August 2023 Newsletter

DUE DATES

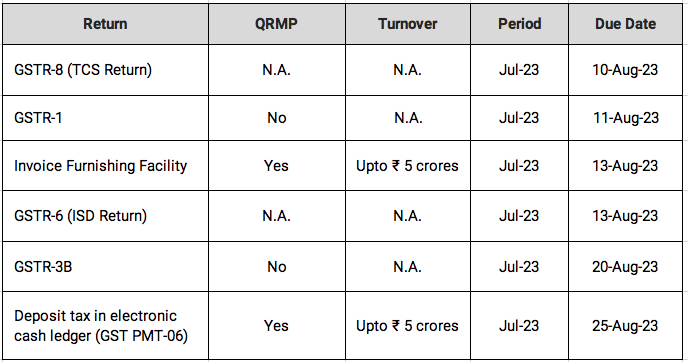

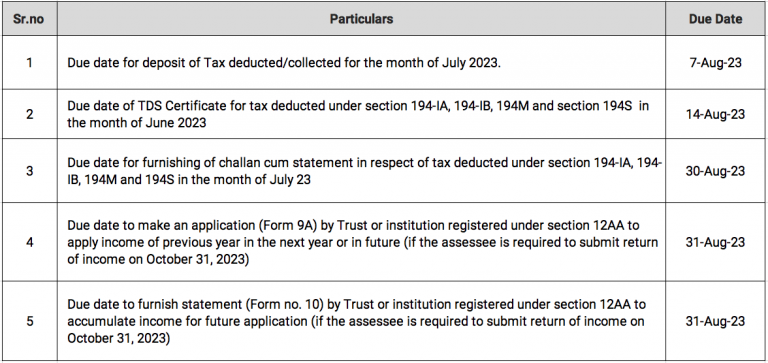

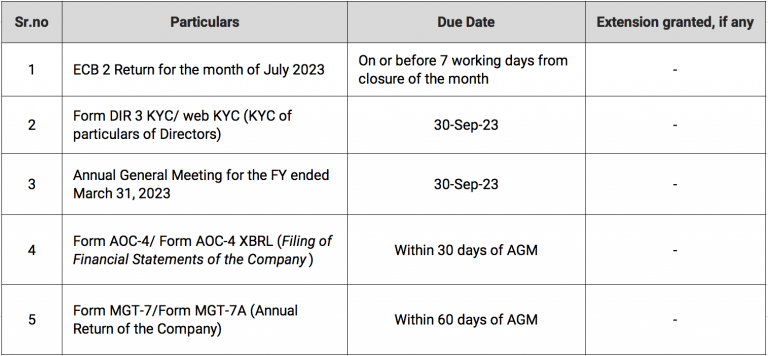

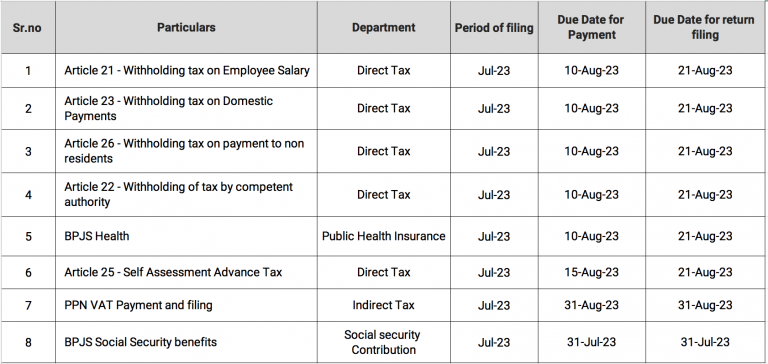

Compliance calendar for due dates falling in August 2023

GST

DIRECT TAX

CORPORATE ADVISORY SERVICES

INDONESIA COMPLIANCE

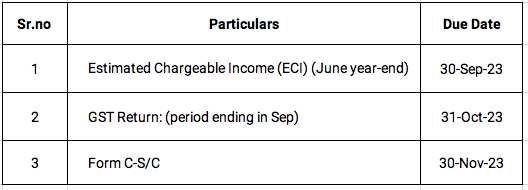

SINGAPORE COMPLIANCE

Direct Tax

Circulars / Notifications / Press Release

Clarification relating to Tax Collected at Source (TCS) on Liberalised Remittance Scheme (LRS) & purchase of overseas tour program package.

- Finance Act, 2023 has amended section 206C(1G) of income-tax act to:

- Increase the TCS rate from 5% to 20% for remittance under LRS and for purchase of overseas tour program package. However, these were not applicable for education and medical purposes; and

- Remove the threshold of Rs. 7 lakhs for triggering TCS on LRS.

- The amendment provided a differential treatment for credit cards under LRS, which is now postponed for the time being.

- Based on the press release issued by the Ministry of Finance, for the first Rs. 7 lakhs remittance under LRS there is no TCS. However, remittance beyond Rs. 7 lakh TCS shall be at the rate of-

- 0.5% of remittance for education purposes which is financed by a loan.

- 5% of remittance for education/medical purpose.

- 20% for other cases.

- For purchase of overseas tour program package under section 206C(1G) of the income-tax act, TCS will be deducted @ 5% for the first Rs. 7 lakh and @ 20% for the expenditure over and above Rs. 7 lakhs.

- Increased rate of TCS would apply from 01st October 2023.

No deduction of TDS on dividend for business engaged in leasing of an aircraft: CBDT Notification

- The central government has specified that TDS shall not be deducted on dividend income paid by any unit of an International Financial Services Centre, primarily engaged in the business of leasing of an aircraft to a company, being a Unit of an International Financial Services Centre primarily engaged in the business of leasing of an aircraft.

Case Laws

Penalty cannot be levied on account of inaccuracy in income furnished : Rajkot ITAT

- Assessee was in the business of share trading. During the year under consideration, it showed a Long-term Capital Gain of Rs. 1,90,574/- and claimed exemption under section 10(38) of the Act.

- Assessing Officer treated this gain as business income and initiated penalty proceedings under Income Tax Act being 100% of the amount of tax sought to be evaded on account of concealment of particulars of income.

- ITAT held such income as business income and not the income under the head capital gain. Such disclosure is an inaccurate claim made by the assessee which cannot be equated with the inaccurate particulars of income.

- Further, there was no question of concealment of income. Hence, the Assessee’s claim was accepted and the penalty was quashed.

Provision of access to data online cannot be regarded as Fees from Technical Services u/s 9(i)(vii) of the Act: ITAT

- Assessee, a tax Resident of US was in the business of providing access to journals , articles , magazines and e-books online . It renders these services through its database and charges subscription fees for the same.

- The Commissioner of Income Tax(“CIT”) passed an order for AY 17-18, alleging that the subscription fees should be taxed as Fees from Technical Services. The CIT believed the assessee themselves make available highly specialized and technical content in the form of solutions, knowledge, experience, skill, know how and processes, besides also withholding TDS @10%.

- Matter reached to ITAT wherein, Tribunal favored the Assessee noting the following facts:

- The business model is based on collating data and making it available on its online software, hence the subscription is not received in making available the copyright or enabling customers to directly use the same. The ITAT relied on Article 7 of US-India DTAA treaty , which states the subscription is a business profit and hence not taxable in India .

GST litigation Update

Indirect Litigation update

Service Tax

Activity of charging electric vehicle amounts to supply of service, liable to GST –Karnataka AAR

In a recent ruling, the Appellate authority for Advance Ruling, Karnataka addressed the issue of Whether charging of electric battery through establishment of various Public Charging Stations (PCS) amounts to supply of electricity energy (supply of goods) or supply of service charge (supply of service).

The authority states that electricity, which is a moveable property and classified as goods, is not supplied as such to the consumer, rather it is converted into chemical energy during its charging process, and the consumer ultimately receives only chemical energy stored in the battery. It is important to note that, the Ministry of Power, in its guidelines, clarified that the activity of charging an Electric battery involves a service that requires the consumption of electricity by the charging station. It does not involve the sale of electricity. Thus, the activity of charging of electric vehicle does not amount to supply of electricity, but it is a supply of service. Consequently, the service is subject to GST @18%.

GST not leviable on the loan issued to a credit card holder – Calcutta High Court

In this case, Citi Bank extended an “increased pay lite loan” to the petitioner, a credit card holder, repayable through 12 EMIs. Petitioner repaid the entire loan amount, along with the accrued interest and IGST to the bank. Petitioner subsequently filed a Writ application, seeking a declaration that the transaction should be exempt from IGST levy and any amount charged in relation to this matter should be reimbursed. The High Court held that while a Banking Institution holds the discretion to provide loans to Credit Card holders, once it chooses to offer such loans, they must treat them akin to other loan types. When GST is exempted in case of a loan transaction, it is applicable to all transactions coming under the category of loan and treating such loans as Credit Card facilities and levying GST on them is not valid. The High Court also noted that in this case, the loan amount was advanced by a cheque or draft issued by the bank, or in other words, the loan amount was not generated by charging the petitioner’s card. Hence, the High Court held that the present transaction with the bank was a service which could not be termed as a credit card service and was not leviable to the GST.

Time limit to avail input tax credit under section 16(4) is constitutional valid – Andhra Pradesh High Court

In the present case the petitioner had filed a writ petition challenging the constitutional validity of section 16(4) of the Central GST Act which provides for time limit to avail input tax credit (“ITC”). The petitioner had filed GSTR 3B of March 2020 belatedly in the month of November 2020 with a late fee and had claimed the ITC pertaining to March 2020. GST authorities issued a notice to the petitioner for recovery of ITC along with interest and penalty as the claim of ITC was time barred under Section 16(4). Petitioner through writ petition challenged the constitutional validity of time limit provided under Section 16(4).

The High Court held that the non obstante clause in Section 16(2) followed by a negative sentence clearly states that unless the conditions mentioned in Section 16(2) are satisfied, no ITC will be eligible. Hence section 16(2) is not an enabling provision but a restricting provision which restricts the eligibility to ITC given under section 16(1). Both Section 16(2) and Section 16(4) are two different restricting provisions which are capable of clear interpretation and will not be overridden by non obstante provision under Section 16(2). High Court concluded that ITC was a mere statutory concession/rebate but not a constitutional right given to a taxpayer and thereby section 16(4) does not violate the constitutional provisions. Further, as far as the admission of GSTR 3B with late fee is concerned, it was held that the collection of late fees was only for the purpose of admitting the return for verification of the taxable turnover but not for consideration of ITC. Hence the High Court dismissed the writ petition and held that the time limit under Section 16(4) is not violative of Articles 14, 19(1)(g) and 300-A of the constitution of India.

Singapore Updates

Latest Updates

Accounting and Corporate Regulatory Authority (ACRA)

1) Singapore's Sustainability Reporting Advisory Committee Recommends Mandatory Climate Reporting for Listed and Large Non-Listed Companies

On 6th July 2023, the Accounting and Corporate Regulatory Authority (ACRA) and Singapore Exchange Regulation (SGX RegCo) have launched a public consultation on the recommendations by the Sustainability Reporting Advisory Committee (SRAC) to advance climate reporting in Singapore. SRAC recommends requiring listed issuers to report International Sustainability Standards Board -aligned climate-related disclosures (CRDs) starting from financial year 2025 (FY2025). Large Non-Listed Companies with annual revenue of at least $1 billion will follow suit in FY2027.

SRAC is an industry-led committee set up by ACRA and SGX RegCo to advise on the roadmap for advancing sustainability reporting by companies in Singapore. The recommendations of SRAC aim to uphold Singapore’s attractiveness as a global business hub while contributing to our national agenda on sustainable development under the Singapore Green Plan 2030.

Following are the key recommendations:

Mandatory climate reporting from FY2025 for all Listed Issuers – Listed Issuers, including those incorporated overseas, business trusts and real estate investment trusts, should report CRDs from FY2025. This will build on their momentum and progress in climate reporting.

a) Mandatory climate reporting from FY2025 for all Listed Issuers – Listed Issuers, including those incorporated overseas, business trusts and real estate investment trusts, should report CRDs from FY2025. This will build on their momentum and progress in climate reporting.

b) Mandatory climate reporting from FY2027 for Large Non-Listed Companies – Non-listed companies with annual revenue of at least $1 billion should make CRDs from FY2027. A review will be conducted in 2027 with the view to mandate climate reporting on Large Non-Listed Companies with revenue of at least $100 million, by around FY2030. The review will consider factors such as international developments, industry capacity and the implementation experience of Large Non-Listed Companies.

c) Prescribed standards aligned with the ISSB requirements for climate reporting –Both Listed Issuers and Large Non-Listed Companies should report CRDs using the local prescribed standards that mirror the requirements in the ISSB standards. To allow more time to prepare, these companies could opt to make certain complex CRDs such as Greenhouse gas Scope 3 emissions1 one/two years after reporting requirements kick in.

d) External assurance requirements – Companies subjected to mandatory climate reporting should obtain external assurance on Greenhouse gas Scope 1 and Scope 2 emissions1 from FY2027 for all Listed Issuers, and FY2029 for Large Non-Listed Companies. The assurance can be provided by ACRA-registered audit firms and Testing, Inspection, Certification firms accredited by the Singapore Accreditation Council.

e) Reporting and Filing Timelines – CRDs should have the same reporting and filing timelines as financial statements to facilitate timely communication to shareholders and other stakeholders. Legal responsibilities should also be imposed on the company, its directors, and/or officers to ensure accountability for CRDs.

Monetary Authority Of Singapore

1) MAS to Strengthen Defence Against Money Laundering Risks in Single Family Offices

On 31st July 2023, the Monetary Authority of Singapore (MAS) has launched a public consultation on a revised framework to strengthen surveillance and defence against money laundering (ML) risks in Singapore’s Single Family Office (SFO) sector. The revised framework will introduce a harmonised class exemption for SFOs with specific requirements to ensure that all SFOs are subject to anti-money laundering controls.

Currently, as SFOs do not manage third-party assets, they can either rely on existing class exemptions from licensing requirements under the Securities and Futures Act or apply to MAS for case-by-case exemptions. To strengthen surveillance and defence against ML risks in the SFO sector, MAS proposes to harmonise the exemption criteria for all SFOs operating in Singapore.

Specifically, to qualify for the class exemption, SFOs must:

• Be incorporated in Singapore;

• Notify MAS and confirm that it is in compliance with the qualifying criteria under the class exemption when they commence operations in Singapore;

• Report annually on total assets managed after the end of each calendar year; and

• Maintain a business relationship with an MAS-regulated financial institution that will perform anti-money laundering checks on these SFOs.

These measures will allow MAS to better monitor SFOs operating in Singapore and address any ML risks in the sector.

2) MAS Publishes Investor Protection Measures for Digital Payment Token Services

On 3rd July 2023, the Monetary Authority of Singapore (MAS) announced new requirements for Digital Payment Token (DPT) service providers to safekeep customer assets under a statutory trust before the end of the year. This will mitigate the risk of loss or misuse of customers’ assets and facilitate the recovery of customers’ assets in the event of a DPT service provider’s insolvency. MAS will also restrict DPT service providers from facilitating lending and staking of DPT tokens by their retail customers.

These measures are introduced following an October 2022 public consultation on regulatory measures to enhance investor protection and market integrity in DPT services. The consultation received significant interest from a wide range of respondents, with broad support for DPT service providers to:

• Segregate customers’ assets from its own assets and held in trust;

• Safeguard customers’ moneys;

• Conduct daily reconciliation of customers’ assets and keep proper books and records;

• Maintain access and operational controls to customers’ DPTs in Singapore; • Ensure that the custody function is operationally independent from other business units; and

• Provide clear disclosures to customers on the risks involved in having their assets held by the DPT service provider.

MAS had also consulted on the broad regulatory approach on market integrity in the October 2022 public consultation. Most respondents agreed with MAS’ observations on good industry practices to address market integrity risks, and some respondents suggested that MAS should impose further measures to prevent market abuse and unfair trading practices. To follow up more specifically, MAS is issuing a separate consultation paper proposing requirements for DPT service providers to address unfair trading practices. It will also set out legislative provisions and the types of wrongful conduct that constitute offences.

3) Monetary Authority of Singapore and National Bank of Cambodia set up Financial Transparency Corridor to support SMEs

On 11th July 2023, the Monetary the Monetary Authority of Singapore (MAS) and the National Bank of Cambodia (NBC) have signed a Memorandum of Understanding (MoU) to collaborate on a Financial Transparency Corridor (FTC) initiative. The initiative aims to establish supporting digital infrastructures to facilitate trade and cross-border related financial services between small and medium-sized enterprises (SMEs) in Singapore and Cambodia.

Under the FTC, a Singapore financial institution, in assessing financing support for a Singapore SME buyer’s cross-border business with a Cambodian SME seller, can utilise the FTC to acquire trusted information from a Cambodian financial institution on the Cambodian SME seller. Similarly, a Cambodian financial institution supporting a Cambodian seller can obtain trusted information on the Singapore buyer through the FTC. Through such enhanced information flows, this can help SMEs in Singapore and Cambodia access broader digital trade networks such as the Business Sans Border Proxtera global network and provide SMEs with greater trade connectivity within ASEAN and other growth regions.

The supporting digital infrastructures under the FTC initiative aims to:

- Establish a consent-based digital infrastructure to facilitate information exchange between participating financial institutions in Singapore and Cambodia, to support the provision of cross-border financial services to SMEs.

- Support financial institutions’ loan assessments for trade financing and an SME’s compliance with anti-money laundering rules to mitigate risks and potential trade disputes.

Legal Updates

1. Amendment to the Prevention of Money-Laundering Act, 2002

The Ministry of Finance, Department of Revenue, has issued a notification dated 07 July 2023 (“Notification”), under the powers conferred by Section 66(1)(ii) of the Prevention of Money-laundering Act, 2002 (“Act”).

As per Section 66 of the Act, the power to cause any person or a body to furnish information, by special or a general order, is cast upon the Director in the event he deems it necessary to do so in public interest. Accordingly, a list of departments and/ or Ministries have been notified periodically to comply with this Section.

The Notification by way of 26th (Twenty-Sixth) entry has inserted ‘Goods and Services Tax Network’[1] in this list. With the implementation of the Notification, the information stored on the Goods and Service Tax Network (“GSTN”) shall be furnished to the Director upon such order being sent by the Director.

MINISTRY OF FINANCE (Department of Revenue)

NOTIFICATION

G.S.R. 491(E).—In exercise of the powers conferred by clause (ii) of sub-section (1) of section 66 of the Prevention of Money-laundering Act, 2002 (15 of 2003), the Central Government, being satisfied that it is necessary in the public interest to do so, hereby makes the following further amendment in the notification of the Government of India, in the Ministry of Finance, Department of Revenue, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R. 381(E), dated the 27th June, 2006, namely:-

In the said notification, after serial number (25) and the entry relating thereto, the following serial number and entry shall be inserted, namely:-

“(26) Goods and Services Tax Network.”.