Due Dates

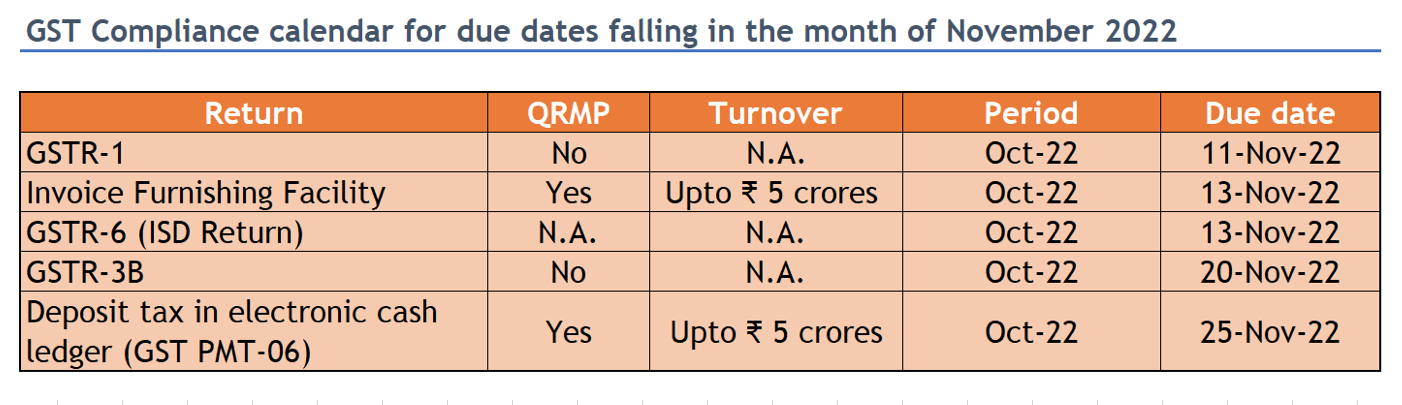

GST Due Dates

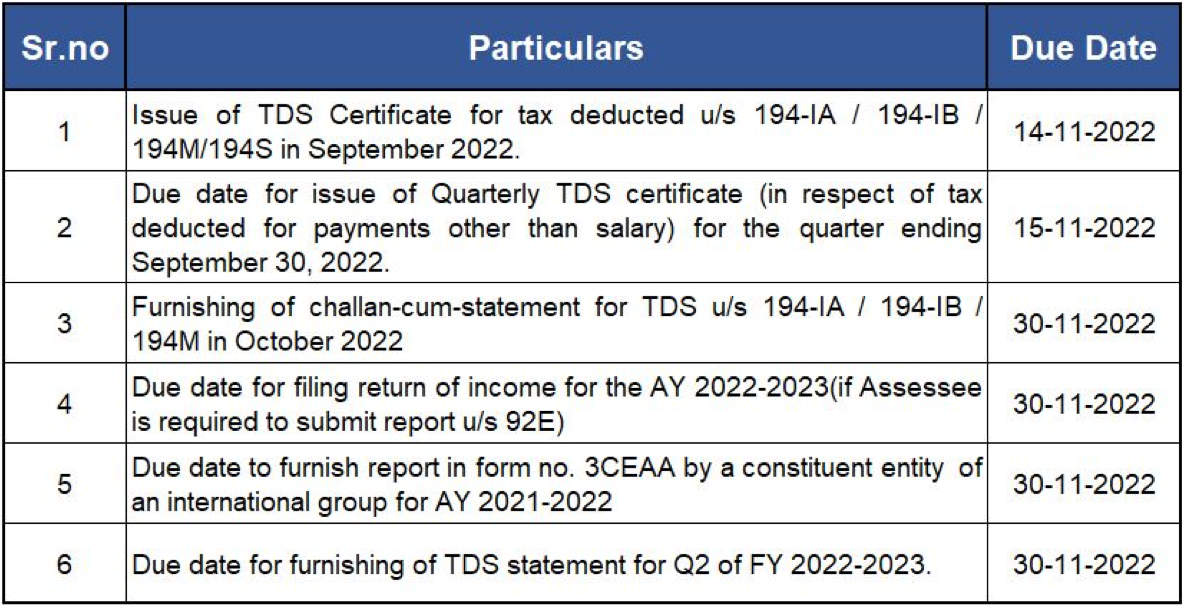

DIRECT TAX

Important Due Dates December 2022

Circulars/Notifications/Press Release/Gossips

Notification No. 125/2022

- CBDT has issued a notification to include Public Investment Fund (PIF) within the ambit of a “sovereign wealth fund” as a specified person covered in the exemption under Section 10(23FE) of the Income-tax Act 1961.

Other Gossips

- Co-browsing feature is available for the taxpayer- allows the Helpdesk agents to collaborate with the taxpayer’s browser in real-time, just at the click of a button. Agents can view and securely navigate the taxpayer’s browser screen and guide them interactively to deliver real-time and personalized support.

- Axis Bank, Central Bank of India, ICICI Bank and Indian Bank have been migrated from OLTAS e-Payment of Taxes at Protean (previously NSDL) to e-Pay Tax facility at the e-Filing portal for payment of taxes henceforth.

Case Laws

Luxora Infrastructure Private Limited Vs Deputy CIT

- In the referred case, Revenue passed an assessment order u/s 153A pursuant to search operation and added the entire receipts in to Assessee’s income u/s 68 and it was confirmed by CIT(A).

- ITAT observes that the issue is squarely covered by jurisdictional HC rulings in favor of the Assessee as per which in the absence of any incriminating material, no addition can be made in a post-search assessment.

- Accordingly, ITAT holds that the impugned additions must be deleted.

Umeshkumar Harilal Shah Vs Income Tax Officer (TDS)

- In the referred case, Revenue observed that assessee earned income from sale of scrap and no TCS was collected on such sale and determined tax liability u/s 206C(1) apart from interest u/s 206C(7).

- Assessee contented that TCS is not applicable as it is not generated through manufacturing activity whereas ITAT clarified that there is no requirement that the goods to be eligible for scrap should be produced/manufacture by the seller itself.

- ITAT thus dismisses Assesse’s appeal, upholds Revenue’s order against failure to collect tax at source on sale of scrap.

DSV Solutions Pvt Ltd Vs Deputy Commissioner of Income Tax

- In the referred case, order was sent to assessee at the old address available in PAN database whereas assessee had intimated new address and hence DRP dismissed appeal stating that objection filed were time barred.

- ITAT rejected revenue’s contention that address was taken as per PAN database and finds that notice u/s 142(1) was sent to new address and address on assessment order was not system generated and opines that the justification of using the old address is devoid of legally sustainable merits.

- ITAT thus holds that that there was no forwarding, not even an effort to forward, the draft assessment order to the correct address and holds impugned order as barred by limitation.

Deepak Kapoor Vs Principal Commissioner of Income-tax

- In the referred case, Assessee sold a property and reported capital gain, but the return was picked up for scrutiny and AO assessed the taxable income by making additions of Rs. 9.84 cr.

- Assessee appealed the order before CIT(A) and was partly allowed, but AO reopened the assessment contented that amount paid to sisters could not be claimed as expenses and also valued the property u/s 50C.

- Hon’ble Delhi HC allows assessee’s writ petition stating initiation of reassessment proceedings on mere change in AO’s opinion is impermissible in law.

Singapore Airlines Ltd. Vs Commissioner of Income Tax

- In the referred case, assessee had executed agreement with agent to pay standard commission on tickets sold by them. Along with this commission they charged additional amount above net fare.

- Assessee deducted tax on standard commission but did not make deduction on supplementary commission which is liable for TDS but included supplementary commission in income and paid taxes on the same.

- CIT held that assessee had a reasonable cause as specified u/s 273B for non-deduction of tax and thus quashes the penalty proceedings.

Triumph International Private Limited Vs Additional Commissioner of Income Tax

- In the referred case, assessee undertook international transaction of sale & purchase of RM and benchmarked them using TNMM with OP/TC as PLI.

- Assessee’s capacity utilization was less than the capacity utilization of comparable entities and hence excluded certain costs which in turn affects its own PLI.

- ITAT refuses the plea of grant of risk adjustment since it was characterized as normal risk bearing entrepreneu w.r.t to correct computation of the capacity utilization of comparable entities and also directs to consider the average of past three years data in case present years data is NA.

Rishikesh Buildcon Private Limited Vs Principal Commissioner of Income Tax

- In the referred case, Assessee filed returns showing loss which were selected for scrutiny by the AO and received notice for the same.

- Revenue appealed against the ITAT order stating that as per facts of the case, the penalty order(s) was passed within six months from the end of the month in which the penalty proceedings were initiated.

- ITAT contends that the order of the AO holding that the penalty order was passed after the expiry of the time limit laid down under Section 275(1)(c) of the Act and is time barred.

Goods and Service Tax

Electricity and water charges collected by the lessor on actual basis liable to GST - Telangana AAR

The Telangana AAR in the case of M/s Duet India Hotels (Hyderabad) Private Limited has held that, the electricity and water charges collected by the applicant-lessor from lessee will constitute a composite supply and will be taxable at the rate applicable to principal supply of leasing services.

In the present case, the applicant contended before the AAR that the reimbursement received from tenant is not a supply as per section 7(1) of Central GST Act. It was also contended by the applicant that they have entered into an agreement with the lessee for collection of electricity and water charges on an actual basis which signifies that the they are acting as a ‘pure agent’ of lessee as per rule 33 of the Central GST Rules.

The AAR however rejected the contention of the applicant on the ground that one of the main conditions to qualify a taxpayer as pure agent is that the payment should be made on authorization of the recipient of services and in the present case, the applicant missed to justify this requirement in their advance ruling application. The AAR further held that the applicant is supplying a bunch of services in which the leasing of premises is the main supply and provision of utilities would be in the nature of incidental/ancillary activity. Therefore, the AAR held that electricity and water charges collected by the applicant on actual basis from tenant is liable to GST.

GST Form DRC-03 is not a valid mode to make pre-deposit payment for cases pertaining to old central excise and service tax laws

CBIC has recently issued a circular no. CBIC-240137/14/2022- dated 28th October 2022 vide which it has clarified that the payment through GST Form DRC-03 is not a valid mode of payment for making pre-deposit under section 35F of the Central Excise Act, 1994 and section 83 of the Finance Act, 1994. In this Circular, CBIC has stated that there exists a dedicated CBIC-GST integrated portal, http://cbic-gst.gov.in which could be utilized by taxpayers for making payment of pre-deposit under the old Central Excise and Service tax law. Detailed procedure to make payment of pre-deposit is explained in Circular no. 1070/3/2019 dated 24th June 2019.

Further, the Circular also clarifies that GST Form DRC-03 is not the valid Form under GST law also to make a payment of pre-deposit for filing GST appeal. In this regard, the Circular advises taxpayers to use GST Form APL-01 to make payment of pre-deposit.

Cybersecurity / IS AUDIT

Mobile: The New Target

The launch of the smart phone brought about another revolution across industries.

Now there is a device as powerful as a computer, easy to carry around in your pocket like a wallet, and with the most user-friendly interface that anybody could handle. The entire business infrastructure changed to accommodate these newfound technologies. And, just like that, smart phones changed the way people work; yet, it feels that security policies haven’t kept pace with the growth.

There is no device out there that can tell your story more accurately than your smartphones. Not just your formal and informal emails, but also your habits, the applications you use that provide an insight to your interests, internet browsing, and many sensitive/confidential information too. Therefore, it is important to understand the threats relevant to the mobile devices, like it or not, it is now a part of your daily business practices. So, we can’t wish this complication away, however, we can take steps to amalgamate this device safely with our infrastructure.

Create A Mobile Device Security Policy

In specific security-oriented scenarios, it is as important to provide employees with smartphones as it is to provide them with a system to work with. That being said, before issuing smart phones or tablets to your employees, be clear to establish a device usage policy. It is paramount that the employee understands the security risk posed due to the violation of the security measures put in place. Well informed, responsible users are the first line of defence against security breaches.

Form a Bring Your Own Device Policy (BYOD)

If employees are allowed to use their personal devices, make sure that you have put up a bring your own device policy in place. You should have security plan for:

- installing remote wiping software on any personal devices used to store or access company data as well as encryption software.

- Education and training for employees on how to safeguard company data when they access wireless networks from their own mobile phones and devices

- Data protection practices that include requiring strong passwords and automatic locking after periods of inactivity

- Protocols for reporting lost or stolen devices

- The use of certain antivirus and protective security software

- Requirements for regular backups

An approved list of apps available for download

Keep the Device and Software Updated

Software updates to mobile devices puts up patches for security gaps, recent vulnerabilities, and other security threats. You need to establish endpoint security software and antivirus software to make sure that your ware is protected. Many of these programs will monitor Short Message Service (SMS) texts, Multimedia Messaging Service (MMS) and call logs for suspicious activity. They can use blacklists to prevent users from installing known malware to their devices.

Backup Device Content on a Regular Basis

Just as you backup your computer data regularly, you should backup data on your company’s mobile devices. If a device is lost or stolen, you’ll have peace of mind knowing your valuable data is safe and that it can be restored.

Choose Passwords Carefully

This would feel like a redundant message you hear on every lecture on security. But you should know that a single email could be associated with more than a hundred applications and email id may remain as a username credential for any SaaS software that you may use daily. This eight-character string is the strongest wall between your information and a malicious hacker. Therefore, it is important to follow the below steps a good password policy practice.

- Employees should change the device’s login password at least every 90 days

- Implement two factor authentication

- Passwords must have minimum of eight characters with uppercase, lowercase, and special characters.

- Don’t use simple or obvious passwords.

Because of the great convenience it offers, smart phones and tablets are vital tools in modern business. While it might be difficult to fully control mobile devices in your organization, there are secure ways to integrate them into your business processes.

SINGAPORE UPDATES

Accounting and Corporate Regulatory Authority (ACRA)

1) Updated BizFinx Preparation tool and Multi Upload Tool are now available

On 30th September 2022, Accounting and Corporate Regulatory Authority (ACRA) released version 3.4 of the BizFinx Preparation Tool (Preptool) and the Multi-Upload Tool (MUT).

Companies can prepare, validate, and upload their Financial Statements using the latest version of these tools from 1st October 2022 and are mandated to do so from 1st December 2022.

The updated Preptool and MUT include the following improvements:

- Some exceptions from validation rules have been re-categorized from genuine error to possible error. This will allow companies to file without applying for business rule exemption once they have confirmed that it is not an error. For example, while it is uncommon, non-dormant companies can indicate its revenue to be zero. Hence, Rule Misc_212 has been re-categorised from genuine error to possible error.

- Guidance notes have been improved to show the linkage between primary statements and notes for some data elements to facilitate reconciliation, such as revenue and notes to revenue. Error messages have also been amended to state clearly how filers can check and correct their filings.

- To combat increasing cybersecurity threats, filers using older Office versions with no security support from Microsoft (i.e. Windows 7 and before) will not be able to operate the Preptool. Please refer to official website from Microsoft for the complete list of affected versions. 32-bit machines will no longer be supported as well.

The ACRA press release sets out instructions on how those with an older version of Preptool/ MUT installed in their computers may update the software.

ACRA advises that to facilitate the transition, all Excel / XBRL.zip files prepared using an older version of Preptool / MUT can be opened and edited in the latest version without any loss of data.

2) Commencement of New Requirements under the Corporate Registers (Miscellaneous Amendments) Act

On 4 October 2022, Accounting and Corporate Regulatory Authority (ACRA) implemented new requirements to strengthen Singapore’s corporate governance regime, and reaffirm Singapore’s commitment to combatting money laundering, terrorism financing and other threats to the integrity of the international financial system. The following requirements will take effect from today, following the passing of the Corporate Registers (Miscellaneous Amendments) Act 2022 by Parliament on 10 January 2022.

Maintaining Registers of Nominee Shareholders

Companies (including foreign companies) are required to maintain a Register of Nominee Shareholders (RONS) at their registered office or at the registered office of their appointed Registered Filing Agent. The RONS will need to contain prescribed particulars of the nominator(s) of the company’s nominee shareholder(s). Companies must set up their RONS by 5 December 2022.

To assist companies in the setting up and maintenance of the RONS, ACRA has developed and published a new guidance document for the RONS.

Identification of Registrable Controllers

Companies and Limited Liability Partnerships (LLPs) which are unable to identify a registrable controller who has a significant interest in or significant control, are required to identify individuals with executive control as their registrable controller(s).

- For companies, directors with executive control and the Chief Executive Officer must be identified as its registrable controller(s).

- For LLPs, partner(s) with executive control must be identified as its registrable controller(s).

Companies and LLPs which were previously unable to identify a registrable controller are now required to record the prescribed particulars of individuals with executive control in their existing Register of Registrable Controllers (RORC) by 5 December 2022. The same information must also be lodged with the ACRA central register (ACRA central RORC) within 2 business days after any update(s) to their own RORC.

https://www.acra.gov.sg/news-events/news-details/id/679

https://www.acra.gov.sg/compliance/register-of-registrable-controllers/help-resources

Monetary Authority of Singapore

1) MAS Consults on Revised Restrictions on E-money Payment Accounts

On 18 October 2022, the Monetary Authority of Singapore (“MAS”) published a consultation paper to seek feedback on proposed changes to the Payment Services Act 2019 (“PS Act“) to:

- Revise the limits on stock cap and flow cap (“Caps”) imposed on personal payment accounts containing e-money (“e-wallet”) issued by a Major Payment Institution (“MPI”) to a user; and

- Introduce a new exemption for a MPI with regard to its arrangements which contemplate “white-label” e-wallet account issuance from the requirement to aggregate all the e-money in the e-wallets issued to the same user for purposes of applying the Caps to the user.

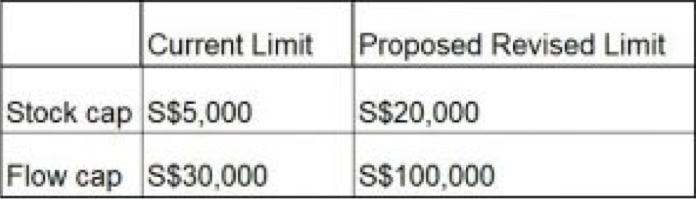

The consultation is targeted at all licensees and regulated entities under the PS Act, financial institutions and other interested parties (including members of the public and payment service users). Feedback must be submitted to MAS by 25 November 2022. This Update highlights the key proposals in the consultation paper. Proposed Revised Caps on Personal E-Wallets Current Caps Presently, an MPI is required under the PS Act to ensure that:

- The amount of funds that can be held at any given time in an e-wallet of a user does not exceed S$5,000 (“stock cap”);

- The total outflow over a rolling 12-month period in an e-wallet of a user does not exceed S$30,000 (“flow cap”).

To facilitate specific user needs, the Caps are subject to the following exemptions:

- Users may load more than S$5,000 into their e-wallets on an intra-day basis, so long as the end-of-day balance is below S$5,000;

- The flow cap excludes funds transferred into the user’s own or designated local bank accounts, or his/her overseas bank account.

Proposed Revision to Caps For better customer convenience and to support innovation in the e-payments landscape, MAS proposes to increase the Caps as follows:

MAS considered the potential impact of revising the caps on the stability of the Singapore financial system. This is because these Caps are relevant to mitigate potential significant outflows from bank deposits to non-bank e-wallets. After considering scenario projections based on historical consumer usage statistics, MAS has taken the view that the financial stability objectives can still be met even with the higher proposed Caps. As raising the Caps also means potentially increasing the funds held or transferred through e-wallets, and therefore exposure to greater potential losses from scams involving e-wallets, MAS has also advised that e-wallet issuers should be aware of this risk and consider whether they need to enhance their anti-scam controls. Proposed New Exemption from Aggregate Caps Requirement for MPIs Under the PS Act at present, an MPI that issues two or more e-wallets to any user is required to aggregate all the e-money in the e-wallets issued to that user and apply the Caps to the user (“Aggregate Caps Requirement”). MAS proposes to exempt an MPI that enters into the following arrangement from the Aggregate Caps Requirement where the MPI:

- Enters into an arrangement with e-money issuance service providers (“e-money issuers”) where the MPI will issue e-wallets on behalf of the e-money issuers, and the e-wallets will store e-money issued by the e-money issuers to their payment service users, and

- Provides the e-wallet issuance service to two or more e-money issuers

(Referred to as the “white-label account issuance arrangement”). This means that for the purposes of applying the Caps, the MPI will not be required to aggregate the e-money in e-wallets issued to the same payment service user under the white-label account issuance arrangement. For clarity, if an MPI issues two or more e-wallets to a payment service user on behalf of a single e-money issuer, the MPI needs to aggregate the e-money contained in those two or more e-wallets issued to that payment service user for the purposes of applying the Caps.

2) MAS proposes measures to reduce risks to consumers from cryptocurrency trading and enhance standards of stable coin-related activities

On 26 October 2022, The Monetary Authority of Singapore (MAS) has published two consultation papers proposing regulatory measures to reduce the risk of consumer harm from cryptocurrency trading and to support the development of stable coins as a credible medium of exchange in the digital asset ecosystem. These measures will be part of the Payment Services Act.

Trading in cryptocurrencies (also known as digital payment tokens or DPTs) is highly risky and not suitable for the general public. However, cryptocurrencies play a supporting role in the broader digital asset ecosystem, and it would not be feasible to ban them. Therefore, to reduce the risk to consumers from speculative trading in cryptocurrencies, MAS will require that DPT service providers ensure proper business conduct and adequate risk disclosure.

The proposed measures cover three broad areas –

- Consumer Access. DPT service providers will be required to provide relevant risk disclosures to enable retail consumers to make informed decisions regarding cryptocurrency trading. They must also disallow the use of credit facilities and leverage by retail consumers for cryptocurrency trading.

- Business Conduct. DPT service providers will be required to implement proper segregation of customers’ assets, mitigate any potential conflicts of interest which arise from the multiple roles they perform, and establish processes for complaints handling.

- Technology Risks. Similar to other financial institutions such as banks, DPT service providers will be required to maintain high availability and recoverability of their critical systems.

Not with standing these regulatory measures, consumers must continue to exercise utmost caution when trading in DPTs and must take responsibility for such trading. Regulations cannot protect consumers from losses arising from the inherently speculative and highly risky nature of DPT trading.

Stable coins have the potential to be a medium of exchange to facilitate transactions in the digital asset ecosystem, provided they are well-regulated and securely backed. The current regulatory framework, which primarily addresses money laundering and terrorism financing risks, and technology and cyber risks, will be expanded to ensure that regulated stable coins have a high degree of value stability.

MAS will regulate the issuance of stable coins which are pegged to a single currency (“SCS”) where the value of SCS in circulation exceeds S$5 million. The key proposed issuer requirements relate to –

- Value Stability.SCS issuers must hold reserve assets in cash, cash equivalents or short-dated sovereign debt securities [1] that are at least equivalent to 100% of the par value of the outstanding SCS in circulation, and these assets must be denominated in the same currency as the pegged currency. Requirements on audit and segregation of reserves, and timely redemption at par value will also apply.

- Reference Currency. All SCS issued in Singapore can be pegged only to the Singapore dollar or any Group of Ten (G10) currencies.

- Stable coin issuers will be required to publish a white paper disclosing details of the SCS, including the redemption rights of stable coin holders.

- Prudential Standards. SCS issuers must, at all times, meet a base capital requirement of the higher of S$1 million or 50% of annual operating expenses of the SCS issuer. They are also required to hold liquid assets which are valued at higher of 50% of annual operating expenses or an amount assessed by the SCS issuer to be needed to achieve recovery or an orderly wind-down.

Banks in Singapore will be allowed to issue SCS as well, and no additional reserve backing and prudential requirements will apply when the SCS is issued as a tokenised form of bank liabilities given the existing rigorous capital and liquidity frameworks applied to banks. For non-issuance services, DPT service providers can offer all types of stable coins provided that they clearly label the MAS-regulated SCS to distinguish them from the unregulated ones. This will help customers make informed decisions on the risks involved in using unregulated stable coins.

Inland Revenue Authority of Singapore

1) Guidance on Country-by-Country Reporting

On 31 October, 2022, the Inland Revenue Authority of Singapore (IRAS) published the fourth edition of the e-tax guide (the “Guide”) on country-by-country (CbC) reporting.

The e-Tax Guide provides taxpayers with guidance on:

The purpose of CbCR;

- The obligation to submit a notice that a Reporting Entity is required to provide a CbC Report (“notification of filing obligation”);

- The obligation to provide a CbC Report;

- How to complete a CbC Report; and

- How to submit a CbC Report to the Comptroller

Amendments

The e-Tax Guide has been updated with the following main changes:

- Requirement for an ultimate parent entity of a Singapore-headquartered multinational enterprise group that is required to submit a Country-by-Country (CbC) Report to notify IRAS of its filing obligation from financial year beginning on or after 1 Jan 2022 (FY 2022), within 3 months from the end of that FY

- Requirement to prepare CbC Reports in CbCR XML Schema format and submit the CbC Reports based on instructions on the IRAS CbCR webpage

- Penalties for non-compliance

2) Guidance on Income Tax & Stamp Duty: Mergers and Acquisitions Scheme

On 31 October, 2022, the Inland Revenue Authority of Singapore (IRAS) published the sixth edition of the e-tax guide (the “Guide”) on Income Tax & Stamp Duty: Mergers and Acquisitions Scheme.

Major Amendments

The e-Tax Guide has been revised to provide clarity to the additional conditions to claim M&A tax benefits based on the 20% threshold and reflect the enhancement to the M&A scheme as announced in Budget 2022:

- Expand the definition of “local employee” to (a) an individual who is hired under central hiring arrangements and deployed to the acquiring company; and (b) an individual who is seconded to the acquiring company

IRAS- Due Dates

- Estimated Chargeable Income (ECI) (September year-end): 31 Dec 2022

- GST ReturnFor the quarter Oct 2022 – Dec 2022: 31 January 2023

- Form C-S/C – 30 Nov2022 (FY ending 31 Dec 2021)