA has vide General Circular No. 08/2022 dated 26 July 2022 issued a clarification on spending of CSR Funds for “Har Ghar Tiranga” Campaign. As per this clarification, spending of CSR funds for the activities related to the said campaign, such as mass scale production and supply of national flag, outreach and amplification efforts and other related activities would be an eligible CSR expenditure pertaining to the promotion of education relating to culture. This is subject to compliances with the provisions under the Companies (CSR) Rules, 2014 and related circulars / clarifications issued by MCA.

MCA to launch V3 forms which will be web based forms and these forms will be enabled with effect from 31 August 2022. Form DIR3-KYC Web, DIR3-KYC Eform, DPT-3, DPT-4, CHG-1, CHG-4, CHG-6, CHG-8 & CHG-9 are the first set of forms which will be disabled from 15 August 2022 and will be available in V3 format w.e.f. 31 August 2022. V3 forms will better serve the Corporates and these forms will be using Artificial Intelligence.

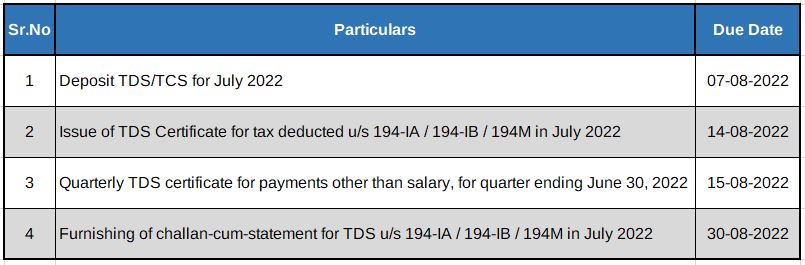

DIRECT TAX

Direct Tax Updates

Circulars / Notifications / Press Release

Notification No. 79/2022

- CBDT has notified income-tax exemption u/s 10(46) for ‘Uttar Pradesh Electricity Regulatory Commission’ – a commission constituted under the Uttar Pradesh Electricity Reforms Act, 1999.

- The Exemption extends to amount received in the form of Government grants, licence fees & Fines and interest thereon.

Notification No. 4/2022

- CBDT has notified that the application for allotment of PAN will be filed in Form FiLLip by a newly incorporated LLP with the MCA. After the generation of the LLP Identification Number, the MCA will forward the data in Form 49A to the Income-tax authority under its digital signature

Notification dated 16 July 2022

CBDT specified below forms to be filed electronically-

a) Form 3CEF: Annual Compliance Report on Advance Pricing Agreement

b) Form 10F: Information to be provided to claim relief under DTAA provisions

c) Form 68: Application for immunity from penalty

Other Forms notified are Forms 10IA, 3BB, 3BC, 10BC, 10FC, 28A, 27C, 58D, 58C etc.

Notification No. 85/2022

- CBDT has notified income-tax exemption u/s 10(46) for ‘Odisha Electricity Regulatory Commission

- The Exemption extends to amount received in the form of license fee from the licensees, application processing fee, Interest earned on Government Grants, license fee and application processing fee.

Case Laws

Worldpart Limited

- In the referred case, the Assessee a non-resident company, declared interest income and paid tax @10% as per DTAA. However, the Assessing Officer (AO) denied the treaty benefit and levied tax @30%.

- AO passed order u/s 143(3) read with section 144C(3)(b) taking the benefit of extended 12 months as 144C section was invoked.

- ITAT observed that section 144C can be invoked only if there is a variation in returned income or loss and not when there is change in rate of tax.

- ITAT concluded that benefit of extended 12 months period cannot be given to the AO. Thus, the Order passed was void ab initio.

Anjuga Selvi Alagiri

- In the referred case, the Assessee failed to furnish a return of income for AY 2010-11 to 2015-16. When it was brought to light by the investigation wing, the assessee filed returns in February 2018. Upon assessed, revenue found variation in income declared by over Rs. 63 lakhs. Revenue imposed a penalty for non-filing of return and belated return with suppressed income.

- The matter reached the High Court where the Assessee contended that delay in furnishing the return of income was not wilful or deliberate but beyond her control since she left India and settled in USA and was not abreast of the Indian tax laws

- As regards Assessee’s submission that the Revenue compounded the cases for AY 2010-11 and 2011-12, but was not inclined to compound the rest of the complaints, High Court observed that compounding of offence under Income-Tax Act is not an absolute right vested in the Assessee and explained that compounding of cases are based on facts and merits of each case where the Assessee disclosed true and actual income but filed return belatedly cannot be equated with case where Assessee failed to disclose the true and actual income and filed returns belatedly.

Natasha Chopra Vs DCIT

In the referred case, an individual Assessee having properties situated outside India did not offer rental income from those properties in income tax return filed in India.

- Assessee contended that since she has offered rental income in respective countries, she was not required to offer those in India and AO has erred in applying section 90(2) and 90(3).

- Hon’ble ITAT dismissed appeal of the assessee stating that the right of the resident country to tax its residents cannot be taken away under the DTAA. ITAT passed order in favour of revenue.

FUTURE FIRST INFO. SERVICES PVT. LTD

- In the referred case, the AO disallowed certain amounts under section 40a(ia) and 40A(2) for short deduction of tax and unreasonable payment to the extent of 50% respectively.

- Upon appeal, it was held that the AO cannot disallow amount under section 40A(2) without evidence or material facts.

- For short deduction, it was held that section 40(a)(ia) has dual limbs ,i.e., firstly there should be deduction of tax and secondly that it should be paid to the government. It further held that in case of short-deduction, the course of action of the revenue should be under section 201.

Cobra Instalaciones Y Services S.A

- In the referred case, Assessee had incurred foreign exchange losses on account of receipt and repayment of funds from Head Office (HO) as a part of working capital requirement and also on account of restatement of the outstanding amount at the year end, which were claimed as revenue expenditure.

- The Revenue disallowed the loss stating that the amounts from HO were recorded as remittance instead of loan. It further relied on Article-7(3) of India-Spain DTAA and held that any notional expenditure/loss toward HO except reimbursement is not an allowable deduction.

- The CIT relied on assessee’ s own case for AY 14-15 and ruled in favour of the Assessee averring that the Article 7(3) of India-Spain DTAA is not applicable because nothing is paid by the Assessee to the HO on account of loss and hence deduction can be claimed.

- The ITAT dismissed the revenue’s appeal based on the ruling of the co-ordinate bench in Assessee’s own case and held there is no reason to depart from the order till it has been reversed.

Darrameks Hotels & Developers v/s ITO

- In the referred case, Assessee was engaged in hotel business. The AO disallowed expenses and depreciation on the ground that Assessee did not carry any business activity during the year.

- When matter reached to ITAT, it was held that income generation of Assessee’s business may start at a much later date than the date of commencement of business.

- Therefore, ITAT deleted disallowance of business expense on the ground that Assessee didn’t earn any income.

Nitesh Estates Limited v/s DCIT

- The Assessee who was in the real estate development business sold one apartment to a Non-resident.

- The Assessee failed to deduct tax on capital gains which was subject to withholding and therefore was considered as an Assessee in default and was subject to additional tax and interest liability by the AO.

The ITAT held that once the conditions laid down under section 195 of the Act are fulfilled, the Assessee is bound to deduct tax. Interest shall be levied on failure to deduct tax

Goods and Service Tax

Supreme Court of India allows additional window of two months from 1 September to claim transitional credits

The Supreme Court of India in the case of M/s Filco Trade Centre Private Limited has given one more opportunity to all the registered taxpayers to claim transitional credits. The court has directed Goods and Services Tax Network (GSTN) to open the GSTN portal for filling transitional credit forms for two months from 1st September 2022 to 31st October 2022. It is worthwhile to note that, all registered persons can take benefit of this direction irrespective of whether they have filed writ petition before the High Courts or whether their case has been decided by Information Technology Grievance Redressal Committee. The jurisdictional GST officers have been directed to verify the claim of transitional credit within 90 days and pass necessary orders after granting reasonable opportunity to the assessee. Thereafter, the allowed transitional credit would be reflected in the electronic credit ledger of the taxpayer.

Just to give background, GST law allowed pre-GST credits to be carried forward into GST regime and Assessees were required to file their claims for transitional credits in prescribed form within the extended timeline of 27th December 2017. However, many Assessees faced technical glitches on GSTN portal in filling their transitional claims and in some cases, there were errors and omissions in the transitional credit claims filed by the Assessees. This order of Supreme Court would indeed benefit all such Assessees to claim their missed transitional credits under GST regime.

Administering of COVID-19 vaccine is not exempt, liable to GST at 5% - Andhra Pradesh AAR

The Andhra Pradesh AAR in the case M/s. Krishna Institute of Medical Sciences Limited has held that, the administering of COVID-19 vaccine is a composite supply wherein the principal supply is sale of vaccine and the transaction is taxable at the rate of 5%. The applicant in this case contended before AAR that the administering of COVID-19 vaccine qualify as ‘healthcare service’ and is eligible for GST exemption. The AAR noted that, there are two activities involved in this transaction viz. sale of vaccine (which is supply of goods) and administering the vaccine (which is supply of service). The AAR further noted that, this transaction constitutes the composite supply, and basis the perception of the consumer / recipient, the sale of vaccine constitutes the principal supply in this transaction. In view of this, the AAR held that, the exemption available to ‘healthcare services’ is not applicable in this case because the present transaction qualifies as sale of vaccine which is taxable at the rate of 5%.

Interest on loan taken on credit card is not exempt – Calcutta High Court

The Calcutta High Court in the case of Mr. Ramesh Kumar Patodia vs CITI Bank NA has held that, interest component of EMI on loan taken on credit card is not exempt and is leviable to GST. The petitioner in this case Mr. Ramesh Kumar Patodia filed a writ petition before High Court praying for a declaration that, interest component of EMI on credit card loan is exempt from levy of GST and issue a direction upon the bank and GST authorities to issue refund of GST collected from the petitioner.

The facts in this case are that, the petitioner is a holder of CITI Bank credit card and availed an instant loan of Rs. 6,50,000/- at 13% interest above his credit limit. As per the terms and conditions of offer of the loan, the EMI amount is to be included as a part of minimum amount due appearing in the monthly credit card statement. If the amount paid towards dues on credit card is less than the total amount due then the finance charges would be levied on the outstanding amount which would include EMI amount as well.

It is worthwhile to note that, services by way of extending loan when consideration is represented by way of interest, are specifically exempt from GST by way of an exemption notification; however, interest involved in credit card services is excluded from this exemption entry and the same is taxable at the rate of 18%.

The High Court in its decision noted that, as per the terms and conditions of loan offer, the said offer was valid only for customers holding CITI Bank credit card. Further, the criteria for processing the loan, the manner in which EMI would reflect in the credit card statement and the fact that interest would be charged in case there is a shortfall in payment of total amount due all goes to prove that, the service rendered by CITI Bank in this case is nothing but a service pertaining to the said credit card. Thus, the Court held that, they are unable to accept the contention of the petitioner that the services in the instant case does not amount to credit card services. Therefore, the High Court held that, interest component of EMI is nothing but interest involved in credit card services which is not exempt under the exemption notification.

Cybersecurity / IS AUDIT

Mobile: The New Target

When the smart phone was launched, there was a revolution in the industry which was bought upon by the most convenient tool to this date. Now there was a device as powerful as a computer, easy to carry around in your pocket like a wallet, and with the most user-friendly interface that anybody could handle. We may take this as granted nowadays, however, it was just like when computers replaced printers and your files in the OS replaced the file cabinets. The entire business infrastructure changed to accommodate the newfound technologies. Just like that, the smart phones have changed the way people work, however, it might feel that policies haven’t been updated as far as the corporate practices are taken into consideration.

There is no device out there that can tell your story accurately than your smartphone. Not just your formal and informal emails, but also your habits, the applications you use that provide an insight to your interests, internet browsing, and many sensitive/confidential information. Therefore, it is important to understand the threats relevant to the mobile devices, because like it or not, it is a part of your daily business practices. So, we can’t wish this complication away, however, we can take steps to amalgamate this device safely with our infrastructure.

Create A Mobile Device Security Policy

In specific security-oriented scenarios, it is important to provide employees with smartphones That being said, before issuing smartphones or tablets to your employees, be clear to establish a device usage policy. It is paramount that the employee understands the security risk posed due to the violation of the security measures put in place. Well informed, responsible users are the first line of defence against security breach.

Form a Bring Your Own Device Policy (BYOD)

If employees are allowed to use their personal devices, make sure that you have put up a bring your own device policy in place. It should have security plan for:

- Requirements for installing remote wiping software on any personal devices used to store or access company data as well as encryption software.

- Education and training for employees on how to safeguard company data when they access wireless networks from their own mobile phones and devices

- Data protection practices that include requiring strong passwords and automatic locking after periods of inactivity

- Protocols for reporting lost or stolen devices

- The use of certain antivirus and protective security software

- Requirements for regular backups

An approved list for those who want to download apps

Keep the Device and Software Updated

Software updated to mobile devices puts up patches for security gaps, recent vulnerabilities, and other security threats. You need to establish endpoint security software and antivirus software to make sure that your ware is protected. Many of these programs will monitor Short Message Service (SMS) texts, Multimedia Messaging Service (MMS) and call logs for suspicious activity. They can use blacklists to prevent users from installing known malware to their devices.

Backup Device Content on a Regular Basis

Just as you backup your computer data regularly, you should backup data on your company’s mobile devices. If a device is lost or stolen, you’ll have peace of mind knowing your valuable data is safe and that it can be restored.

Choose Passwords Carefully

This would feel like a redundant message you hear on every lecture on security. But you should know that a single email could be associated with more than a hundred applications and email id may remain as a username credential for any SaaS software that you may use daily. This eight-character string is the strongest wall between your information and a malicious hacker. Therefore, it is important to follow the below steps a good password policy practice.

- Employees should change the device’s login password at least every 90 days

- Implement two factor authentication

- Passwords must have minimum of eight characters with uppercase, lowercase, and special characters.

- Don’t use simple or obvious passwords.

Because of the great convenience it offers, smart phones and tablets are vital tools in modern business. While it might be difficult to fully control mobile devices in your organization, there are secure ways to integrate them into your business processes.

SINGAPORE UPDATES

Monetary Authority of Singapore and Other Updates

1) MAS to Launch Inaugural Singapore Sovereign Green Bond Issuance

Singapore’s central bank looks to raise at least $1.5 billion with the inaugural sale of a sovereign green bond, whose proceeds will finance projects with environmental benefits, including the Jurong Region Line and Cross Island Line.

The first sovereign green bond – called Green Singapore Government Securities (Infrastructure), or Green SGS (Infra) – will be launched via a book-building process within the week, the Monetary Authority of Singapore (MAS) announced on 1 August 2022.

Both institutional and individual investors can apply to purchase the bonds.

The Green SGS (Infra) will be issued under the Singapore Green Bond Framework, which details guidelines for green bonds issued by the public sector as well as other information such as the operational approach to managing green bond proceeds.

MAS said the planned issuance of the first sovereign green bond marks the introduction of syndication as a new method for issuing Singapore Government Securities, complementing the regular schedule of SGS auctions where buyers have to submit bids for the government bonds.

Syndication involves the appointment of a group of banks, or bookrunners, to jointly market and distribute a bond.

Both institutional and individual investors can apply to purchase the inaugural Green SGS (Infra). Interested institutional investors may approach the appointed bookrunners for more information – these are DBS Bank Ltd. (DBS), Deutsche Bank AG Singapore Branch (DB), The Hongkong and Shanghai Banking Corporation Limited Singapore Branch (HSBC), Oversea-Chinese Banking Corporation Limited (OCBC), and Standard Chartered Bank (Singapore) Limited (SCB). Subsequently, individual investors will be able to apply for bonds via application channels provided by DBS (including POSB), OCBC, and United Overseas Bank Limited (UOB), after MAS announces the opening of the Public Offer.

2) Singapore and Malaysia Agree to Deepen Cooperation in Digital Economy and Green Economy

The Singapore Ministry of Trade and Industry announced that Ministry of Trade and Industry Gan Kim Yong and Malaysia Senior Minister and Minister of International Trade and Industry YB Dato’ Seri Mohamed Azmin Ali had agreed to begin discussions on frameworks of Corporation in the Digital economy and green economy with a view to concluding the frameworks this year.

The press notes that the COVID-19 pandemic highlighted the importance of digital connectivity between countries and accelerated the digital transformation of traditional business models, prompting Singapore and Malaysia to seek to foster greater interoperability and collaboration. Similarly the challenges of Climate change and sustainability were acknowledged and a commitment to work together towards a low carbon future was made.

The Ministers recognised that the digital and green economies are the key to sustainable and inclusive growth for both countries. The Frameworks of Cooperation would strengthen dialogue and cooperation in these areas, and would serve as the basis for future bilateral cooperation initiatives related to the digital and green economies.

3) Monetary Authority of Singapore and the International Financial Services Centre Authority Exchange Memorandum of Understanding on Supervisory Cooperation

The Monetary Authority of Singapore (MAS) and the International Financial Services Centre Authority (IFSCA) have exchanged a memorandum of understanding (MOU) on July 29,2022.

The MOU, which was signed in the presence of Indian Prime Minister Narendra Modi at India’s GIFT City Gandhinagar, India.

The MOU provides a framework for supervisory cooperation between the two authorities in relation to financial services including stock exchanges and technical cooperation. It paves the way for mutual assistance and the facilitation of the exchange of information between the Authorities, to strengthen the supervision of cross-border operations of the exchanges and compliance by the exchanges with the applicable laws and regulations.

IRAS- Due Dates

- Estimated Chargeable Income (ECI) (June year-end) 30 September 2022

- GST Return: July 2022 – September 2022 : 31 October 2022

- Form C-S/C : 30 November-2022